Answered step by step

Verified Expert Solution

Question

1 Approved Answer

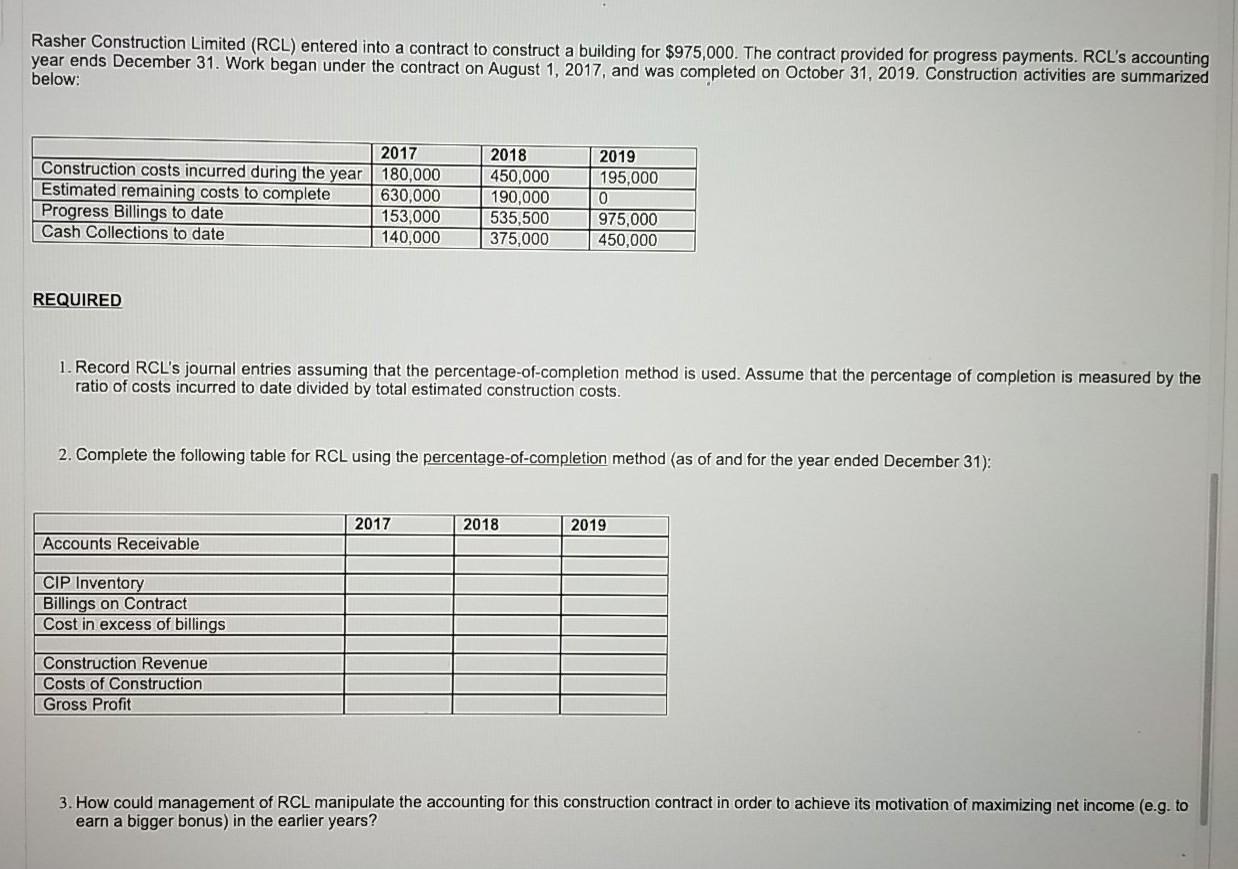

Rasher Construction Limited (RCL) entered into a contract to construct a building for $975,000. The contract provided for progress payments. RCL's accounting year ends December

Rasher Construction Limited (RCL) entered into a contract to construct a building for $975,000. The contract provided for progress payments. RCL's accounting year ends December 31. Work began under the contract on August 1, 2017, and was completed on October 31, 2019. Construction activities are summarized below: 2017 Construction costs incurred during the year 180,000 Estimated remaining costs to complete 630,000 Progress Billings to date 153,000 Cash Collections to date 140,000 2018 450,000 190,000 535,500 375,000 2019 195,000 0 975,000 450,000 REQUIRED 1. Record RCL's journal entries assuming that the percentage-of-completion method is used. Assume that the percentage of completion is measured by the ratio of costs incurred to date divided by total estimated construction costs. 2. Complete the following table for RCL using the percentage-of-completion method (as of and for the year ended December 31): 2017 2018 2019 Accounts Receivable CIP Inventory Billings on Contract Cost in excess of billings Construction Revenue Costs of Construction Gross Profit 3. How could management of RCL manipulate the accounting for this construction contract in order to achieve its motivation of maximizing net income (e.g. to earn a bigger bonus) in the earlier years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started