Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RATIOS CALCULATED; QUESTIONS READY TO ANSWER. THANKS Questions Calculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios for 2020E.

RATIOS CALCULATED; QUESTIONS READY TO ANSWER. THANKS

Questions

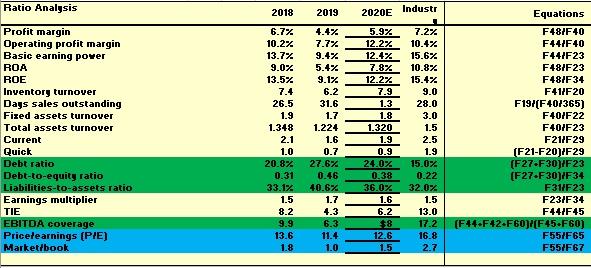

- Calculate the projected debt ratio, debt-to-equity ratio, liabilities-to-assets ratio, times-interest-earned ratio, and EBITDA coverage ratios for 2020E. How does Computron compare with the industry with respect to financial leverage? What can you conclude from these ratios?

- Calculate the projected price/earnings ratio and market/book ratio for 2020E. Do these ratios indicate that investors are expected to have a high or low opinion of the company?

Ratio Analysis 2018 2019 Profit margin Operating profit margin Basic earning pover ROA ROE Inventory turnover Days sales outstanding Fized assets turnover Total assets turnover Current Quick Debt ratio Debt-to-equity ratio Liabilities-to-assets ratio Earnings multiplier TIE EBITDA coverage Pricelearnings (P/E) Market/book 6.7% 10.2% 13.7% 9.0% 13.5% 7.4 26.5 1.9 1.348 2.1 1.0 20.8% 0.31 33.172 1.5 8.2 9.9 13.6 1.8 4.4% 7.7% 9.4% 5.4% 9.1% 6.2 31.6 1.7 1.224 1.6 0.7 27.6% 0.46 40.6% 1.7 2020E Industr 1 5.9% 7.2% 12.2% 10.4% 12.4% 15.6% 7.8% 10.8% 12.27 15.4% 7.9 9.0 1.3 28.0 1.8 3.0 1.320 1.5 1.9 2.5 0.9 1.9 24.0% 15.0% 0.38 0.22 36.0% 32.07 1.6 1.5 13.0 $8 17.2 12.6 16.8 1.5 2.7 Equations F48/F 40 F44/F40 F44/F23 F48/F23 F48/F34 F41/F20 F19/(F40/365) F40/F22 F40/F23 F21/F29 (F21-F20/F29 (F27.F30/F23 (F27-F30)/F34 F31F23 F23/F34 F44/F45 (F44.F42-F60)(F45.F60) F55/F65 F55/F67 6.2 6.3 11.4 1.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started