Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rate IFE and EFE Matrix for below case study A. B. Case Abstract Headquartered in Dubai in the United Arab Emirates, the Emirates Group is

Rate IFE and EFE Matrix for below case study

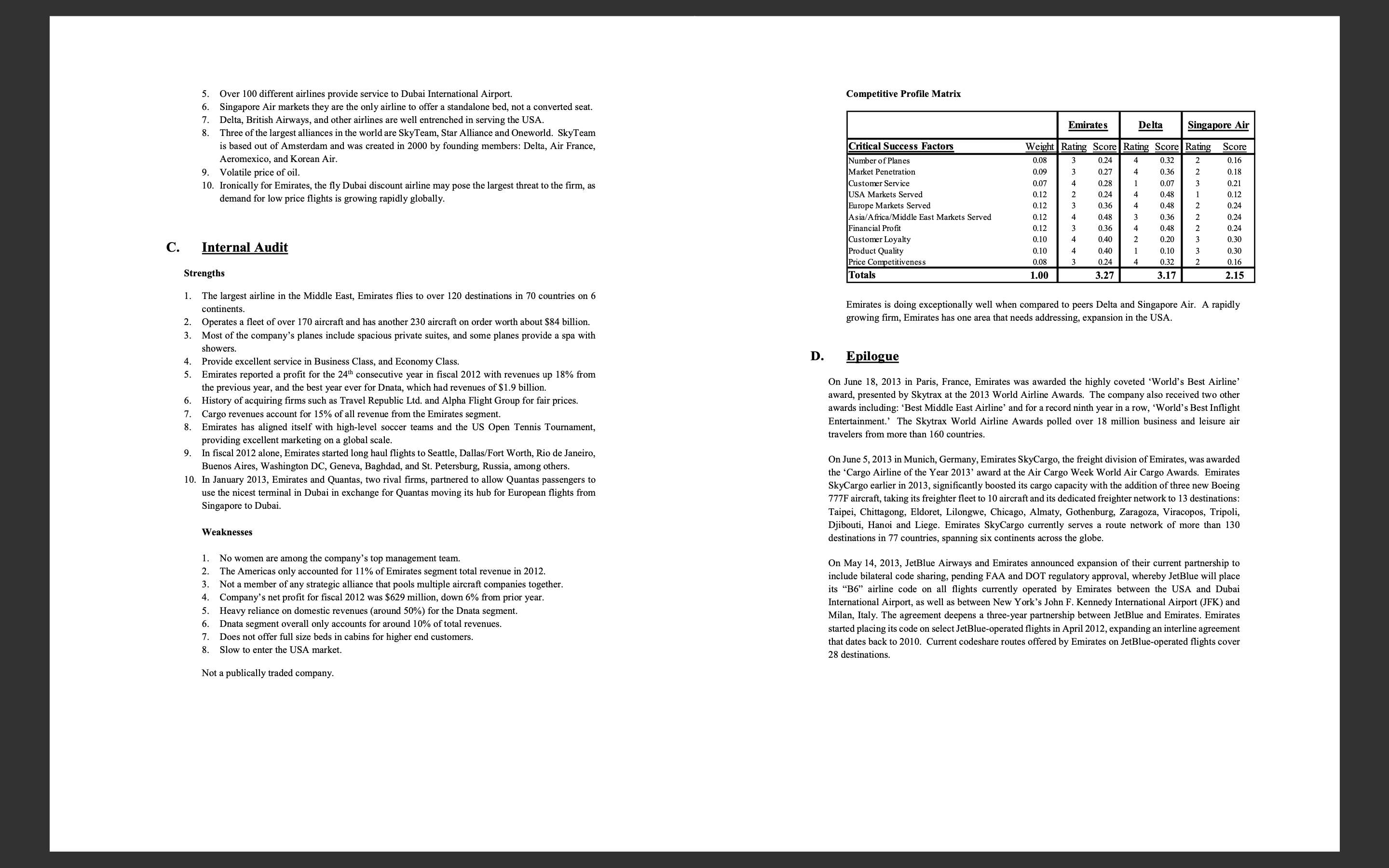

A. B. Case Abstract Headquartered in Dubai in the United Arab Emirates, the Emirates Group is the parent of Emirates, the largest airline in the Middle East, operating over 2,500 flights per week from its hub at Dubai International Airport. Emirates flies to 120 cities in 70 countries and operates 4 of the world's 10 longest non-stop commercial flights. With 50,000 employees and 50 subsidiaries, the Emirates Group is wholly owned by the government of Dubai and controlled by the Investment Corp. of Dubai. Emirates is very profitable and growing over 20% annually. The Emirates Group - 2013 Forest R. David After beginning flights from Dubai to Warsaw, Algiers, Tokyo Haneda, and Stockholm in mid-2013, the Emirates is preparing to launch flights to Conakry in Guinea, Sialkot in Pakistan, Kabul, Kiev, Taipei, and Boston in the coming months. In October 2013, Emirates began flights from Dubai to Clark in the Philippines, a nonstop flight between Milan and New York, and a brand new A380 service to Brisbane. A clear strategic plan is needed for the firm to know when and where globally to roll out its popular services. External Audit Opportunities 1. The Dirham is pegged to the US Dollar so currency fluctuations are not significant. 2. The Government of Dubai treats Emirates as a wholly independent business entity on its own, and attributes this to the firm's success. 3. Dubai International Airport is expected to be the world's busiest by 2016. For fiscal 2012, Singapore Air profits were down $756 million to $336 million or 69%. In 2013, profits in the airline industry are expected to continue to rise to $8.4 billion. North American carriers are expected to end 2012 with a collective net profit of $2.4 billion, despite GDP growth of only 2.0% and oil at a high price of $109.5/barrel. 4. 5. 6. Backed financially by the Dubai government. 7. British Airways, Delta, US airways and other carriers serving Europe and the USA do not offer near the level of service as Emirates. 8. Growing middle class around the world. 9. Air traffic is forecasted to grow 5.3% annually between 2012 and 2016. 10. Through 2016, the USA will remain the single largest market for domestic passengers at 710 million annually. Threats 1. Singapore Air is considered the closest competitor based on an overall business model of top service at a premium price and markets served. 2. Women are traditionally not allowed the same access to upper level jobs in the Middle East as men. 4. 3. Rising fuel prices hurt overall profits, as fuel accounts for over 40% of all costs for Emirates. The Arab Spring and instability in Africa also hurt profits, but the company's net profit for fiscal 2012 was $629 million, down 61% from prior year.

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer The Emirates Group 2013 A Case Abstract Company Overview The Emirates Group headquartered in Dubai United Arab Emirates is the parent company o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started