Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ramp Up Storage Containers produces a 1,000-cubic-foot metal storage unit that is used by storage companies and other businesses needing low-cost, mobile storage units.

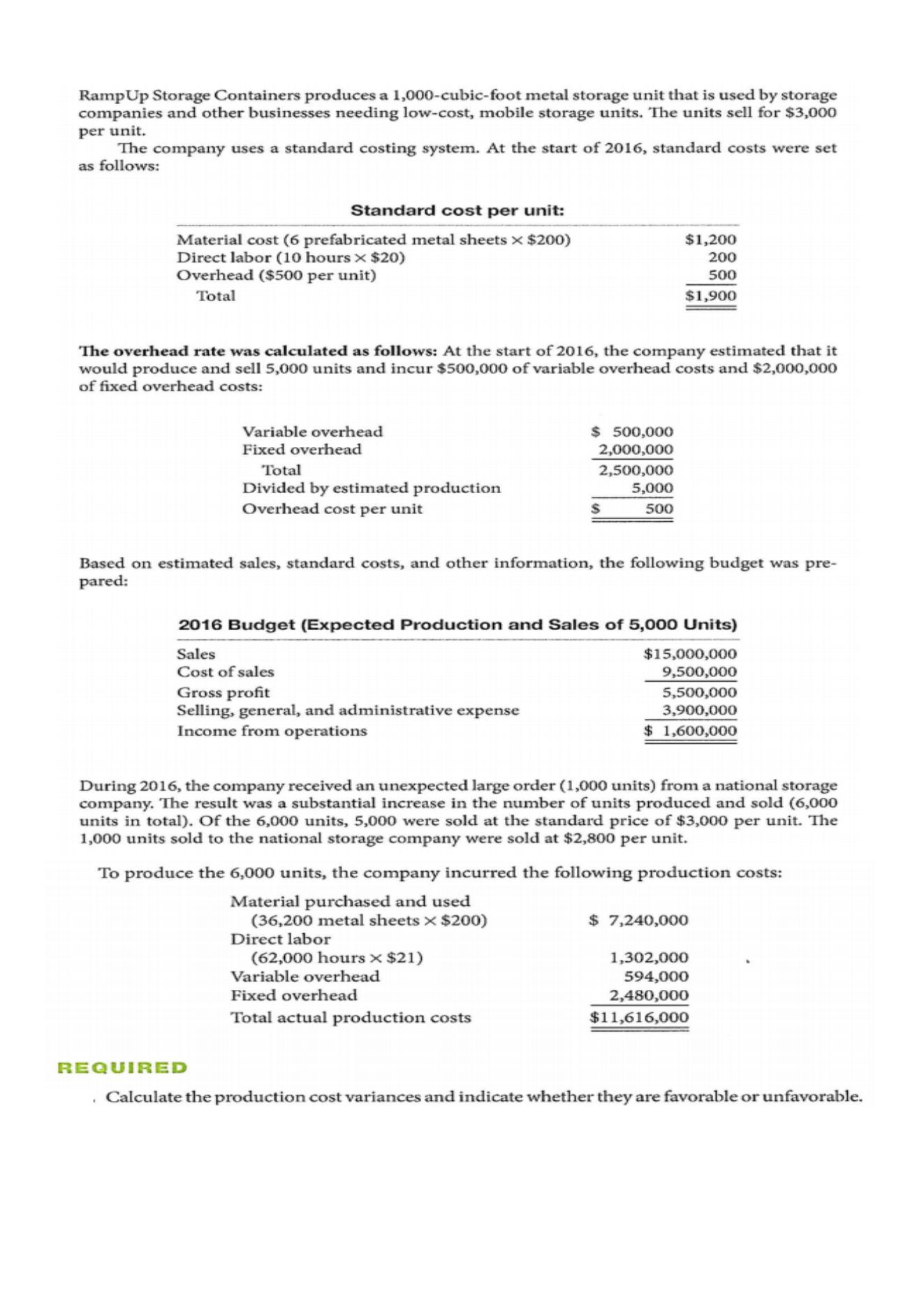

Ramp Up Storage Containers produces a 1,000-cubic-foot metal storage unit that is used by storage companies and other businesses needing low-cost, mobile storage units. The units sell for $3,000 per unit. The company uses a standard costing system. At the start of 2016, standard costs were set as follows: Standard cost per unit: Material cost (6 prefabricated metal sheets $200) Direct labor (10 hours $20) Overhead ($500 per unit) Total The overhead rate was calculated as follows: At the start of 2016, the company estimated that it would produce and sell 5,000 units and incur $500,000 of variable overhead costs and $2,000,000 of fixed overhead costs: Variable overhead Fixed overhead Total Divided by estimated production Overhead cost per unit Gross profit Selling, general, and administrative expense Income from operations $ 500,000 2,000,000 2,500,000 5,000 500 Based on estimated sales, standard costs, and other information, the following budget was pre- pared: $1,200 200 500 $1,900 $ 2016 Budget (Expected Production and Sales of 5,000 Units) Sales Cost of sales (62,000 hours $21) Variable overhead Fixed overhead Total actual production costs During 2016, the company received an unexpected large order (1,000 units) from a national storage company. The result was a substantial increase in the number of units produced and sold (6,000 units in total). Of the 6,000 units, 5,000 were sold at the standard price of $3,000 per unit. The 1,000 units sold to the national storage company were sold at $2,800 per unit. $15,000,000 9,500,000 5,500,000 3,900,000 $1,600,000 To produce the 6,000 units, the company incurred the following production costs: Material purchased and used (36,200 metal sheets $200) Direct labor $ 7,240,000 1,302,000 594,000 2,480,000 $11,616,000 REQUIRED Calculate the production cost variances and indicate whether they are favorable or unfavorable.

Step by Step Solution

★★★★★

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started