Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ramada Company produces one golf cart model. A partially complete table of company costs follows: Number of golf carts produced and sold Total costs

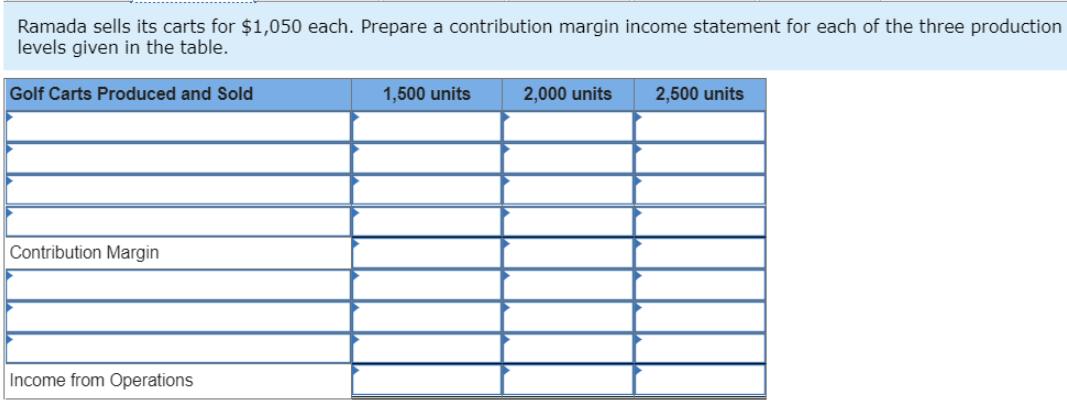

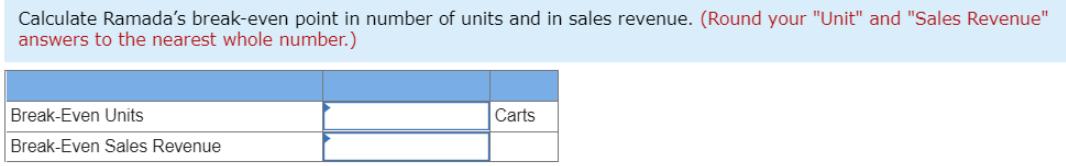

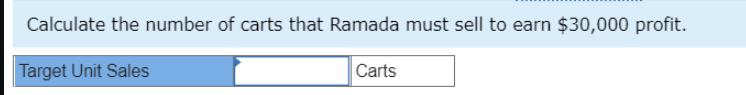

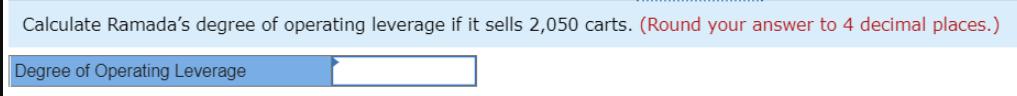

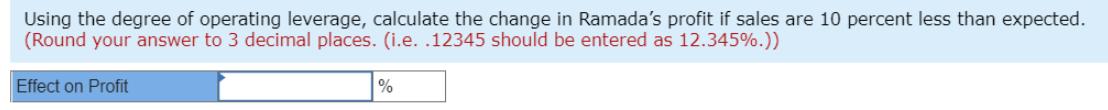

Ramada Company produces one golf cart model. A partially complete table of company costs follows: Number of golf carts produced and sold Total costs Variable costs Fixed costs per year Total costs 1,500 2,000 2,500 $ 840,000 600, 000 1,440,000 $ Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit ? Required: 1. Complete the table. 2. Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. 4. Calculate Ramada's break-even point in number of units and in sales revenue. 5. Assume Ramada sold 1,000 carts last year. Without performing any calculations, determine whether Ramada earned a profit last year. 6. Calculate the number of carts that Ramada must sell to earn $30,000 profit. 7. Calculate Ramada's degree of operating leverage if it sells 2,050 carts. 8. Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. Required 1 Required 2 Required 4 Required 5 Required 6 Required 7 Required 8 Complete the table. (Round your "Cost per Unit" answers to 2 decimal places.) Number of Golf Carts Produced and Sold 1,500 Units 2,000 Units 2,500 Units Total costs Variable costs 840,000 Fixed costs per year 600,000 Total costs 0 $ 1,440,000 S Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit 0.00 $ 0.00 $ 0.00 %24 %24 Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. Golf Carts Produced and Sold 1,500 units 2,000 units 2,500 units Contribution Margin Income from Operations Calculate Ramada's break-even point in number of units and in sales revenue. (Round your "Unit" and "Sales Revenue" answers to the nearest whole number.) Break-Even Units Carts Break-Even Sales Revenue Calculate the number of carts that Ramada must sell to earn $30,000 profit. Target Unit Sales Carts Calculate Ramada's degree of operating leverage if it sells 2,050 carts. (Round your answer to 4 decimal places.) Degree of Operating Leverage Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. (Round your answer to 3 decimal places. (i.e. .12345 should be entered as 12.345%.)) Effect on Profit % Ramada Company produces one golf cart model. A partially complete table of company costs follows: Number of golf carts produced and sold Total costs Variable costs Fixed costs per year Total costs 1,500 2,000 2,500 $ 840,000 600, 000 1,440,000 $ Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit ? Required: 1. Complete the table. 2. Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. 4. Calculate Ramada's break-even point in number of units and in sales revenue. 5. Assume Ramada sold 1,000 carts last year. Without performing any calculations, determine whether Ramada earned a profit last year. 6. Calculate the number of carts that Ramada must sell to earn $30,000 profit. 7. Calculate Ramada's degree of operating leverage if it sells 2,050 carts. 8. Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. Required 1 Required 2 Required 4 Required 5 Required 6 Required 7 Required 8 Complete the table. (Round your "Cost per Unit" answers to 2 decimal places.) Number of Golf Carts Produced and Sold 1,500 Units 2,000 Units 2,500 Units Total costs Variable costs 840,000 Fixed costs per year 600,000 Total costs 0 $ 1,440,000 S Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit 0.00 $ 0.00 $ 0.00 %24 %24 Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. Golf Carts Produced and Sold 1,500 units 2,000 units 2,500 units Contribution Margin Income from Operations Calculate Ramada's break-even point in number of units and in sales revenue. (Round your "Unit" and "Sales Revenue" answers to the nearest whole number.) Break-Even Units Carts Break-Even Sales Revenue Calculate the number of carts that Ramada must sell to earn $30,000 profit. Target Unit Sales Carts Calculate Ramada's degree of operating leverage if it sells 2,050 carts. (Round your answer to 4 decimal places.) Degree of Operating Leverage Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. (Round your answer to 3 decimal places. (i.e. .12345 should be entered as 12.345%.)) Effect on Profit % Ramada Company produces one golf cart model. A partially complete table of company costs follows: Number of golf carts produced and sold Total costs Variable costs Fixed costs per year Total costs 1,500 2,000 2,500 $ 840,000 600, 000 1,440,000 $ Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit ? Required: 1. Complete the table. 2. Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. 4. Calculate Ramada's break-even point in number of units and in sales revenue. 5. Assume Ramada sold 1,000 carts last year. Without performing any calculations, determine whether Ramada earned a profit last year. 6. Calculate the number of carts that Ramada must sell to earn $30,000 profit. 7. Calculate Ramada's degree of operating leverage if it sells 2,050 carts. 8. Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. Required 1 Required 2 Required 4 Required 5 Required 6 Required 7 Required 8 Complete the table. (Round your "Cost per Unit" answers to 2 decimal places.) Number of Golf Carts Produced and Sold 1,500 Units 2,000 Units 2,500 Units Total costs Variable costs 840,000 Fixed costs per year 600,000 Total costs 0 $ 1,440,000 S Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit 0.00 $ 0.00 $ 0.00 %24 %24 Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. Golf Carts Produced and Sold 1,500 units 2,000 units 2,500 units Contribution Margin Income from Operations Calculate Ramada's break-even point in number of units and in sales revenue. (Round your "Unit" and "Sales Revenue" answers to the nearest whole number.) Break-Even Units Carts Break-Even Sales Revenue Calculate the number of carts that Ramada must sell to earn $30,000 profit. Target Unit Sales Carts Calculate Ramada's degree of operating leverage if it sells 2,050 carts. (Round your answer to 4 decimal places.) Degree of Operating Leverage Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. (Round your answer to 3 decimal places. (i.e. .12345 should be entered as 12.345%.)) Effect on Profit % Ramada Company produces one golf cart model. A partially complete table of company costs follows: Number of golf carts produced and sold Total costs Variable costs Fixed costs per year Total costs 1,500 2,000 2,500 $ 840,000 600, 000 1,440,000 $ Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit ? Required: 1. Complete the table. 2. Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. 4. Calculate Ramada's break-even point in number of units and in sales revenue. 5. Assume Ramada sold 1,000 carts last year. Without performing any calculations, determine whether Ramada earned a profit last year. 6. Calculate the number of carts that Ramada must sell to earn $30,000 profit. 7. Calculate Ramada's degree of operating leverage if it sells 2,050 carts. 8. Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. Required 1 Required 2 Required 4 Required 5 Required 6 Required 7 Required 8 Complete the table. (Round your "Cost per Unit" answers to 2 decimal places.) Number of Golf Carts Produced and Sold 1,500 Units 2,000 Units 2,500 Units Total costs Variable costs 840,000 Fixed costs per year 600,000 Total costs 0 $ 1,440,000 S Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit 0.00 $ 0.00 $ 0.00 %24 %24 Ramada sells its carts for $1,050 each. Prepare a contribution margin income statement for each of the three production levels given in the table. Golf Carts Produced and Sold 1,500 units 2,000 units 2,500 units Contribution Margin Income from Operations Calculate Ramada's break-even point in number of units and in sales revenue. (Round your "Unit" and "Sales Revenue" answers to the nearest whole number.) Break-Even Units Carts Break-Even Sales Revenue Calculate the number of carts that Ramada must sell to earn $30,000 profit. Target Unit Sales Carts Calculate Ramada's degree of operating leverage if it sells 2,050 carts. (Round your answer to 4 decimal places.) Degree of Operating Leverage Using the degree of operating leverage, calculate the change in Ramada's profit if sales are 10 percent less than expected. (Round your answer to 3 decimal places. (i.e. .12345 should be entered as 12.345%.)) Effect on Profit %

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Number of Golf carts produced and sold 1500 2000 2500 total costs variable costs 630000 840000 105...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started