Answered step by step

Verified Expert Solution

Question

1 Approved Answer

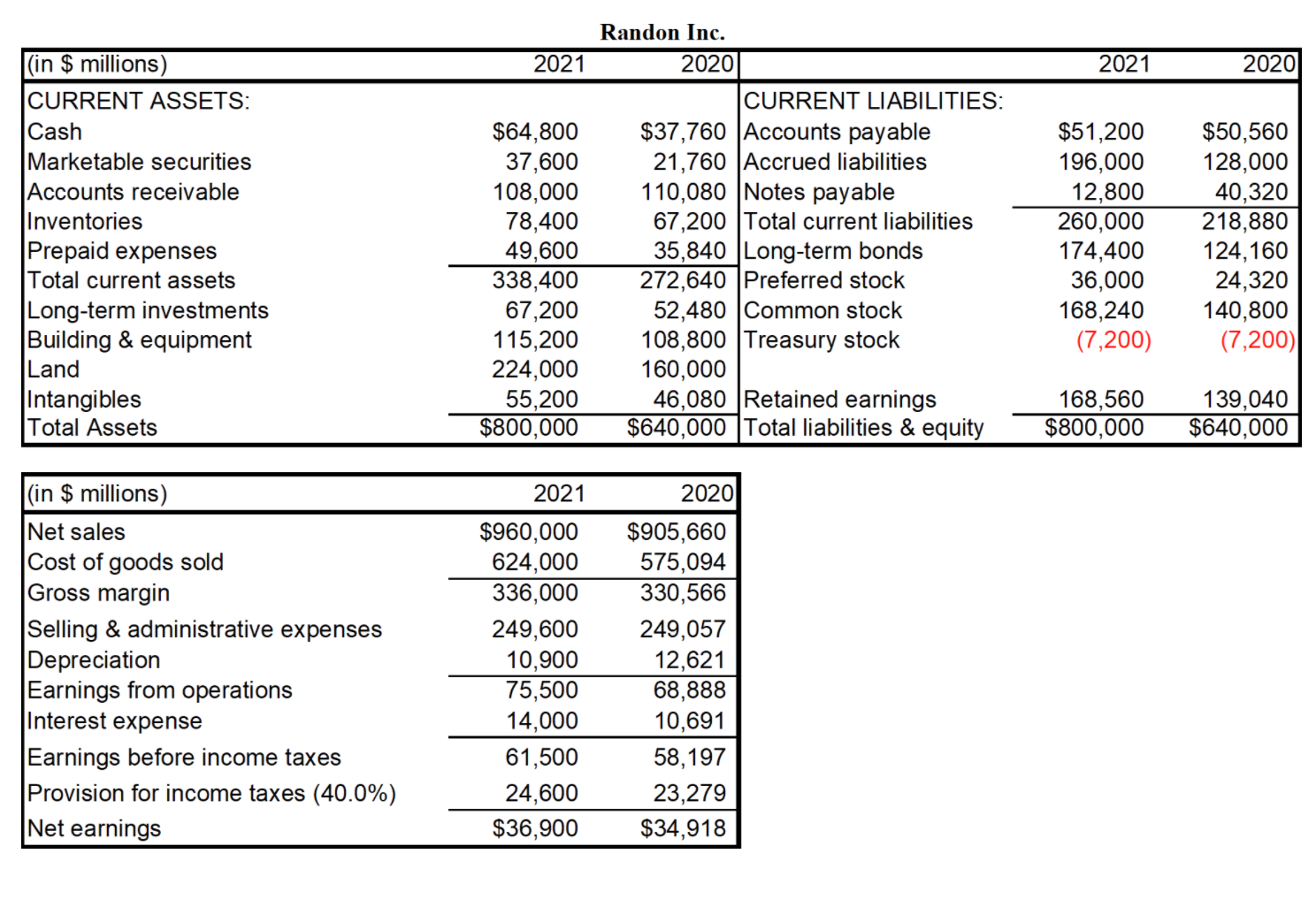

Randon Inc.'s 2021 pro forma and 2020 actual balance sheets and income statements are as shown. Analysts project that the company's free cash flows for

Randon Inc.'s 2021 pro forma and 2020 actual balance sheets and income statements are as shown. Analysts project that the company's free cash flows for years 2022 to 2025 are as follows, and that after 2025 FCFs are expected to grow at a constant 7.3% annually. Randon Inc. WACC is 12.6%.

End of Year 2021 2022 2023 2024 2025

FCF ? -$9,500M $880M $4,200M $11,300M

- Calculate the 2021 estimated free cash flow for Randon Inc.

- Calculate the 2025 horizon value for Randon Inc.

- Calculate the value of operation for Randon Inc. at the end of year 2020 (i.e. at year 0).

- Calculate the value of firm for Randon Inc. at the end of year 2020.

- Suppose Randon Inc. has 3 million shares of common stock outstanding. Calculate the estimated intrinsic value per share for their common stock.

Randon Inc. (in $ millions) 2021 2020 2021 2020 CURRENT ASSETS: CURRENT LIABILITIES: Cash $64,800 $37,760 Accounts payable $51,200 $50,560 Marketable securities 37,600 21,760 Accrued liabilities 196,000 128,000 Accounts receivable 108,000 110,080 Notes payable 12,800 40,320 Inventories 78,400 67,200 Total current liabilities 260,000 218,880 Prepaid expenses 49,600 35,840 Long-term bonds 174,400 124,160 Total current assets 338,400 272,640 Preferred stock 36,000 24,320 Long-term investments 67,200 52,480 Common stock 168,240 140,800 Building & equipment 115,200 Land 224,000 108,800 Treasury stock 160,000 (7,200) (7,200) Intangibles 55,200 46,080 Retained earnings 168,560 139,040 Total Assets $800,000 $640,000 Total liabilities & equity $800,000 $640,000 (in $ millions) 2021 2020 Net sales $960,000 $905,660 Cost of goods sold 624,000 575,094 Gross margin 336,000 330,566 Selling & administrative expenses 249,600 249,057 Depreciation 10,900 12,621 Earnings from operations 75,500 68,888 Interest expense 14,000 10,691 Earnings before income taxes 61,500 58,197 Provision for income taxes (40.0%) 24,600 23,279 Net earnings $36,900 $34,918

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the estimated free cash flow for Randon Inc in 2021 we need to find the difference between the net earnings and the changes in working ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started