Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RAROC A financial institution wants to evaluate the credit risk of a potential loan to a A-rated borrower via the RAROC approach. The contractual

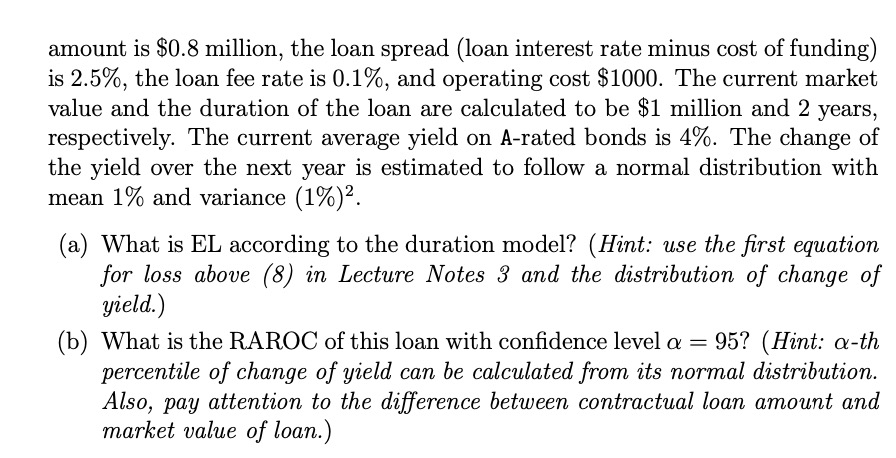

RAROC A financial institution wants to evaluate the credit risk of a potential loan to a A-rated borrower via the RAROC approach. The contractual loan amount is $0.8 million, the loan spread (loan interest rate minus cost of funding) is 2.5%, the loan fee rate is 0.1%, and operating cost $1000. The current market value and the duration of the loan are calculated to be $1 million and 2 years, respectively. The current average yield on A-rated bonds is 4%. The change of the yield over the next year is estimated to follow a normal distribution with mean 1% and variance (1%) 2. (a) What is EL according to the duration model? (Hint: use the first equation for loss above (8) in Lecture Notes 3 and the distribution of change of yield.) (b) What is the RAROC of this loan with confidence level a = = 95? (Hint: a-th percentile of change of yield can be calculated from its normal distribution. Also, pay attention to the difference between contractual loan amount and market value of loan.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Loan Analysis Loan Parameters Amount 08 million Loan Spread 25 Loan Fee Rate 01 Operating Cost 1000 Current Market Value 1 million Duration 2 years Cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started