Answered step by step

Verified Expert Solution

Question

1 Approved Answer

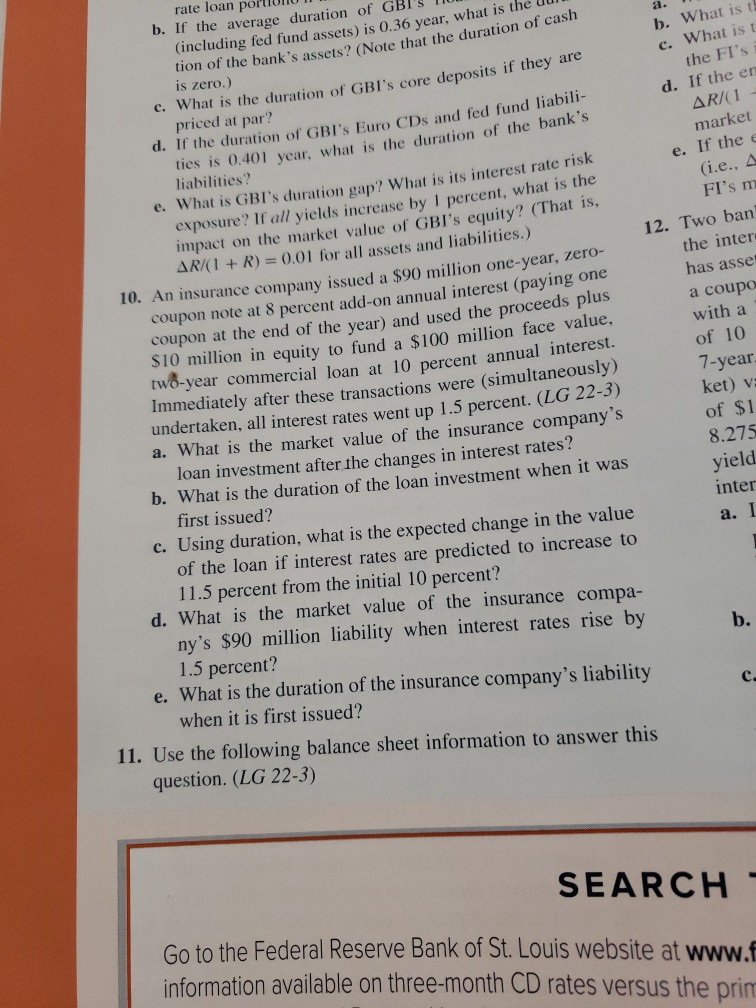

rate loan por UNUI b. If the average duration of GBI'S Tom (including fed fund assets) is 0.36 year, what is the un tion of

rate loan por UNUI b. If the average duration of GBI'S Tom (including fed fund assets) is 0.36 year, what is the un tion of the bank's assets? (Note that the duration of cash is zero.) What is the c. What ist the FI's d. If the en AR/(1 - market e. If thee (i.e., 4 c. What is the duration of GBI's core deposits if they are FI's m Two ban the inter has asse a coupo with a of 10 7-year. ket) VE of $1 8.275 priced at par? d. If the duration of GBI's Euro CDs and fed fund liabili- ties is 0.401 year, what is the duration of the banks liabilities? e. What is GBI's duration gap? What is its interest rate risk exposure? If all yields increase by 1 percent, what is the impact on the market value of GBI's equity? (That is, AR/(1+R) = 0.01 for all assets and liabilities.) 10. An insurance company issued a $90 million one-year, zero- coupon note at 8 percent add-on annual interest (paying one coupon at the end of the year) and used the proceeds plus $10 million in equity to fund a $100 million face value, two-year commercial loan at 10 percent annual interest. Immediately after these transactions were (simultaneously) undertaken, all interest rates went up 1.5 percent. (LG 22-3) a. What is the market value of the insurance company's loan investment after the changes in interest rates? b. What is the duration of the loan investment when it was first issued? c. Using duration, what is the expected change in the value of the loan if interest rates are predicted to increase to 11.5 percent from the initial 10 percent? d. What is the market value of the insurance compa- ny's $90 million liability when interest rates rise by 1.5 percent? e. What is the duration of the insurance company's liability when it is first issued? 11. Use the following balance sheet information to answer this question. (LG 22-3) yield inter a. I b. SEARCH Go to the Federal Reserve Bank of St. Louis website at www.f information available on three-month CD rates versus the prim rate loan por UNUI b. If the average duration of GBI'S Tom (including fed fund assets) is 0.36 year, what is the un tion of the bank's assets? (Note that the duration of cash is zero.) What is the c. What ist the FI's d. If the en AR/(1 - market e. If thee (i.e., 4 c. What is the duration of GBI's core deposits if they are FI's m Two ban the inter has asse a coupo with a of 10 7-year. ket) VE of $1 8.275 priced at par? d. If the duration of GBI's Euro CDs and fed fund liabili- ties is 0.401 year, what is the duration of the banks liabilities? e. What is GBI's duration gap? What is its interest rate risk exposure? If all yields increase by 1 percent, what is the impact on the market value of GBI's equity? (That is, AR/(1+R) = 0.01 for all assets and liabilities.) 10. An insurance company issued a $90 million one-year, zero- coupon note at 8 percent add-on annual interest (paying one coupon at the end of the year) and used the proceeds plus $10 million in equity to fund a $100 million face value, two-year commercial loan at 10 percent annual interest. Immediately after these transactions were (simultaneously) undertaken, all interest rates went up 1.5 percent. (LG 22-3) a. What is the market value of the insurance company's loan investment after the changes in interest rates? b. What is the duration of the loan investment when it was first issued? c. Using duration, what is the expected change in the value of the loan if interest rates are predicted to increase to 11.5 percent from the initial 10 percent? d. What is the market value of the insurance compa- ny's $90 million liability when interest rates rise by 1.5 percent? e. What is the duration of the insurance company's liability when it is first issued? 11. Use the following balance sheet information to answer this question. (LG 22-3) yield inter a. I b. SEARCH Go to the Federal Reserve Bank of St. Louis website at www.f information available on three-month CD rates versus the prim

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started