Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rate Duration Assets Cash 90 day T-Bills Loans Treasures Repos Market Value $ 20 M $75 M S640 M $230 M 5.27 M 39 11%

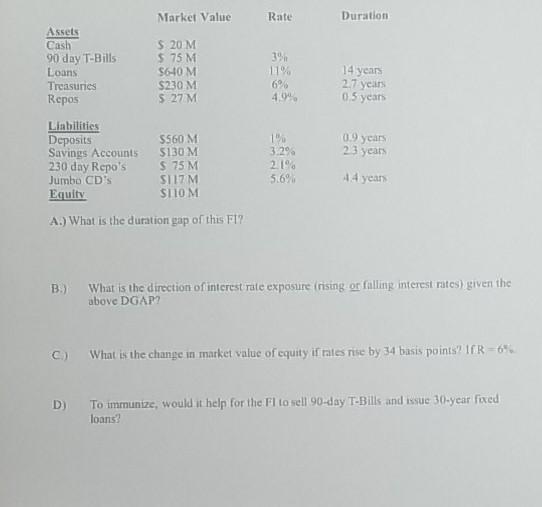

Rate Duration Assets Cash 90 day T-Bills Loans Treasures Repos Market Value $ 20 M $75 M S640 M $230 M 5.27 M 39 11% 14 years 27 years 0.5 years 4.94 0.9 years 23 years Liabilities Deposits 5560 M Savings Accounts 5130 M 230 day Repo's $ 75 M Jumbo CD's SIM Equity STOM A.) What is the duration gap of this Fl? 3.29 21% 5.6% 4.4 years B) What is the direction of interest rate exposure (rising or falling interest rates) given the above DGAP? C) What is the change in market value of equity if rates rise by 34 basis points? IR 64% D To immunize, would it help for the Fl to sell 90-day T-Bills and issue 30-year fixed loans Rate Duration Assets Cash 90 day T-Bills Loans Treasures Repos Market Value $ 20 M $75 M S640 M $230 M 5.27 M 39 11% 14 years 27 years 0.5 years 4.94 0.9 years 23 years Liabilities Deposits 5560 M Savings Accounts 5130 M 230 day Repo's $ 75 M Jumbo CD's SIM Equity STOM A.) What is the duration gap of this Fl? 3.29 21% 5.6% 4.4 years B) What is the direction of interest rate exposure (rising or falling interest rates) given the above DGAP? C) What is the change in market value of equity if rates rise by 34 basis points? IR 64% D To immunize, would it help for the Fl to sell 90-day T-Bills and issue 30-year fixed loans

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started