Answered step by step

Verified Expert Solution

Question

1 Approved Answer

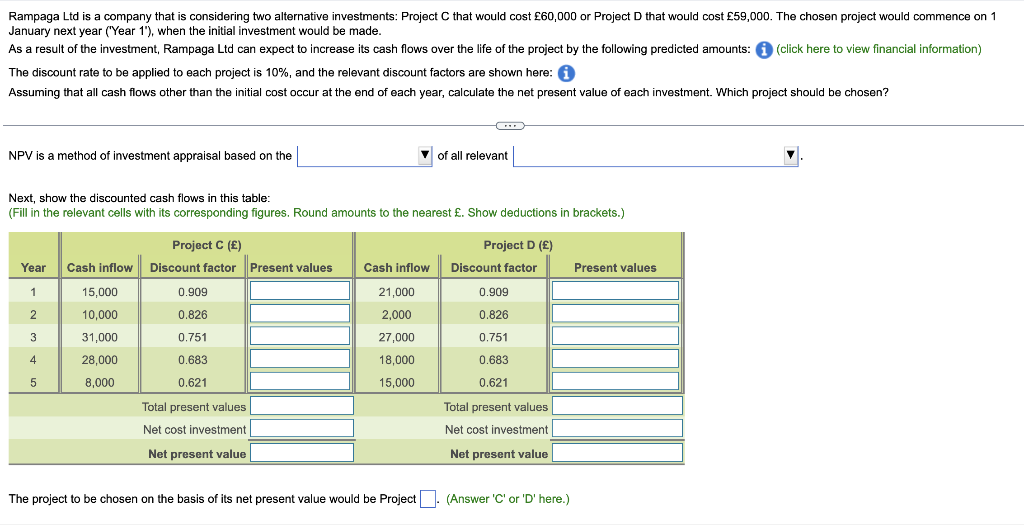

Rampaga Ltd is a company that is considering two alternative investments: Project C that would cost 60,000 or Project D that would cost 59,000.

Rampaga Ltd is a company that is considering two alternative investments: Project C that would cost 60,000 or Project D that would cost 59,000. The chosen project would commence on 1 January next year ("Year 1"), when the initial investment would be made. As a result of the investment, Rampaga Ltd can expect to increase its cash flows over the life of the project by the following predicted amounts: (click here to view financial information) The discount rate to be applied to each project is 10%, and the relevant discount factors are shown here: i Assuming that all cash flows other than the initial cost occur at the end of each year, calculate the net present value of each investment. Which project should be chosen? NPV is a method of investment appraisal based on the Next, show the discounted cash flows in this table: (Fill in the relevant cells with its corresponding figures. Round amounts to the nearest . Show deductions Year 1 2 3 4 5 Project C () Cash inflow Discount factor Present values 15,000 10,000 31,000 28.000 8,000 0.909 0.826 0.751 0.683 0.621 Total present values Net cost investment Net present value of all relevant Project D () Cash inflow Discount factor 21,000 2,000 27,000 18,000 15,000 0.909 0.826 0.751 0.683 0.621 Total present values Net cost investment Net present value The project to be chosen on the basis of its net present value would be Project. (Answer 'C' or 'D' here.) brackets.) Present values

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV we need to discount each future cash inflow to its present va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started