Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an independent

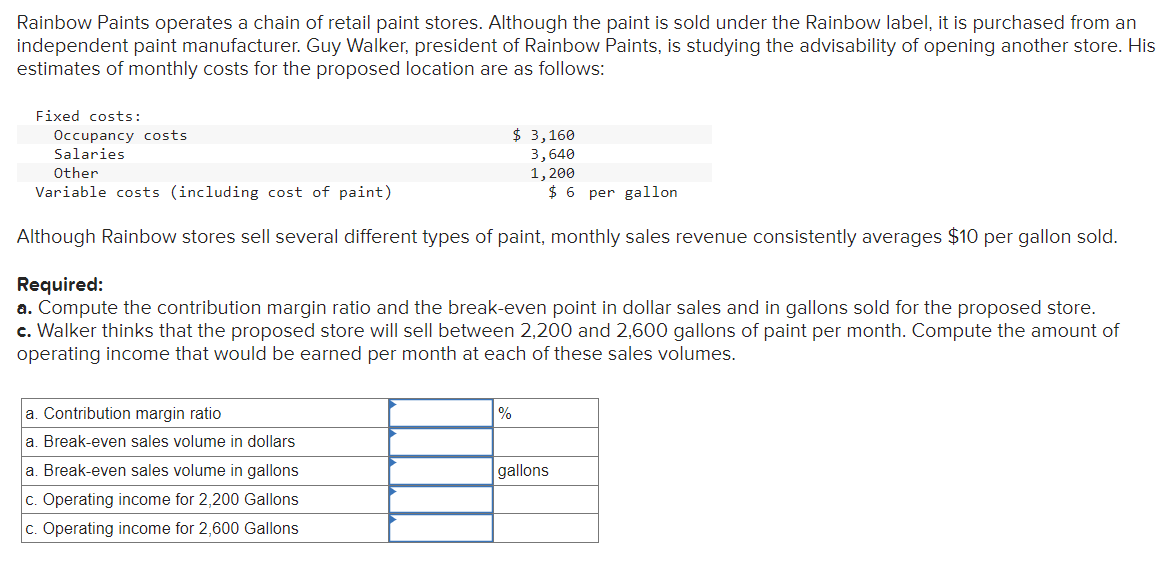

Rainbow Paints operates a chain of retail paint stores. Although the paint is sold under the Rainbow label, it is purchased from an independent paint manufacturer. Guy Walker, president of Rainbow Paints, is studying the advisability of opening another store. His estimates of monthly costs for the proposed location are as follows: Fixed costs: Occupancy costs Salaries Other $ 3,160 Variable costs (including cost of paint) 3,640 1,200 $6 per gallon Although Rainbow stores sell several different types of paint, monthly sales revenue consistently averages $10 per gallon sold. Required: a. Compute the contribution margin ratio and the break-even point in dollar sales and in gallons sold for the proposed store. c. Walker thinks that the proposed store will sell between 2,200 and 2,600 gallons of paint per month. Compute the amount of operating income that would be earned per month at each of these sales volumes. a. Contribution margin ratio a. Break-even sales volume in dollars a. Break-even sales volume in gallons c. Operating income for 2,200 Gallons c. Operating income for 2,600 Gallons % gallons

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started