Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rainbow Coat Factory sells new leather and fur coats to various retail chains. They also do repairs. Repairs are paid when the item is

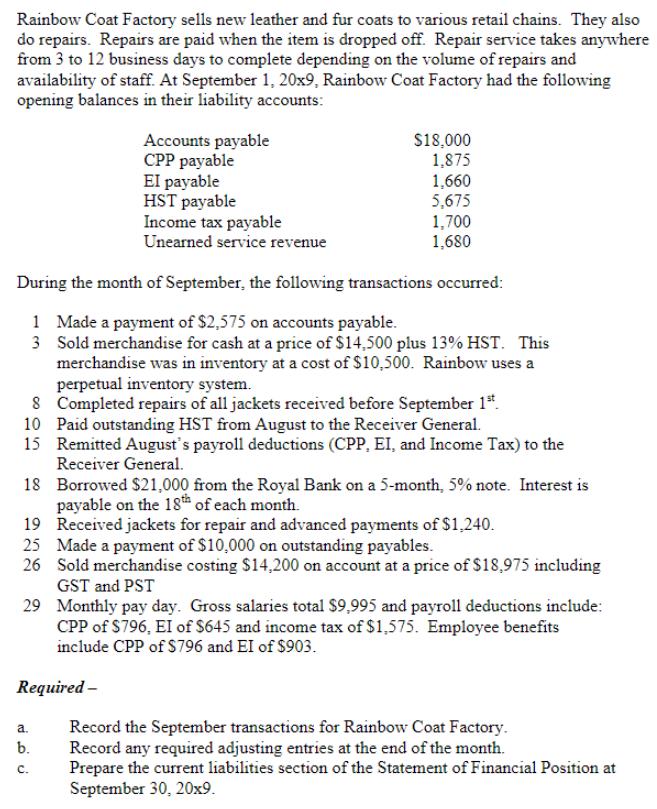

Rainbow Coat Factory sells new leather and fur coats to various retail chains. They also do repairs. Repairs are paid when the item is dropped off. Repair service takes anywhere from 3 to 12 business days to complete depending on the volume of repairs and availability of staff. At September 1, 20x9, Rainbow Coat Factory had the following opening balances in their liability accounts: Accounts payable CPP payable El payable HST payable Income tax payable Unearned service revenue $18,000 1,875 1,660 5,675 a. b. C. 1,700 1,680 During the month of September, the following transactions occurred: 1 Made a payment of $2,575 on accounts payable. 3 Sold merchandise for cash at a price of $14,500 plus 13% HST. This merchandise was in inventory at a cost of $10,500. Rainbow uses a perpetual inventory system. 8 Completed repairs of all jackets received before September 1st. 10 Paid outstanding HST from August to the Receiver General. 15 Remitted August's payroll deductions (CPP, EI, and Income Tax) to the Receiver General. 18 19 Received jackets for repair and advanced payments of $1,240. 25 Made a payment of $10,000 on outstanding payables. 26 Sold merchandise costing $14,200 on account at a price of $18,975 including GST and PST Borrowed $21,000 from the Royal Bank on a 5-month, 5% note. Interest is payable on the 18th of each month. 29 Monthly pay day. Gross salaries total $9,995 and payroll deductions include: CPP of $796, EI of $645 and income tax of $1,575. Employee benefits include CPP of $796 and EI of $903. Required - Record the September transactions for Rainbow Coat Factory. Record any required adjusting entries at the end of the month. Prepare the current liabilities section of the Statement of Financial Position at September 30, 20x9.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Accounts payable 2575 CPP payable 796 EI payable 645 HST payable 1575 Inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started