Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rainy Day Co. has established an asset financing plan. The company has $200,000 in temporary current assets, $400,000 in permanent current assets and $700,000

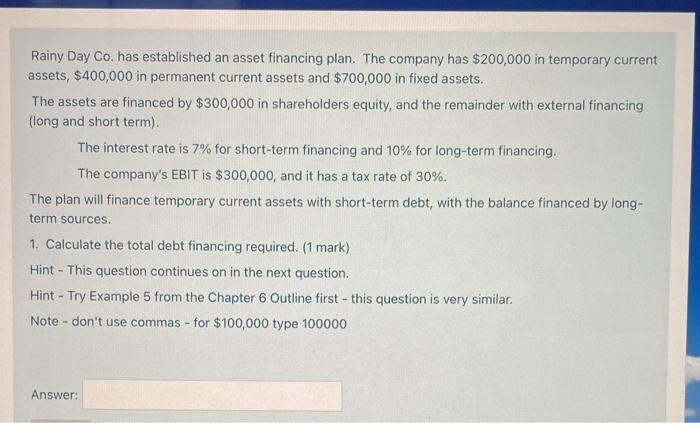

Rainy Day Co. has established an asset financing plan. The company has $200,000 in temporary current assets, $400,000 in permanent current assets and $700,000 in fixed assets. The assets are financed by $300,000 in shareholders equity, and the remainder with external financing (long and short term). The interest rate is 7% for short-term financing and 10% for long-term financing. The company's EBIT is $300,000, and it has a tax rate of 30%. The plan will finance temporary current assets with short-term debt, with the balance financed by long- term sources. 1. Calculate the total debt financing required. (1 mark) Hint - This question continues on in the next question. Hint - Try Example 5 from the Chapter 6 Outline first - this question is very similar. Note don't use commas - for $100,000 type 100000 Answer:

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started