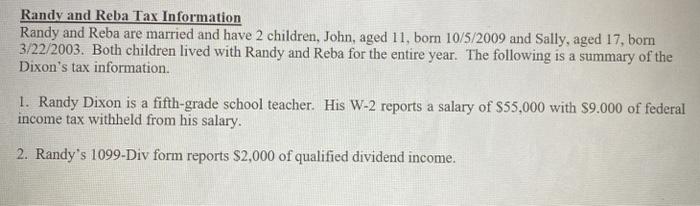

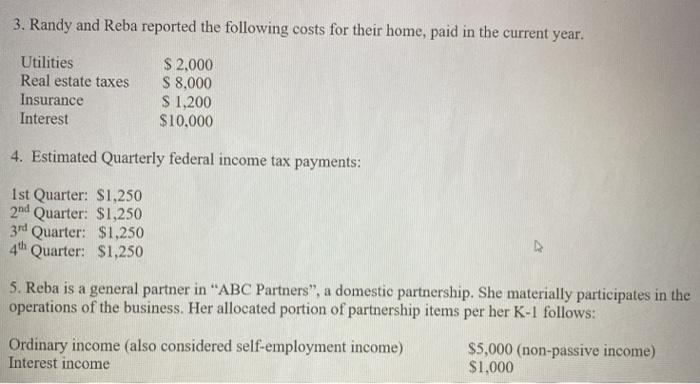

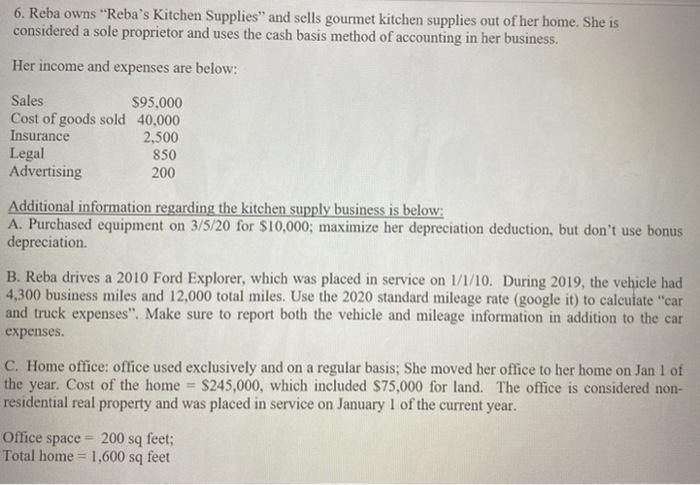

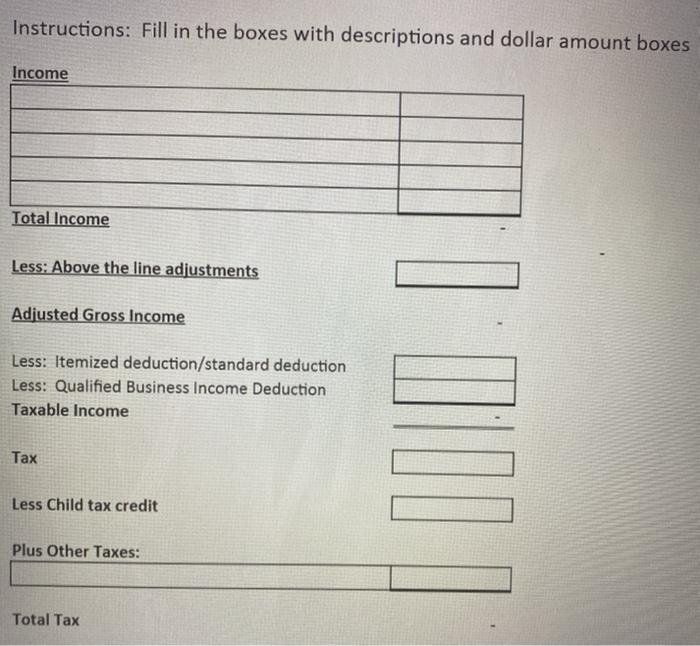

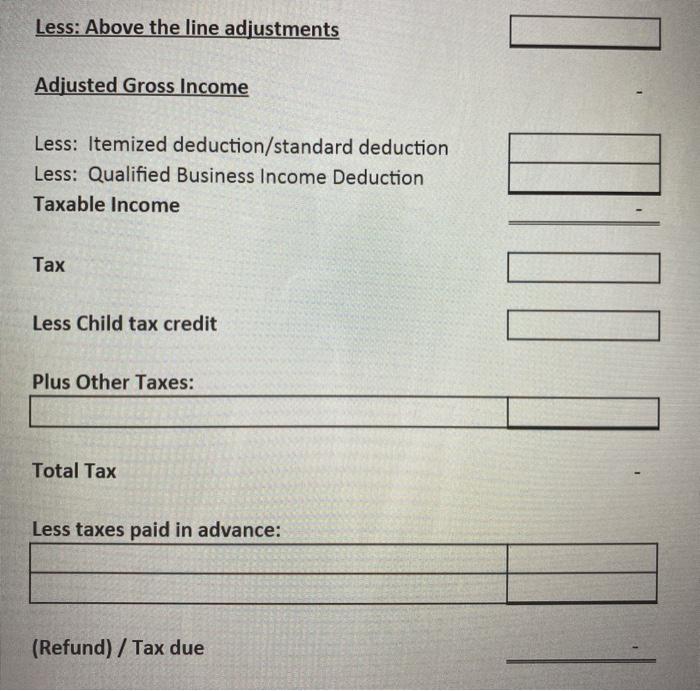

Randy and Reba Tax Information Randy and Reba are married and have 2 children, John, aged 11, born 10/5/2009 and Sally, aged 17, born 3/22/2003. Both children lived with Randy and Reba for the entire year. The following is a summary of the Dixon's tax information. 1. Randy Dixon is a fifth-grade school teacher. His W-2 reports a salary of $55,000 with $9.000 of federal income tax withheld from his salary. 2. Randy's 1099-Div form reports $2,000 of qualified dividend income. 3. Randy and Reba reported the following costs for their home, paid in the current year. Utilities Real estate taxes Insurance Interest $ 2,000 S 8,000 S 1.200 $10,000 4. Estimated Quarterly federal income tax payments: 1st Quarter: $1,250 2nd Quarter: $1,250 3rd Quarter: $1,250 4th Quarter: $1,250 5. Reba is a general partner in "ABC Partners", a domestic partnership. She materially participates in the operations of the business. Her allocated portion of partnership items per her K-1 follows: Ordinary income (also considered self-employment income) Interest income $5,000 (non-passive income) $1,000 6. Reba owns "Reba's Kitchen Supplies" and sells gourmet kitchen supplies out of her home. She is considered a sole proprietor and uses the cash basis method of accounting in her business. Her income and expenses are below: Sales $95.000 Cost of goods sold 40,000 Insurance 2,500 Legal 850 Advertising 200 Additional information regarding the kitchen supply business is below: A. Purchased equipment on 3/5/20 for $10,000; maximize her depreciation deduction, but don't use bonus depreciation. B. Reba drives a 2010 Ford Explorer, which was placed in service on 1/1/10. During 2019, the vehicle had 4,300 business miles and 12,000 total miles. Use the 2020 standard mileage rate (google it) to calculate "car and truck expenses". Make sure to report both the vehicle and mileage information in addition to the car expenses. C. Home office office used exclusively and on a regular basis; She moved her office to her home on Jan 1 of the year. Cost of the home = $245,000, which included $75,000 for land. The office is considered non- residential real property and was placed in service on January 1 of the current year. Office space = 200 sq feet; Total home = 1,600 sq feet Randy and Reba Tax Information Randy and Reba are married and have 2 children, John, aged 11, born 10/5/2009 and Sally, aged 17, born 3/22/2003. Both children lived with Randy and Reba for the entire year. The following is a summary of the Dixon's tax information. 1. Randy Dixon is a fifth-grade school teacher. His W-2 reports a salary of $55,000 with $9.000 of federal income tax withheld from his salary. 2. Randy's 1099-Div form reports $2,000 of qualified dividend income. 3. Randy and Reba reported the following costs for their home, paid in the current year. Utilities Real estate taxes Insurance Interest $ 2,000 S 8,000 S 1.200 $10,000 4. Estimated Quarterly federal income tax payments: 1st Quarter: $1,250 2nd Quarter: $1,250 3rd Quarter: $1,250 4th Quarter: $1,250 5. Reba is a general partner in "ABC Partners", a domestic partnership. She materially participates in the operations of the business. Her allocated portion of partnership items per her K-1 follows: Ordinary income (also considered self-employment income) Interest income $5,000 (non-passive income) $1,000 6. Reba owns "Reba's Kitchen Supplies" and sells gourmet kitchen supplies out of her home. She is considered a sole proprietor and uses the cash basis method of accounting in her business. Her income and expenses are below: Sales $95.000 Cost of goods sold 40,000 Insurance 2,500 Legal 850 Advertising 200 Additional information regarding the kitchen supply business is below: A. Purchased equipment on 3/5/20 for $10,000; maximize her depreciation deduction, but don't use bonus depreciation. B. Reba drives a 2010 Ford Explorer, which was placed in service on 1/1/10. During 2019, the vehicle had 4,300 business miles and 12,000 total miles. Use the 2020 standard mileage rate (google it) to calculate "car and truck expenses". Make sure to report both the vehicle and mileage information in addition to the car expenses. C. Home office office used exclusively and on a regular basis; She moved her office to her home on Jan 1 of the year. Cost of the home = $245,000, which included $75,000 for land. The office is considered non- residential real property and was placed in service on January 1 of the current year. Office space = 200 sq feet; Total home = 1,600 sq feet