Answered step by step

Verified Expert Solution

Question

1 Approved Answer

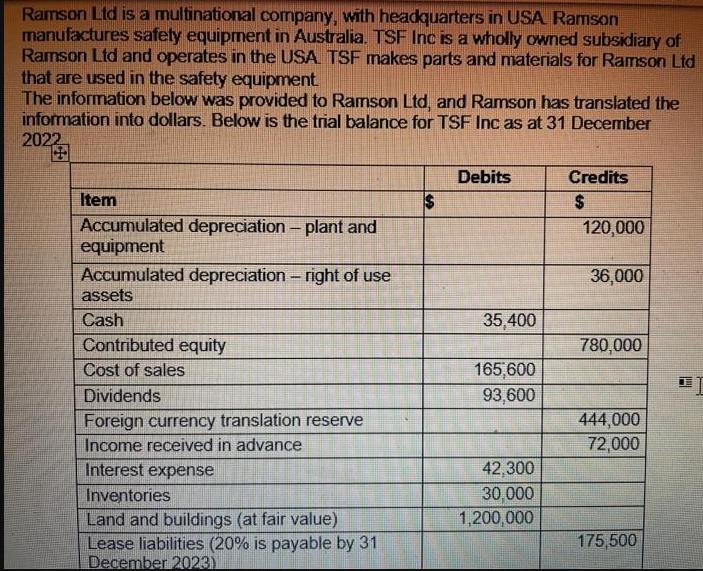

Ramson Ltd is a multinational company, with headquarters in USA Ramson manufactures safety equipment in Australia. TSF Inc is a wholly owned subsidiary of

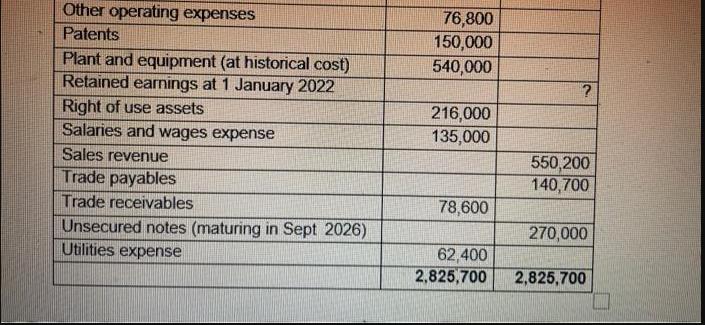

Ramson Ltd is a multinational company, with headquarters in USA Ramson manufactures safety equipment in Australia. TSF Inc is a wholly owned subsidiary of Ramson Ltd and operates in the USA. TSF makes parts and materials for Ramson Ltd that are used in the safety equipment. The information below was provided to Ramson Ltd, and Ramson has translated the information into dollars. Below is the trial balance for TSF Inc as at 31 December 2022 Item Accumulated depreciation - plant and equipment Accumulated depreciation - right of use assets Cash Contributed equity Cost of sales Dividends Foreign currency translation reserve Income received in advance Interest expense Inventories Land and buildings (at fair value) Lease liabilities (20% is payable by 31 December 2023) $ Debits 35,400 165,600 93,600 42,300 30,000 1,200,000 Credits $ 120,000 36,000 780,000 444,000 72,000 175,500 Other operating expenses Patents Plant and equipment (at historical cost) Retained earnings at 1 January 2022 Right of use assets Salaries and wages expense Sales revenue Trade payables Trade receivables Unsecured notes (maturing in Sept 2026) Utilities expense 76,800 150,000 540,000 216,000 135,000 78,600 ? 550,200 140,700 270,000 62,400 2,825,700 2,825,700 Required: A: Using the trial balance above, prepare a classified statement of financial position in the narrative format for Ramson Ltd as at 31 December 2022. B: TSF is a wholly owned subsidiary based in a foreign country. Identify and clearly describe 2 international accounting issues that Ramson Ltd faces as a result of having a subsidiary that operates in a foreign country.

Step by Step Solution

★★★★★

3.44 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

A Classified Statement of Financial Position as at 31 December 2022 for Ramson Ltd Assets Current Assets Cash and Cash Equivalents 78600 Trade Receiva...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started