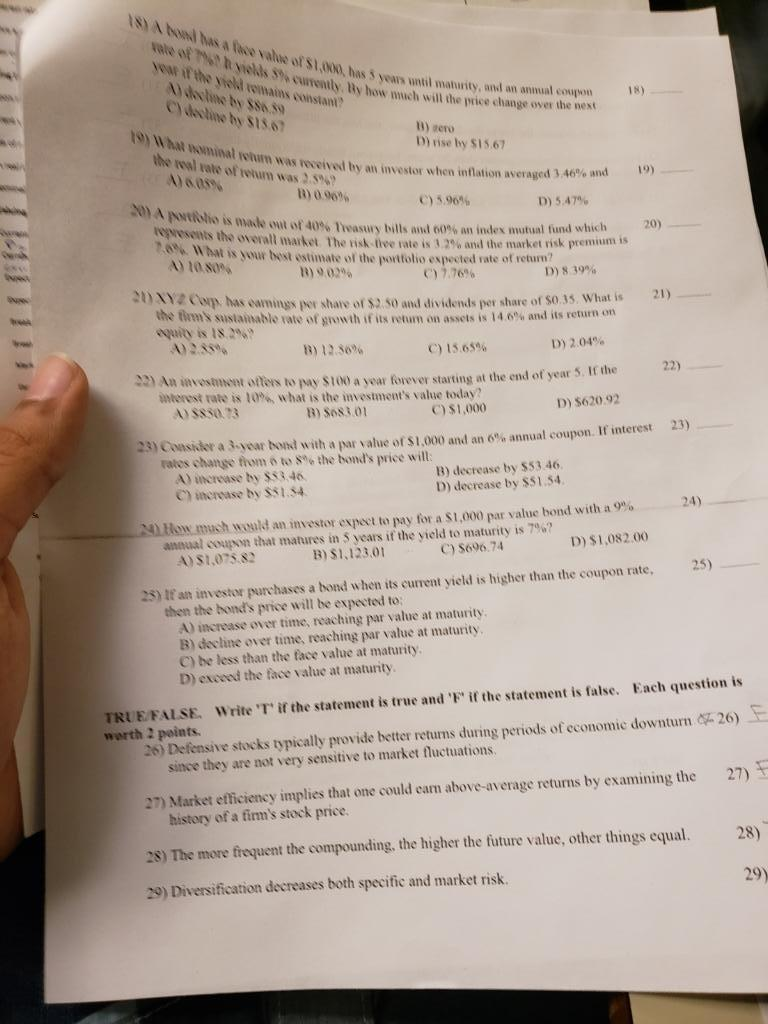

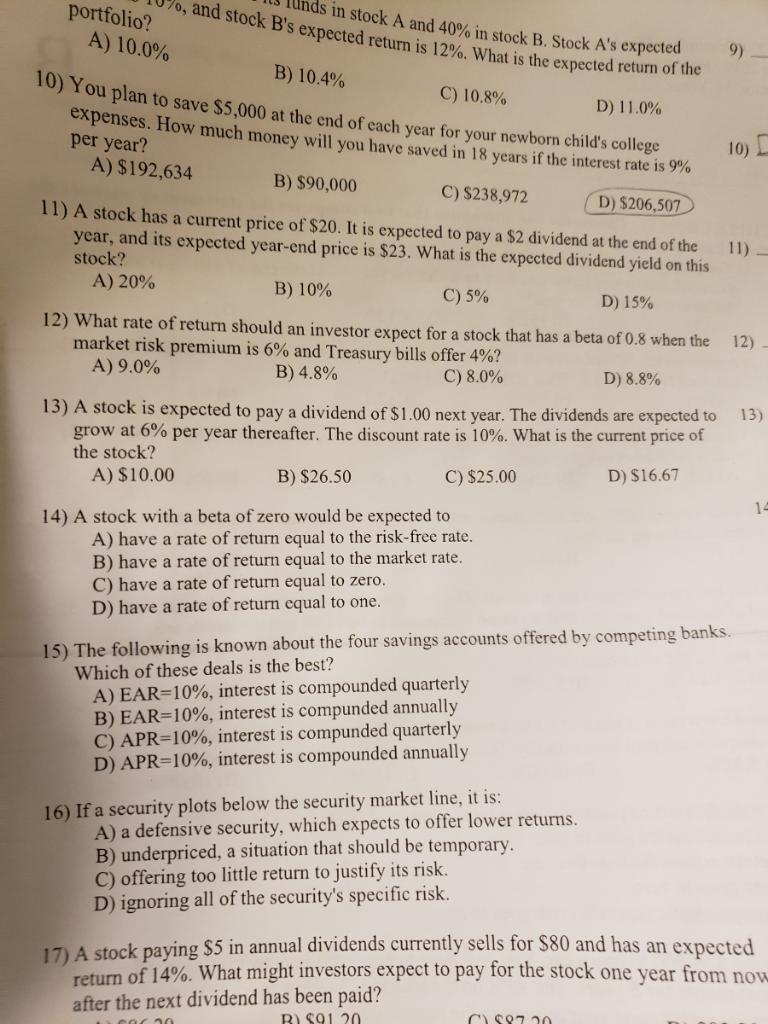

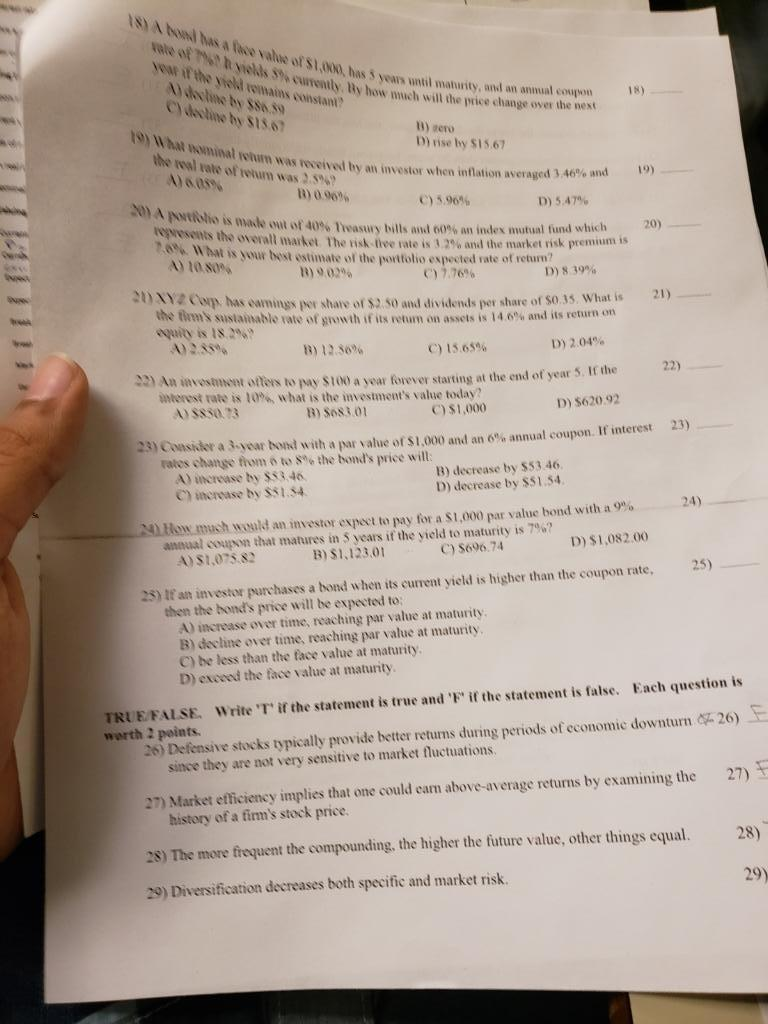

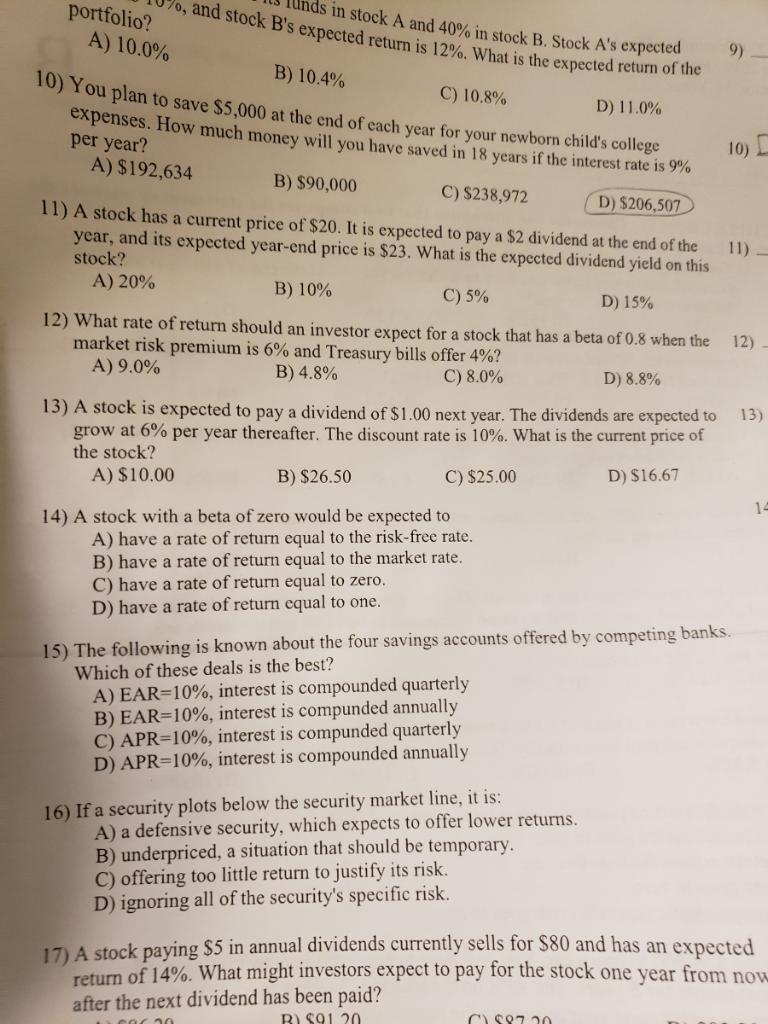

rate of 7%? h yells 5% yow it the yiold remains constant? saline by $88 50 cydedine by $1807 a faee value o S1.00 has 5 years until matiurity 81,(000, has 5 years until maturity, and an anmual soupon B) Curently. By how much will the price change over the nest H3 18) U) eero D) nse by S15.67 relum was received by an investor when inflation averaged 3 46% and the real rate ofrenim was 2.5%? A)6.05% 1110 96% C) 5.96% D) 5.47% 20) A port ho is made out of40% hvasury bills and 60% an inde reqvesents the overall market. The risk tiee rate i % W hat is your best estimate of the portfolio expected rate of return x mutual fund which overall market The risk-five rate is 3 2% and the market risk premium is A) /(180% noo B) 02% D)839% 76% C) AYph has eamings por shavs of S2 S0 and dividends per share of So 3 the tim's sustainable rate ofgrowth if its return on assets is 14 6% and its return on equity is 18.2%" A)255% 15. What is 21) D) 2.04% C) 15 65% B) 12 56% 22) If the S2) An invesamont oftes to pay $100 a year fovever starting at the end of year 5. interest rate is 10% what is the investment's value today? B) Sos3.01 D) 5620.92 C) $1,000 SS30 73 consider a 3-year bond with a par value of $1,000 and an 6% annual coupon. If nterest rates change from 0 to 8% the bond's price will A) increase by $33.46 ) incroase by $31.34 23) B) decrease by $53.46. D) decrease by $51.54 24) aulow.much would an investor expect to pay for a si,000 par value bond with a 9% annual coupon that matures in 5 years if the yield to maturity is 7%? D) $1,082.00 C) S696.74 B) S1,123,01 )S1,075.82 25) 25) tf an investor purchases a bond when its current yield is higher than the coupon rate, then the bond's price will be expected to A) increase over time, reaching par value at maturity B) decline over time, reaching par value at maturity C) be less than the face value at maturity D) exceed the face vaue at maturity TRUEFALSE Write T' if the statement is true and 'P it the statement is false. Each question is worth 2 points 26) Defensive stocks typically provide better returns during periods of economic downturn 0 26) since they are not very sensitive to market fluctuations 27) Market efficiency implies that one could earm above-average returns by examining the 27) history of a fim's stock price. 28) The more frequent the compounding, the higher the future value, other things equal. 28) 29) 29) Diversification decreases both specific and market risk. 070, and stock 9) funds in stock A and 40% in stock B. Stock A's expected. , s expected return is 12%. What is the expected return of the portfolio? A) 10.0% B) 10.4% 10) C) 10.8% You D) 11.0% plan to save $5,000 at the end of each year for your newborn child's college expenses. How much money will you have saved in 18 years if the interest rate is 9% per year? A) $192,634 10) B) $90,000 C) $238,972 D) $206,507 11) A stock has a current price of $20. It is expected to pay a $2 dividend at the end of the 11) year, and its expected year-end price is $23. What is the expected dividend yield on this stock? A) 20% 0 0 D) 15% 12) What rate of return should an investor expect for a stock that has a beta of 0.8 when the market risk premium is 6% and Treasury bills offer 4%? A) 9.0% 12) D) 8.8% B) 4.8% C) 8.0% 13) 3) A stock is expected to pay a dividend of $1.00 next year. The dividends are expected to grow at 6% per year thereafter. The discount rate is 10%. What is the current price of the stock? A) $10.00 D) S16.67 C) $25.00 B) S26.50 14 14) A stock with a beta of zero would be expected to A) have a rate of return equal to the risk-free rate B) have a rate of return equal to the market rate. C) have a rate of return equal to zero. D) have a rate of return equal to one. 15) The following is known about the four savings accounts offered by competing banks. Which of these deals is the best? A) EAR-10%, interest is compounded quarterly B) EAR-10%, interest is compunded annually C) APR-1090, interest is compunded quarterly D) APR-10%, interest is compounded annually 16) If a security plots below the security market line, it is A) a defensive security, which expects to offer lower returns. B) underpriced, a situation that should be temporary. C) offering too little return to justify its risk. D) ignoring all of the security's specific risk 17) A stock paying S5 in annual dividends currently sells for $80 and has an expected return of 14%. What might investors expect to pay for the stock one year from now after the next dividend has been paid? R) S91 20