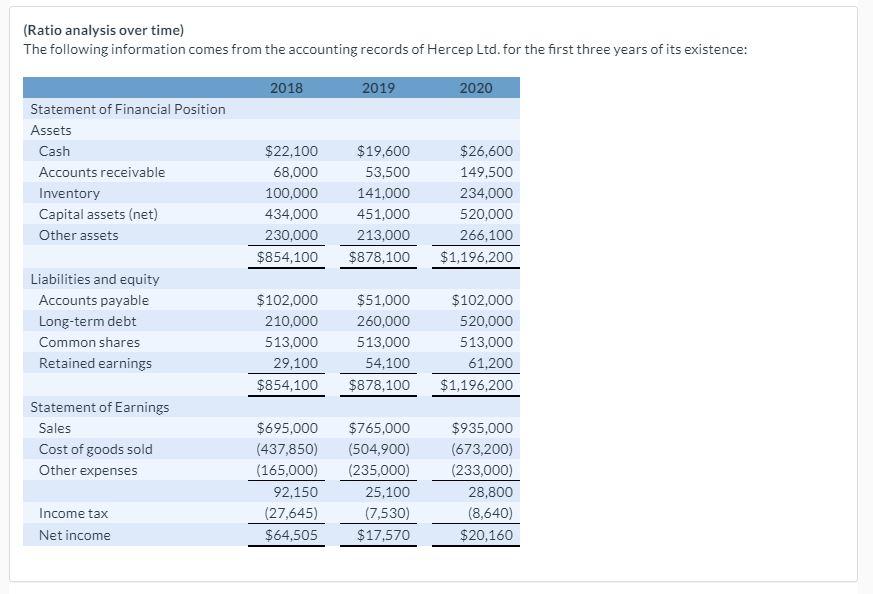

(Ratio analysis over time) The following information comes from the accounting records of Hercep Ltd. for the first three years of its existence: 2018

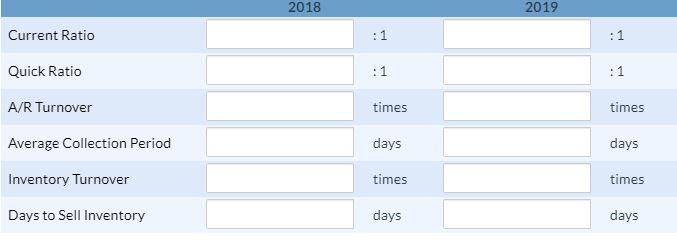

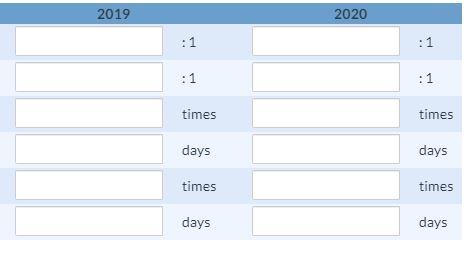

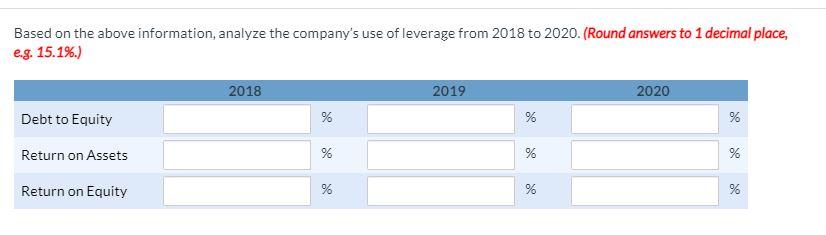

(Ratio analysis over time) The following information comes from the accounting records of Hercep Ltd. for the first three years of its existence: 2018 2019 2020 Statement of Financial Position Assets Cash $22,100 $19,600 $26,600 Accounts receivable 68,000 53,500 149,500 Inventory 100,000 141,000 234,000 Capital assets (net) 434,000 451,000 520,000 Other assets 230,000 213,000 266,100 $854,100 $878,100 $1,196,200 Liabilities and equity Accounts payable $102,000 $51,000 $102,000 Long-term debt 210,000 260,000 520,000 Common shares 513,000 513,000 513,000 Retained earnings 29,100 54,100 61,200 $854,100 $878,100 $1,196,200 Statement of Earnings Sales $695,000 $765,000 $935,000 Cost of goods sold (437,850) (504,900) (673,200) Other expenses (165,000) (235,000) (233,000) 92,150 25,100 28,800 Income tax (27,645) (7,530) (8,640) Net income $64,505 $17,570 $20,160 2018 2019 Current Ratio :1 :1 Quick Ratio :1 :1 A/R Turnover times times Average Collection Period days days Inventory Turnover times times Days to Sell Inventory days days 2019 2020 :1 :1 times times days days times times days days Based on the above information, analyze the company's use of leverage from 2018 to 2020. (Round answers to 1 decimal place, e.g. 15.1%.) 2018 2019 2020 Debt to Equity % % % Return on Assets Return on Equity % % %

Step by Step Solution

3.37 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Particulars 2018 Calculation 2019 Calculation 2020 Sales 0 765000695000695000100 101 935000695000695...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started