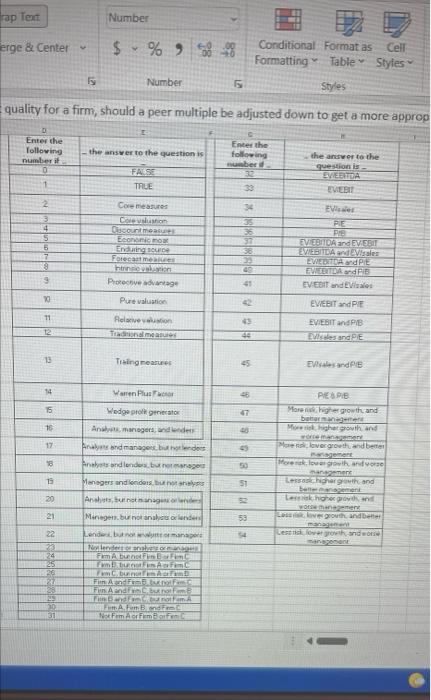

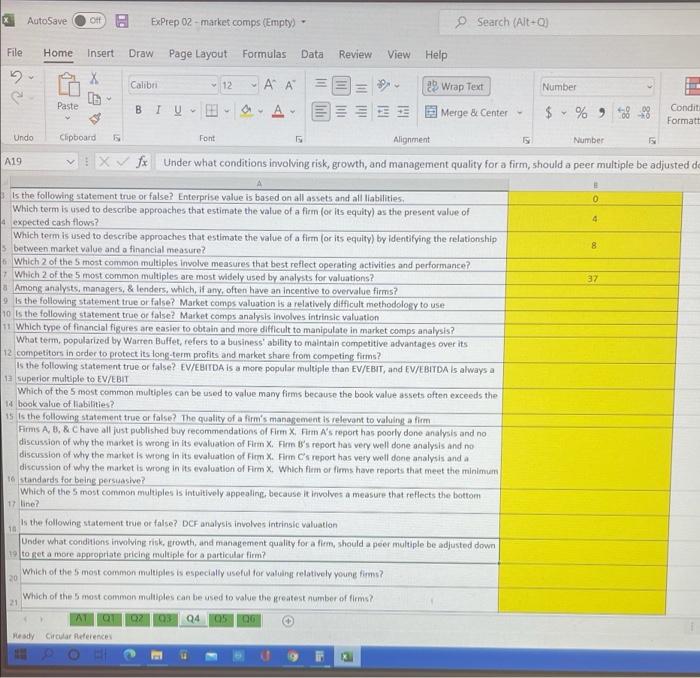

rap Text Number erge & Center $ % ... Conditional Format as Cell Formatting Table Styles Number 6 Styles quality for a firm, should a peer multiple be adjusted down to get a more approp the answer to the question is Enter the Tollowing number at 0 1 Enter the following number 30 33 FASE TRUE the answer to the question is WEBITDA CVEBIT 2 34 2 4 5 5 7 9 Core measures Com Discount est Economico Endingu Forecame EVaser FE PIE EVENDA and EVERIT RAIS EWEDITDA and PIE EUR EVEBIT and Evil Protective 0 Pure valuation EVEBIT and PIE 71 12 Relivo Tanaman EVEBIT and Evides and PE 44 13 Tingmeatures 45 Essende 14 Waren Plus 46 PES PIE Marger growth and 15 Wedge promet Anamariagers, and anders 15 Mogherowth and 17 Any and managers, but hendes Moreover growth and better gement More logo and worse B Analytandendus ongest 28 SSS 15 Managers and fondos bus 51 Les higher guth and 20 Ans, but not Lancho 21 Mineger. buhalter over growth and better manager Lesnickr growth and NNNN 22 28 24 25 26 Lender Tube Fim Abu TANTO C. FA FinA 29 50 31 PA Fm AutoSave ExPrep 02 - market comps (Empty) Search (Alt-O) File Home Insert Draw Page Layout Formulas Data Review View Help 2 5 2 X Calibri 12 - A A 29 Wrap Text TH Number TH Paste Merge & Center $ % Condit Formatt Undo Clipboard 5 Font 5 Number Alignment fx Under what conditions involving risk, growth, and management quality for a firm, should a peer multiple be adjusted de A19 X 0 4 8 37 Is the following statement true or false? Enterprise value is based on all assets and all liabilities, Which term is used to describe approaches that estimate the value of a firm (or its equity) as the present value of 4 expected cash flows? Which term is used to describe approaches that estimate the value of a firm (or its equity) by identifying the relationship between market value and a financial measure? Which 2 of the Smost common multiples involve measures that best reflect operating activities and performance? Which 2 of the 5 most common multiples are most widely used by analysts for valuations? Among analysts, managers, & lenders, which, if any, often have an incentive to overvalue firms? 9 is the following statement true or fake? Market comps valuation is a relatively difficult methodology to use 10 is the following statement true or false? Market comps analysis involves intrinsic valuation 11. Which type of financial figures are easier to obtain and more difficult to manipulate in market comps analysis? What term. popularized by Warren Buffet, refers to a business' ability to maintain competitive advantages over its 12 competitors in order to protect its long-term profits and market share from competing firms? is the following statement true or false? EV/EBITDA is a more popular multiple than EV/EBIT, and EV/EBITDA is always a 12 superior multiple to EV/EBIT Which of the 5 most common multiples can be used to value many firms because the book value assets often exceeds the 14 book value of liabilities? 15 is the following statement true or fake? The quality of a firm's management is relevant to valuing a fim Firms A, B. & Chave all just published buy recommendations of Fim X. Fim A's report has poorly done analysis and no discussion of why the market is wrong in its evaluation of Fem X. Firm's report has very well done analysis and no discussion of why the market is wrong in its evaluation of Fim X. Firm's report has very well done analysis and a discussion of why the market is wrong in its evaluation of Firm X, Which firm or firms have reports that meet the minimum 16 standards for being persuasive? Which of the most common multiples is intuitively appealing because it involves a measure that reflects the bottom 17 line? is the following statement true or false? DCF analysis involves intrinsic valuation Under what conditions involving risk, growth, and management quality for a fim, should a peer multiple be adjusted down 19 to get a more appropriate pricing multiple for a particular firm? Which of the most common multiples is especially useful for valuing relatively young firms? 20 Which of the most common multiples can be used to value the greatest number of flom? AT 01 02 03 04 0500 Ready Circular derences 10 21 rap Text Number erge & Center $ % ... Conditional Format as Cell Formatting Table Styles Number 6 Styles quality for a firm, should a peer multiple be adjusted down to get a more approp the answer to the question is Enter the Tollowing number at 0 1 Enter the following number 30 33 FASE TRUE the answer to the question is WEBITDA CVEBIT 2 34 2 4 5 5 7 9 Core measures Com Discount est Economico Endingu Forecame EVaser FE PIE EVENDA and EVERIT RAIS EWEDITDA and PIE EUR EVEBIT and Evil Protective 0 Pure valuation EVEBIT and PIE 71 12 Relivo Tanaman EVEBIT and Evides and PE 44 13 Tingmeatures 45 Essende 14 Waren Plus 46 PES PIE Marger growth and 15 Wedge promet Anamariagers, and anders 15 Mogherowth and 17 Any and managers, but hendes Moreover growth and better gement More logo and worse B Analytandendus ongest 28 SSS 15 Managers and fondos bus 51 Les higher guth and 20 Ans, but not Lancho 21 Mineger. buhalter over growth and better manager Lesnickr growth and NNNN 22 28 24 25 26 Lender Tube Fim Abu TANTO C. FA FinA 29 50 31 PA Fm AutoSave ExPrep 02 - market comps (Empty) Search (Alt-O) File Home Insert Draw Page Layout Formulas Data Review View Help 2 5 2 X Calibri 12 - A A 29 Wrap Text TH Number TH Paste Merge & Center $ % Condit Formatt Undo Clipboard 5 Font 5 Number Alignment fx Under what conditions involving risk, growth, and management quality for a firm, should a peer multiple be adjusted de A19 X 0 4 8 37 Is the following statement true or false? Enterprise value is based on all assets and all liabilities, Which term is used to describe approaches that estimate the value of a firm (or its equity) as the present value of 4 expected cash flows? Which term is used to describe approaches that estimate the value of a firm (or its equity) by identifying the relationship between market value and a financial measure? Which 2 of the Smost common multiples involve measures that best reflect operating activities and performance? Which 2 of the 5 most common multiples are most widely used by analysts for valuations? Among analysts, managers, & lenders, which, if any, often have an incentive to overvalue firms? 9 is the following statement true or fake? Market comps valuation is a relatively difficult methodology to use 10 is the following statement true or false? Market comps analysis involves intrinsic valuation 11. Which type of financial figures are easier to obtain and more difficult to manipulate in market comps analysis? What term. popularized by Warren Buffet, refers to a business' ability to maintain competitive advantages over its 12 competitors in order to protect its long-term profits and market share from competing firms? is the following statement true or false? EV/EBITDA is a more popular multiple than EV/EBIT, and EV/EBITDA is always a 12 superior multiple to EV/EBIT Which of the 5 most common multiples can be used to value many firms because the book value assets often exceeds the 14 book value of liabilities? 15 is the following statement true or fake? The quality of a firm's management is relevant to valuing a fim Firms A, B. & Chave all just published buy recommendations of Fim X. Fim A's report has poorly done analysis and no discussion of why the market is wrong in its evaluation of Fem X. Firm's report has very well done analysis and no discussion of why the market is wrong in its evaluation of Fim X. Firm's report has very well done analysis and a discussion of why the market is wrong in its evaluation of Firm X, Which firm or firms have reports that meet the minimum 16 standards for being persuasive? Which of the most common multiples is intuitively appealing because it involves a measure that reflects the bottom 17 line? is the following statement true or false? DCF analysis involves intrinsic valuation Under what conditions involving risk, growth, and management quality for a fim, should a peer multiple be adjusted down 19 to get a more appropriate pricing multiple for a particular firm? Which of the most common multiples is especially useful for valuing relatively young firms? 20 Which of the most common multiples can be used to value the greatest number of flom? AT 01 02 03 04 0500 Ready Circular derences 10 21