Question

Randy Dillingwater wanted to perform a discounted cash flow analysis of the proposed acquisition of Flanders Inc. However, the cash-sweep provision of the debt financing

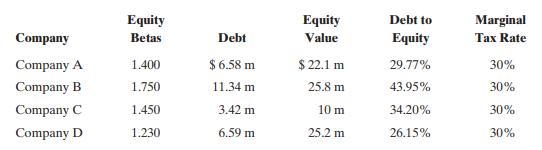

Randy Dillingwater wanted to perform a discounted cash flow analysis of the proposed acquisition of Flanders Inc. However, the cash-sweep provision of the debt financing meant that the debt ratio was expected to change systematically over the five-year planned investment period used by Randys firm (Clearstone Capital). This, Randy recalled, would make the traditional weighted average cost of capital (WACC) model for valuing firms tough to use. Instead, he decided to use the APV model, which separates the valuation of operating and financial cash flows into two separate calculations. In preparation for his analysis, Randy did some initial research to determine reasonable estimates of the capital market components of the capital asset pricing model (CAPM). First, he noted that the twenty-year long-term government bond yield was currently 5% and that the return premium of the equity market in excess of the long-term government bond yield had historically averaged about 5.5%. All that remained to do was estimate the unleveraged beta coefficient for Flanders. To perform this analysis, Randy decided that he needed to calculate the unleveraged equity betas for a sample of similar firms and use the average of the sample as his estimate of Flanders unleveraged beta. He then collected the following information on four publicly traded firms that were deemed close substitutes for Flanders:

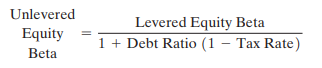

The equity betas were what Randy referred to as leveraged equity betas because they were calculated using stock market returns, which in turn reflected the firms use of debt in its capital structure. Consequently, Randy needed to unleveraged the equity betas. To perform this analysis, Randy decided to assume that the firms debt had a zero beta so that the unleveraged beta was defined as follows:

a. What is your estimate of Flanders unleveraged equity beta? (Hint: Refer back to Table 4-1.)

b. Using CAPM, what is the required rate of return that Randy should use to value Flanders operating cash flows?

CompanyCompanyACompanyBCompanyCCompanyDEquityBetas1.4001.7501.4501.230Debt$6.58m11.34m3.42m6.59mEquityValue$22.1m25.8m10m25.2mDebttoEquity29.77%43.95%34.20%26.15%MarginalTaxRate30%30%30%30% Unlevered

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started