Question

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500. The machine's useful

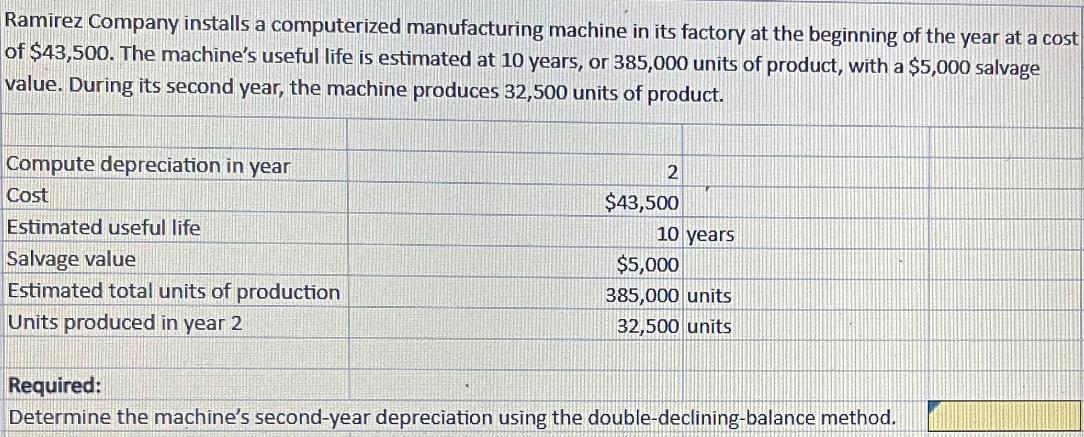

Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $43,500. The machine's useful life is estimated at 10 years, or 385,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 32,500 units of product. Compute depreciation in year 2 Cost Estimated useful life Salvage value Estimated total units of production Units produced in year 2 Required: $43,500 10 years $5,000 385,000 units 32,500 units Determine the machine's second-year depreciation using the double-declining-balance method.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the machines secondyear depreciation using the doubledecliningbalance method we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental accounting principle

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

21st edition

1259119831, 9781259311703, 978-1259119835, 1259311708, 978-0078025587

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App