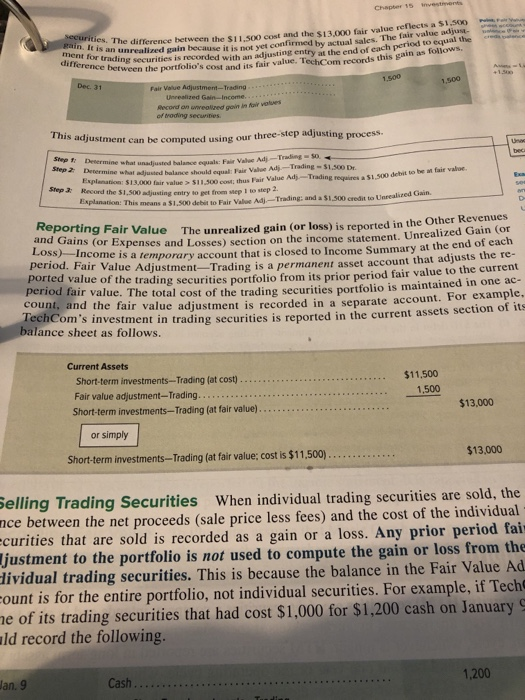

Rain. It is an unrealized in because it is not yet confirmed by actual sales. The fair value adjust securities. The difference between the $11.500 cost and the $13.000 fair value reflects a $1.SE ment for trading securities is recorded with an adjusting entry at the end of each period to equal the difference between the portfolio's cost and its fair value. TechCom records this girin as follows. Chapter 15 vesten 1.500 1,500 Dec 31 Step 2: Fair Value Adjustment - Trading Unrealized Gin-Income Record on oltre point in for values of trading securities This adjustment can be computed using our three-step adjusting process Shop Determine what unadjusted balance quote Fair Value Adj - Trading - 50. Step2 Determine what adjusted balance should equal: Poir Value Adj -Trading - S1.500 DE Explanation: $13,000 fair value > $11.500 cost; thus Fair Value Adj-Trading requires a $1.500 debit to be a fair value. Record the $1.500 justing entry to get from step to step 2. Explanation: This means a $1.500 debit to Pair Value Adj - Trading and a $1.500 credit to Uncalized Gain. Reporting Fair Value and Gains (or Expenses and Losses) section on the income statement. Unrealized Gain (or The unrealized gain (or loss) is reported in the Other Revenues Loss)-Income is a temporary account that is closed to Income Summary at the end of each period. Fair Value Adjustment Trading is a permanent asset account that adjusts the re- ported value of the trading securities portfolio from its prior period fair value to the current period fair value. The total cost of the trading securities portfolio is maintained in one ac- count, and the fair value adjustment is recorded in a separate account. For example, TechCom's investment in trading securities is reported in the current assets section of its balance sheet as follows. Current Assets Short-term investments-Trading (at cost) Fair value adjustment-Trading... Short-term investments-Trading (at fair value) $11,500 1,500 $13,000 or simply $13,000 Short-term investments --Trading (at fair value; cost is $11,500) Selling Trading Securities When individual trading securities are sold, the nce between the net proceeds (sale price less fees) and the cost of the individual ecurities that are sold is recorded as a gain or a loss. Any prior period fai justment to the portfolio is not used to compute the gain or loss from the Hividual trading securities. This is because the balance in the Fair Value Ad count is for the entire portfolio, not individual securities. For example, if Tech me of its trading securities that had cost $1,000 for $1,200 cash on January ald record the following. 1,200 Jan. 9 Cash Rain. It is an unrealized in because it is not yet confirmed by actual sales. The fair value adjust securities. The difference between the $11.500 cost and the $13.000 fair value reflects a $1.SE ment for trading securities is recorded with an adjusting entry at the end of each period to equal the difference between the portfolio's cost and its fair value. TechCom records this girin as follows. Chapter 15 vesten 1.500 1,500 Dec 31 Step 2: Fair Value Adjustment - Trading Unrealized Gin-Income Record on oltre point in for values of trading securities This adjustment can be computed using our three-step adjusting process Shop Determine what unadjusted balance quote Fair Value Adj - Trading - 50. Step2 Determine what adjusted balance should equal: Poir Value Adj -Trading - S1.500 DE Explanation: $13,000 fair value > $11.500 cost; thus Fair Value Adj-Trading requires a $1.500 debit to be a fair value. Record the $1.500 justing entry to get from step to step 2. Explanation: This means a $1.500 debit to Pair Value Adj - Trading and a $1.500 credit to Uncalized Gain. Reporting Fair Value and Gains (or Expenses and Losses) section on the income statement. Unrealized Gain (or The unrealized gain (or loss) is reported in the Other Revenues Loss)-Income is a temporary account that is closed to Income Summary at the end of each period. Fair Value Adjustment Trading is a permanent asset account that adjusts the re- ported value of the trading securities portfolio from its prior period fair value to the current period fair value. The total cost of the trading securities portfolio is maintained in one ac- count, and the fair value adjustment is recorded in a separate account. For example, TechCom's investment in trading securities is reported in the current assets section of its balance sheet as follows. Current Assets Short-term investments-Trading (at cost) Fair value adjustment-Trading... Short-term investments-Trading (at fair value) $11,500 1,500 $13,000 or simply $13,000 Short-term investments --Trading (at fair value; cost is $11,500) Selling Trading Securities When individual trading securities are sold, the nce between the net proceeds (sale price less fees) and the cost of the individual ecurities that are sold is recorded as a gain or a loss. Any prior period fai justment to the portfolio is not used to compute the gain or loss from the Hividual trading securities. This is because the balance in the Fair Value Ad count is for the entire portfolio, not individual securities. For example, if Tech me of its trading securities that had cost $1,000 for $1,200 cash on January ald record the following. 1,200 Jan. 9 Cash