Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rajan Naidoo, a South African resident, made several donations during his 2023 year of assessment which ended on 28 February 2023. Rajan has two

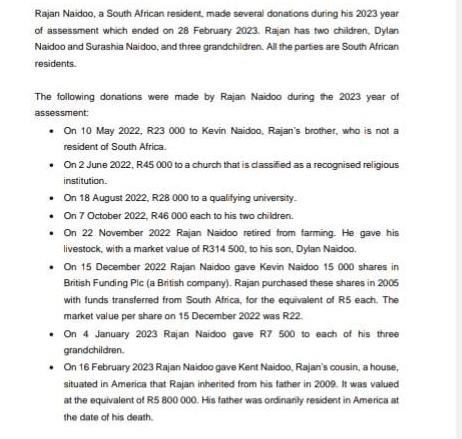

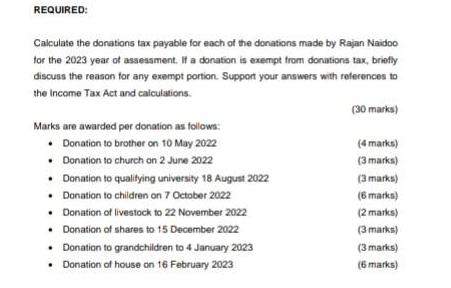

Rajan Naidoo, a South African resident, made several donations during his 2023 year of assessment which ended on 28 February 2023. Rajan has two children, Dylan Naidoo and Surashia Naidoo, and three grandchildren. All the parties are South African residents. The following donations were made by Rajan Naidoo during the 2023 year of assessment: On 10 May 2022, R23 000 to Kevin Naidoo, Rajan's brother, who is not a resident of South Africa. On 2 June 2022, R45 000 to a church that is classified as a recognised religious institution. On 18 August 2022, R28 000 to a qualifying university. On 7 October 2022, R46 000 each to his two children. On 22 November 2022 Rajan Naidoo retired from farming. He gave his livestock, with a market value of R314 500, to his son, Dylan Naidoo. On 15 December 2022 Rajan Naidoo gave Kevin Naidoo 15 000 shares in British Funding Plc (a British company). Rajan purchased these shares in 2005 with funds transferred from South Africa, for the equivalent of R5 each. The market value per share on 15 December 2022 was R22. . On 4 January 2023 Rajan Naidoo gave R7 500 to each of his three grandchildren. On 16 February 2023 Rajan Naidoo gave Kent Naidoo, Rajan's cousin, a house, situated in America that Rajan inherited from his father in 2009. It was valued at the equivalent of R5 800 000. His father was ordinarily resident in America at the date of his death.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the donations tax payable for each of the donations made by Rajan Naidoo during the 2023 year of assessment we need to consider the provi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started