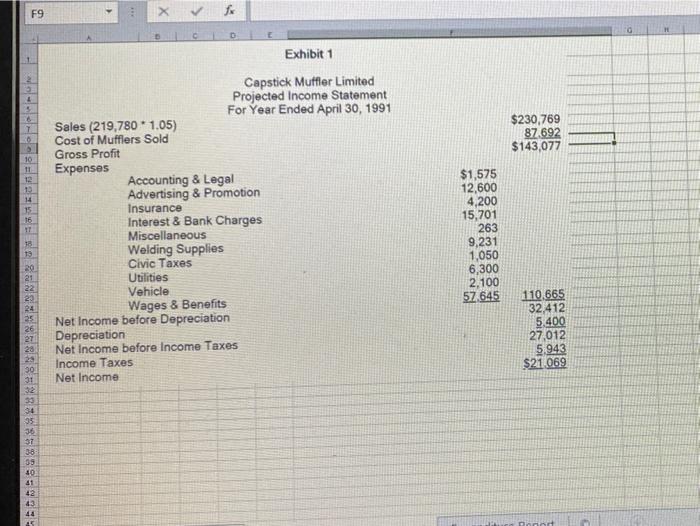

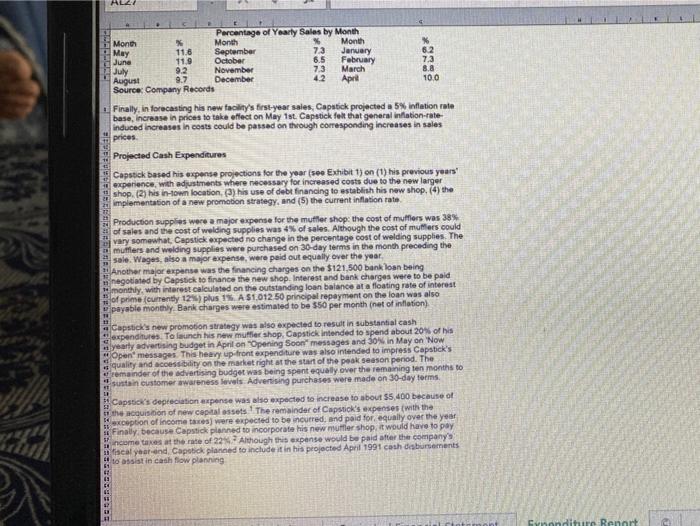

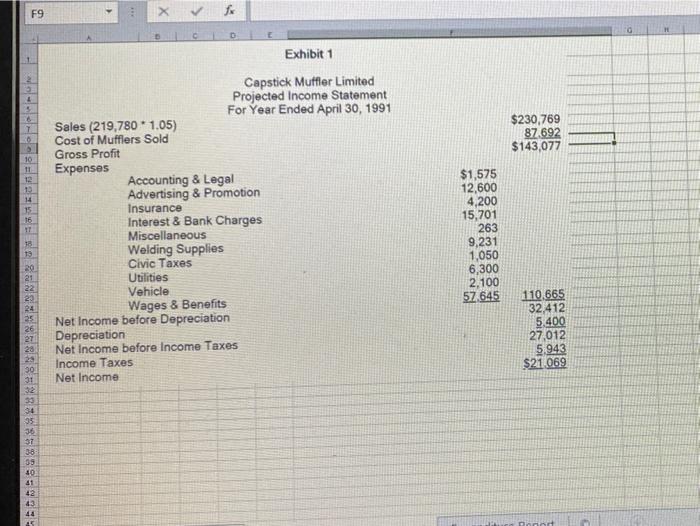

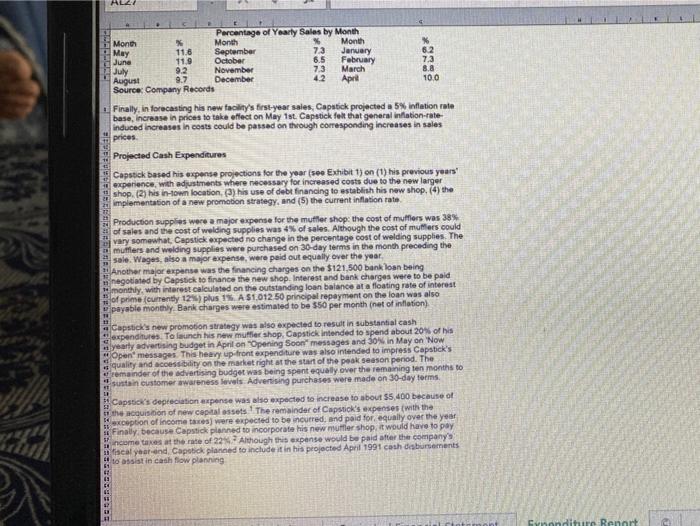

raon) Archimenta. Pred Vie Local (douch ON La www DONCTID VW 0 AB Capstick Muller 12-Month Cash Flow th wo 40 Cash Operations C Jan 20 1 Aug 31 Sep 11 1 Dec 31 20 Fabr20ANG Der w Niet Cash ofron Operations LIM c e M 144 F9 X f Exhibit 1 2 1 T 8 $230,769 87.692 $143,077 10 11 12 1 14 15 16 Capstick Muffler Limited Projected Income Statement For Year Ended April 30, 1991 Sales (219,780 * 1.05) Cost of Mufflers Sold Gross Profit Expenses Accounting & Legal Advertising & Promotion Insurance Interest & Bank Charges Miscellaneous Welding Supplies Civic Taxes Utilities Vehicle Wages & Benefits Net Income before Depreciation Depreciation Net Income before Income Taxes Income Taxes Net Income $1,575 12,600 4,200 15,701 263 9,231 1,050 6,300 2,100 57 645 18 20 21 22 22 24 25 26 110 665 32,412 5.400 27,012 5.943 $21.069 28 30 31 34 36 37 38 888 41 42 43 44 port 73 88 SEE Percentage of Yearly Sales by Month Month X Month % Month May 11.6 September 7.3 January 62 June 11.9 October 6.5 February 7.3 July 9.2 November March August 9.7 December 4.2 April 100 Source: Company Records Finally, in forecasting his new facility's first-year sales, Capstick projected a 5% inflation rate base, Increase in prices to take effect on May 1st. Capstick felt that general inflation-tate induced increases in costs could be passed on through corresponding increases in sales prices Projected Cash Expenditures Capstick based his expense projections for the year(see Exhibit 1)on (1) his previous years experience with adjustments where necessary for increased costs due to the new larger shop. (2) his in-town location (3) his use of debt financing to establish his new shop. (4) the implementation of a new promotion strategy, and (5) the current inflation rate Production supplies were a major expense for the muffler shop: the cost of muffiers was 38% of sales and the cost of welding supplies was 4% of sales. Although the cost of muffers could vary somewhat Capstick expected no change in the percentage cost of welding supplies. The muliers and welding supplies were purchased on 30-day terms in the month preceding the sale. Wages, also a major expense, were paid out equally over the year, Another major expense was the financing charges on the $121,500 bank loan being m negotiated by Capstick to finance the new shop. Interest and bank charges were to be paid 1 monthly, with interest calculated on the outstanding loan balance at a floating rate of interest of prime (currently 12%) plus 1% A $1,012 50 principal repayment on the loan was also payable monthly Bank charges were estimated to be 350 per month (net of inflation) 11 a Capstick's new promotion strategy was also expected to result in substantial cash expenditures. To launch this new muffier shop. Capstick intended to spend about 20% of his yearly advertising budget in April on Opening Soon" messages and 30% in May on Now Open" messages. This heavy up front expenditure was also intended to impress Capstick's quality and accessibility on the market right at the start of the peak season period. The remainder of the advertising budget was being spent equally over the remaining ten months to sustain customer wareness levels Advertising purchases were made on 30-day terms 50 Capstick's depreciation expense was also expected to increase to about $5,400 because of the acquisition of new capital assets. The remainder of Capstick's expenses with the exception of income taxes were expected to be incurred, and paid for equally over the year Finally, because Capstick planned to incorporate his new muffier shop, it would have to pay SF ncome taxes at the rate of 22 Although this expense would be paid after the company's fiscal year-end, Capotik planned to include it in his projected April 1991 cash disbursements 116 ssist in cash flow planning 18 LE SD 61 41 15 88 12 H1 nditure Renart raon) Archimenta. Pred Vie Local (douch ON La www DONCTID VW 0 AB Capstick Muller 12-Month Cash Flow th wo 40 Cash Operations C Jan 20 1 Aug 31 Sep 11 1 Dec 31 20 Fabr20ANG Der w Niet Cash ofron Operations LIM c e M 144 F9 X f Exhibit 1 2 1 T 8 $230,769 87.692 $143,077 10 11 12 1 14 15 16 Capstick Muffler Limited Projected Income Statement For Year Ended April 30, 1991 Sales (219,780 * 1.05) Cost of Mufflers Sold Gross Profit Expenses Accounting & Legal Advertising & Promotion Insurance Interest & Bank Charges Miscellaneous Welding Supplies Civic Taxes Utilities Vehicle Wages & Benefits Net Income before Depreciation Depreciation Net Income before Income Taxes Income Taxes Net Income $1,575 12,600 4,200 15,701 263 9,231 1,050 6,300 2,100 57 645 18 20 21 22 22 24 25 26 110 665 32,412 5.400 27,012 5.943 $21.069 28 30 31 34 36 37 38 888 41 42 43 44 port 73 88 SEE Percentage of Yearly Sales by Month Month X Month % Month May 11.6 September 7.3 January 62 June 11.9 October 6.5 February 7.3 July 9.2 November March August 9.7 December 4.2 April 100 Source: Company Records Finally, in forecasting his new facility's first-year sales, Capstick projected a 5% inflation rate base, Increase in prices to take effect on May 1st. Capstick felt that general inflation-tate induced increases in costs could be passed on through corresponding increases in sales prices Projected Cash Expenditures Capstick based his expense projections for the year(see Exhibit 1)on (1) his previous years experience with adjustments where necessary for increased costs due to the new larger shop. (2) his in-town location (3) his use of debt financing to establish his new shop. (4) the implementation of a new promotion strategy, and (5) the current inflation rate Production supplies were a major expense for the muffler shop: the cost of muffiers was 38% of sales and the cost of welding supplies was 4% of sales. Although the cost of muffers could vary somewhat Capstick expected no change in the percentage cost of welding supplies. The muliers and welding supplies were purchased on 30-day terms in the month preceding the sale. Wages, also a major expense, were paid out equally over the year, Another major expense was the financing charges on the $121,500 bank loan being m negotiated by Capstick to finance the new shop. Interest and bank charges were to be paid 1 monthly, with interest calculated on the outstanding loan balance at a floating rate of interest of prime (currently 12%) plus 1% A $1,012 50 principal repayment on the loan was also payable monthly Bank charges were estimated to be 350 per month (net of inflation) 11 a Capstick's new promotion strategy was also expected to result in substantial cash expenditures. To launch this new muffier shop. Capstick intended to spend about 20% of his yearly advertising budget in April on Opening Soon" messages and 30% in May on Now Open" messages. This heavy up front expenditure was also intended to impress Capstick's quality and accessibility on the market right at the start of the peak season period. The remainder of the advertising budget was being spent equally over the remaining ten months to sustain customer wareness levels Advertising purchases were made on 30-day terms 50 Capstick's depreciation expense was also expected to increase to about $5,400 because of the acquisition of new capital assets. The remainder of Capstick's expenses with the exception of income taxes were expected to be incurred, and paid for equally over the year Finally, because Capstick planned to incorporate his new muffier shop, it would have to pay SF ncome taxes at the rate of 22 Although this expense would be paid after the company's fiscal year-end, Capotik planned to include it in his projected April 1991 cash disbursements 116 ssist in cash flow planning 18 LE SD 61 41 15 88 12 H1 nditure Renart