Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Raj Steel Traders Limited Raj Steel Traders Limited purchases the products and sells to the customer with a minimal process at their end and

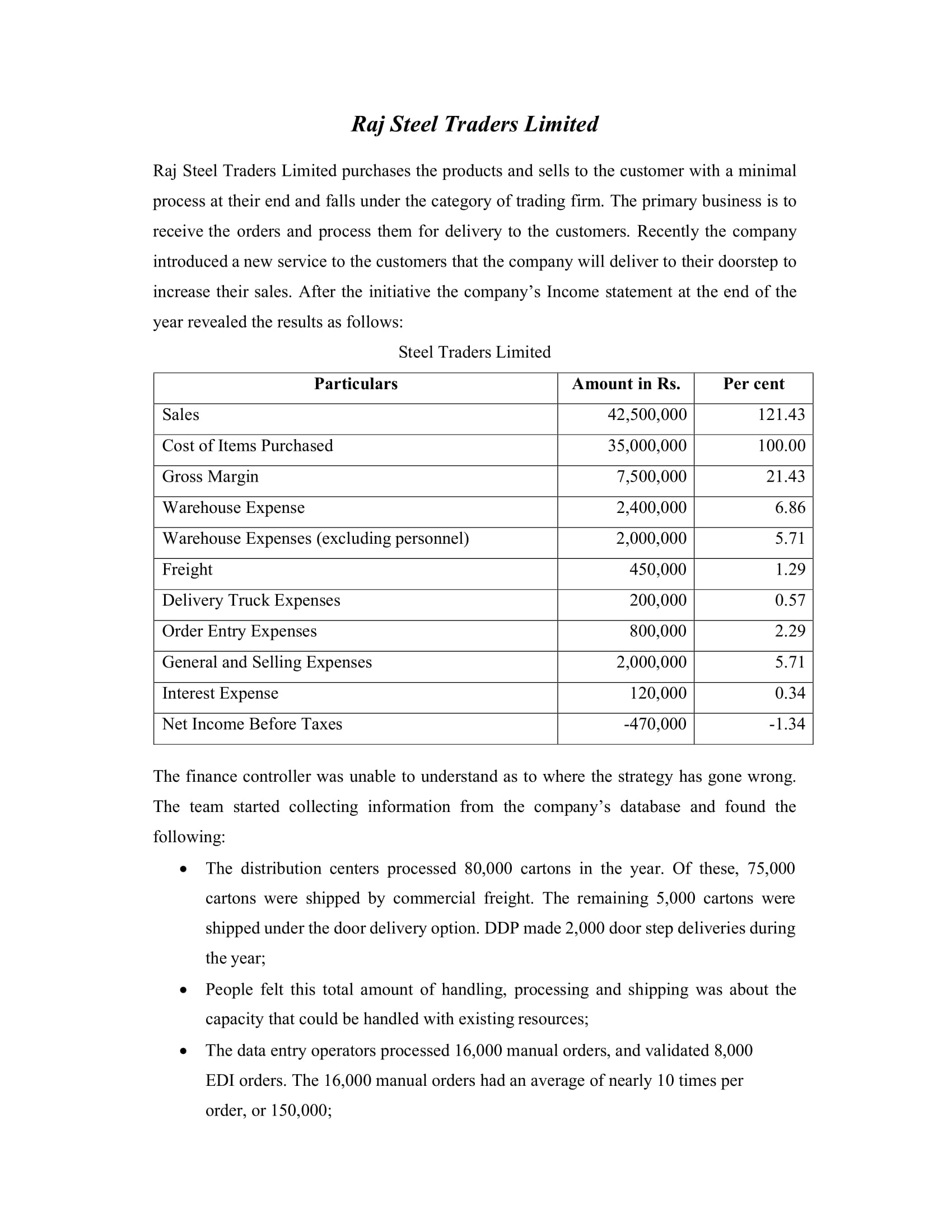

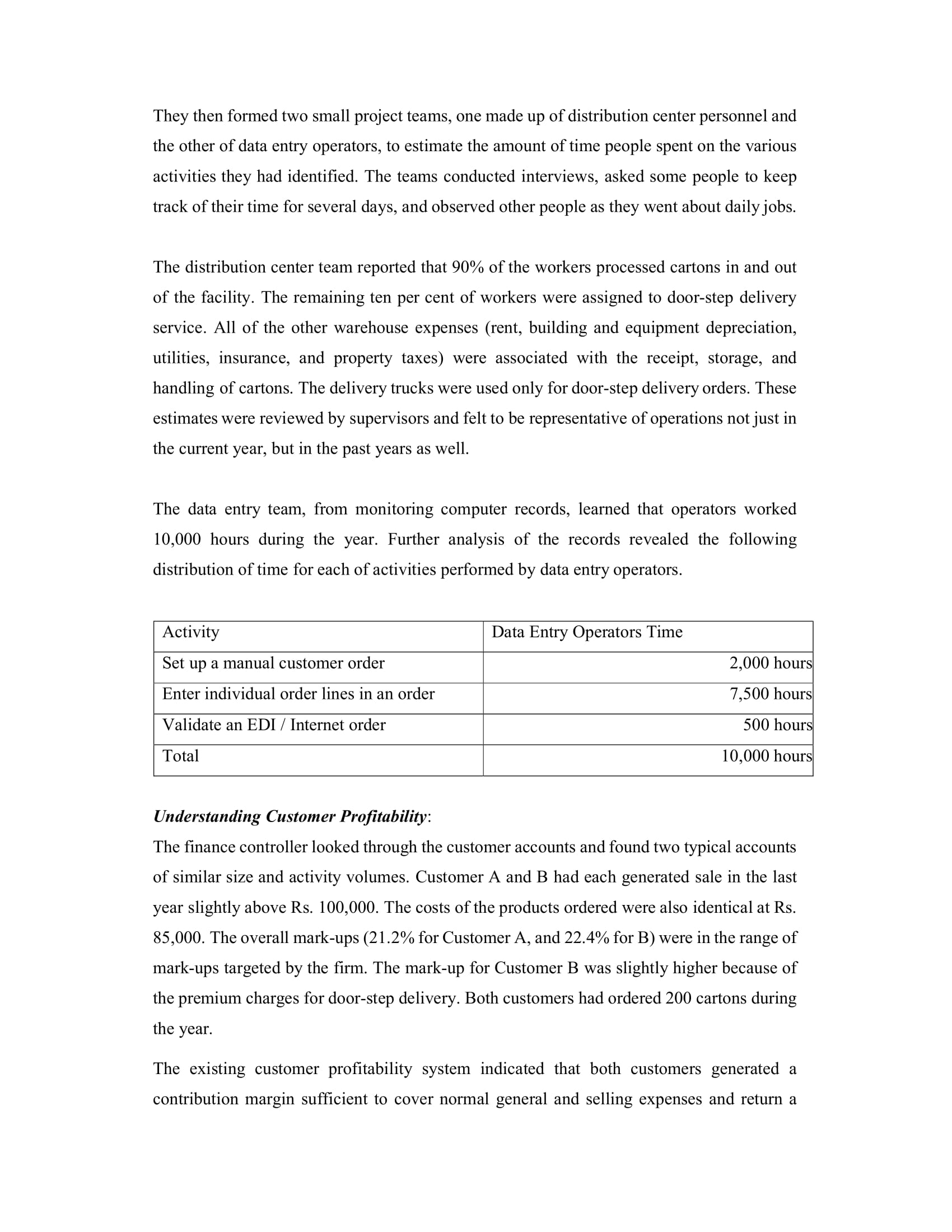

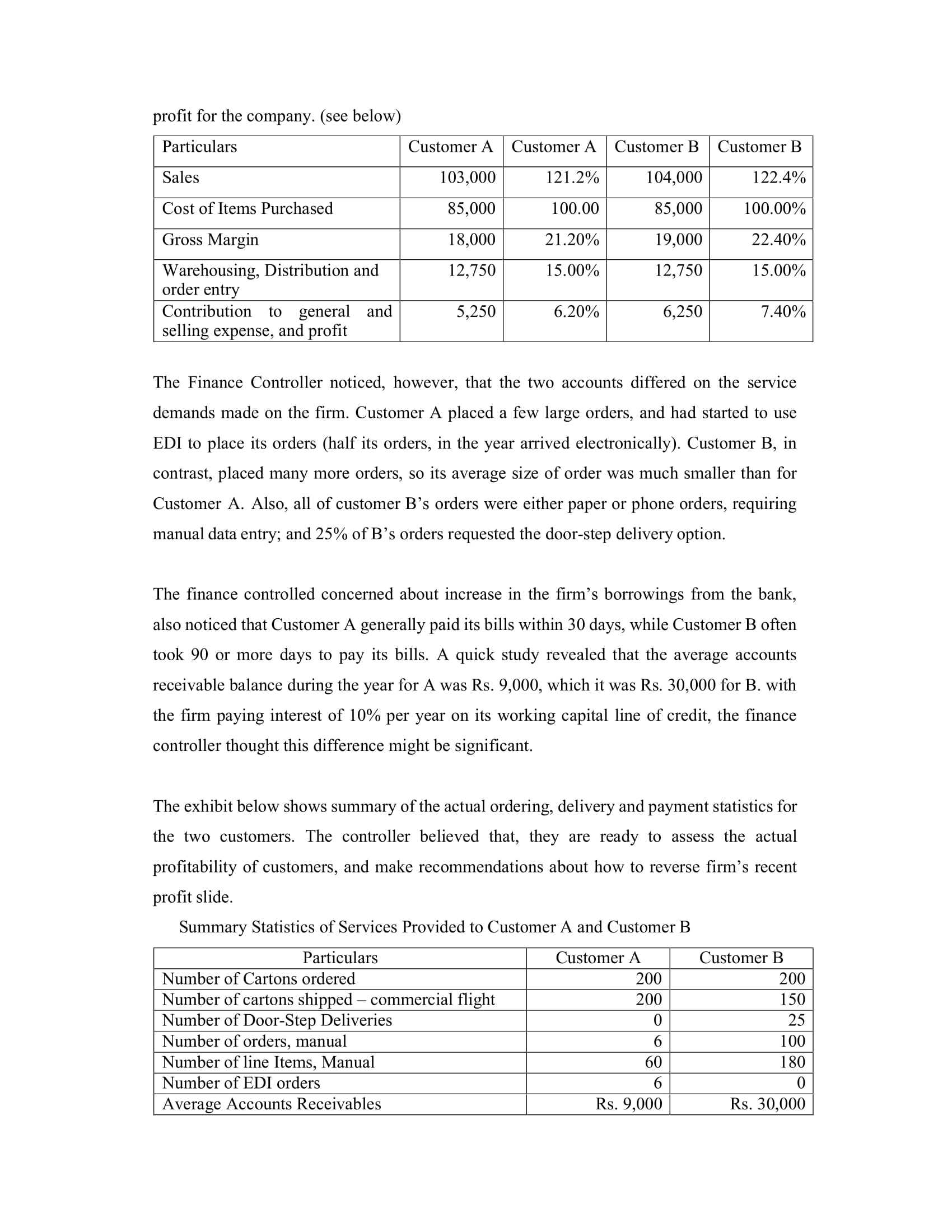

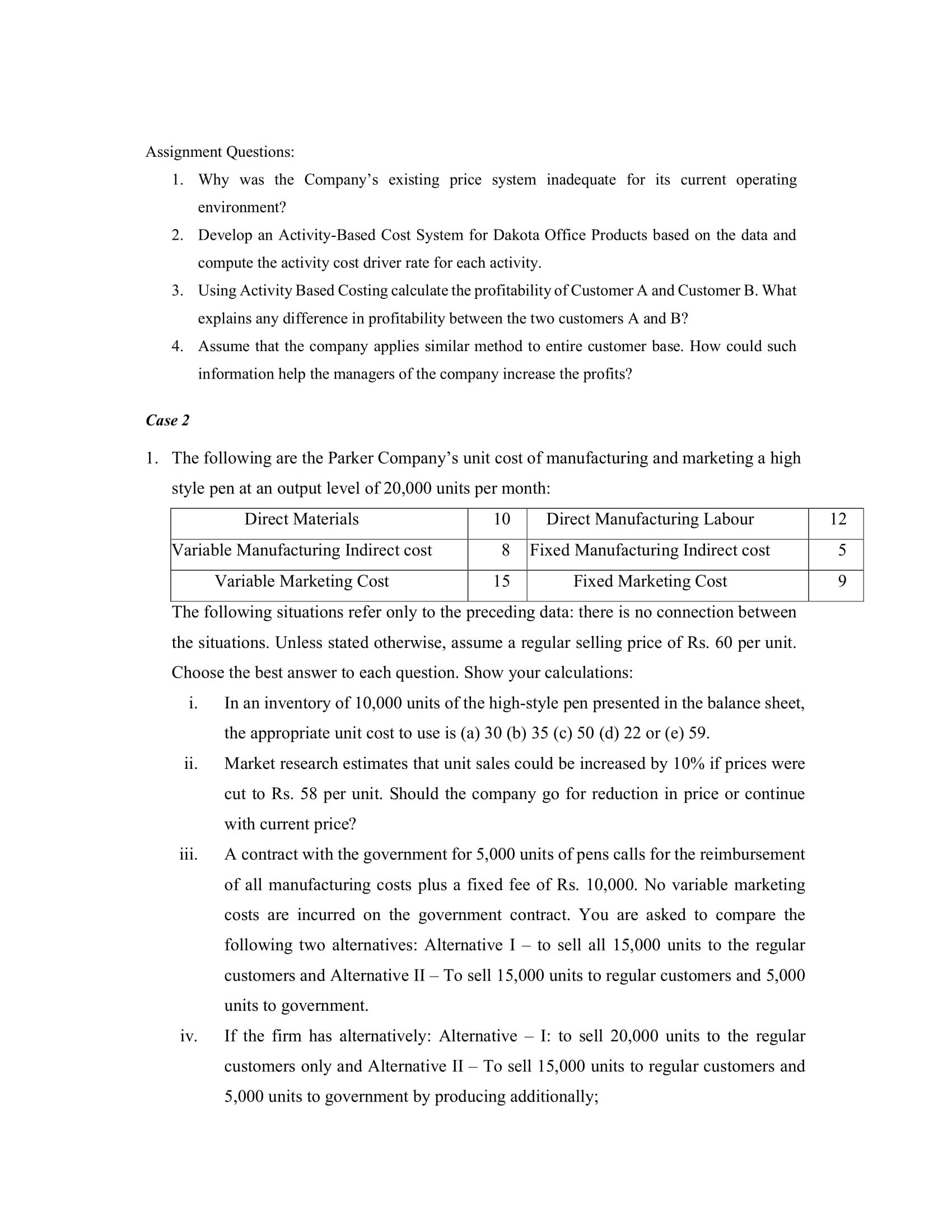

Raj Steel Traders Limited Raj Steel Traders Limited purchases the products and sells to the customer with a minimal process at their end and falls under the category of trading firm. The primary business is to receive the orders and process them for delivery to the customers. Recently the company introduced a new service to the customers that the company will deliver to their doorstep to increase their sales. After the initiative the company's Income statement at the end of the year revealed the results as follows: Steel Traders Limited Particulars Sales Cost of Items Purchased Amount in Rs. 42,500,000 Per cent 121.43 35,000,000 100.00 Gross Margin 7,500,000 21.43 Warehouse Expense 2,400,000 6.86 Warehouse Expenses (excluding personnel) 2,000,000 5.71 Freight 450,000 1.29 Delivery Truck Expenses 200,000 0.57 Order Entry Expenses 800,000 2.29 General and Selling Expenses 2,000,000 5.71 Interest Expense 120,000 0.34 Net Income Before Taxes -470,000 -1.34 The finance controller was unable to understand as to where the strategy has gone wrong. The team started collecting information from the company's database and found the following: The distribution centers processed 80,000 cartons in the year. Of these, 75,000 cartons were shipped by commercial freight. The remaining 5,000 cartons were shipped under the door delivery option. DDP made 2,000 door step deliveries during the year; People felt this total amount of handling, processing and shipping was about the capacity that could be handled with existing resources; The data entry operators processed 16,000 manual orders, and validated 8,000 EDI orders. The 16,000 manual orders had an average of nearly 10 times per order, or 150,000; They then formed two small project teams, one made up of distribution center personnel and the other of data entry operators, to estimate the amount of time people spent on the various activities they had identified. The teams conducted interviews, asked some people to keep track of their time for several days, and observed other people as they went about daily jobs. The distribution center team reported that 90% of the workers processed cartons in and out of the facility. The remaining ten per cent of workers were assigned to door-step delivery service. All of the other warehouse expenses (rent, building and equipment depreciation, utilities, insurance, and property taxes) were associated with the receipt, storage, and handling of cartons. The delivery trucks were used only for door-step delivery orders. These estimates were reviewed by supervisors and felt to be representative of operations not just in the current year, but in the past years as well. The data entry team, from monitoring computer records, learned that operators worked 10,000 hours during the year. Further analysis of the records revealed the following distribution of time for each of activities performed by data entry operators. Activity Set up a manual customer order Enter individual order lines in an order Validate an EDI / Internet order Total Data Entry Operators Time 2,000 hours 7,500 hours 500 hours 10,000 hours Understanding Customer Profitability: The finance controller looked through the customer accounts and found two typical accounts of similar size and activity volumes. Customer A and B had each generated sale in the last year slightly above Rs. 100,000. The costs of the products ordered were also identical at Rs. 85,000. The overall mark-ups (21.2% for Customer A, and 22.4% for B) were in the range of mark-ups targeted by the firm. The mark-up for Customer B was slightly higher because of the premium charges for door-step delivery. Both customers had ordered 200 cartons during the year. The existing customer profitability system indicated that both customers generated a contribution margin sufficient to cover normal general and selling expenses and return a profit for the company. (see below) Particulars Customer A Customer A Customer B Customer B Sales 103,000 121.2% 104,000 122.4% Cost of Items Purchased 85,000 100.00 85,000 100.00% Gross Margin 18,000 21.20% 19,000 22.40% Warehousing, Distribution and 12,750 15.00% 12,750 15.00% order entry Contribution to general and 5,250 6.20% 6,250 7.40% selling expense, and profit The Finance Controller noticed, however, that the two accounts differed on the service demands made on the firm. Customer A placed a few large orders, and had started to use EDI to place its orders (half its orders, in the year arrived electronically). Customer B, in contrast, placed many more orders, so its average size of order was much smaller than for Customer A. Also, all of customer B's orders were either paper or phone orders, requiring manual data entry; and 25% of B's orders requested the door-step delivery option. The finance controlled concerned about increase in the firm's borrowings from the bank, also noticed that Customer A generally paid its bills within 30 days, while Customer B often took 90 or more days to pay its bills. A quick study revealed that the average accounts receivable balance during the year for A was Rs. 9,000, which it was Rs. 30,000 for B. with the firm paying interest of 10% per year on its working capital line of credit, the finance controller thought this difference might be significant. The exhibit below shows summary of the actual ordering, delivery and payment statistics for the two customers. The controller believed that, they are ready to assess the actual profitability of customers, and make recommendations about how to reverse firm's recent profit slide. Summary Statistics of Services Provided to Customer A and Customer B Particulars Number of Cartons ordered Number of Door-Step Deliveries Number of cartons shipped - commercial flight Number of orders, manual Number of line Items, Manual Number of EDI orders Average Accounts Receivables Customer A Customer B 200 200 200 150 0 25 6 100 60 180 6 0 Rs. 9,000 Rs. 30,000 Assignment Questions: 1. Why was the Company's existing price system inadequate for its current operating environment? 2. Develop an Activity-Based Cost System for Dakota Office Products based on the data and compute the activity cost driver rate for each activity. 3. Using Activity Based Costing calculate the profitability of Customer A and Customer B. What explains any difference in profitability between the two customers A and B? 4. Assume that the company applies similar method to entire customer base. How could such information help the managers of the company increase the profits? Case 2 1. The following are the Parker Company's unit cost of manufacturing and marketing a high style pen at an output level of 20,000 units per month: Direct Materials 10 Direct Manufacturing Labour 12 Variable Manufacturing Indirect cost 8 Fixed Manufacturing Indirect cost Variable Marketing Cost 15 Fixed Marketing Cost 10 0 The following situations refer only to the preceding data: there is no connection between the situations. Unless stated otherwise, assume a regular selling price of Rs. 60 per unit. Choose the best answer to each question. Show your calculations: i. ii. iii. iv. In an inventory of 10,000 units of the high-style pen presented in the balance sheet, the appropriate unit cost to use is (a) 30 (b) 35 (c) 50 (d) 22 or (e) 59. Market research estimates that unit sales could be increased by 10% if prices were cut to Rs. 58 per unit. Should the company go for reduction in price or continue with current price? A contract with the government for 5,000 units of pens calls for the reimbursement of all manufacturing costs plus a fixed fee of Rs. 10,000. No variable marketing costs are incurred on the government contract. You are asked to compare the following two alternatives: Alternative I - to sell all 15,000 units to the regular customers and Alternative II - To sell 15,000 units to regular customers and 5,000 units to government. If the firm has alternatively: Alternative - I: to sell 20,000 units to the regular customers only and Alternative II - To sell 15,000 units to regular customers and 5,000 units to government by producing additionally;

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A financial analysis problem Lets break it down step by step The problem The finance controller of Raj Steel Traders Limited is unable to understand w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started