Question

Please use the EXCEL FILE ONLY to solve the question. Pleasure if you show the process! 5. Suppose that you are comparing the following two

Please use the EXCEL FILE ONLY to solve the question. Pleasure if you show the process!

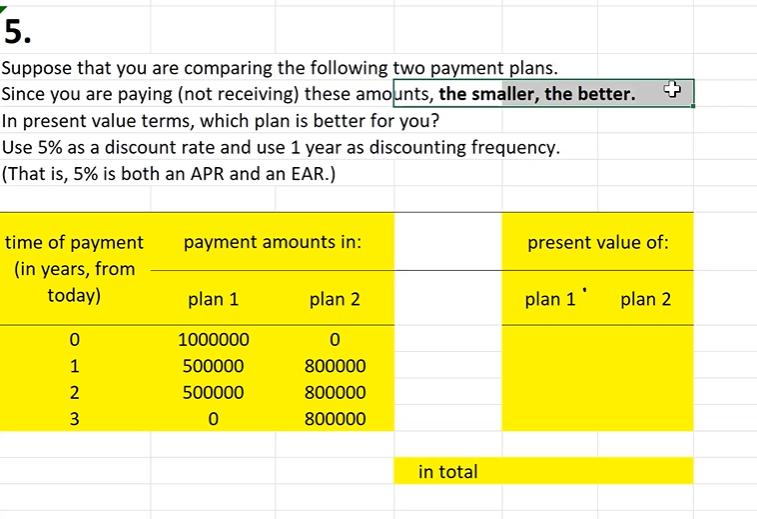

5. Suppose that you are comparing the following two payment plans. Since you are paying (not receiving) these amounts, the smaller, the better. In present value terms, which plan is better for you? Use 5% as a discount rate and use 1 year as discounting frequency. (That is, 5% is both an APR and an EAR.) time of payment (in years, from today) 0 1 23 payment amounts in: plan 1 1000000 500000 500000 0 plan 2 0 800000 800000 800000 in total present value of: plan 1 plan 2

Step by Step Solution

3.60 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the present value of each payment plan we need to discount each payment back to the pre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Horngrens Financial And Managerial Accounting The Financial Chapters

Authors: Tracie L. Miller Nobles, Brenda L. Mattison, Ella Mae Matsumura

6th Edition

978-0134486840, 134486838, 134486854, 134486846, 9780134486833, 978-0134486857

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App