Answered step by step

Verified Expert Solution

Question

1 Approved Answer

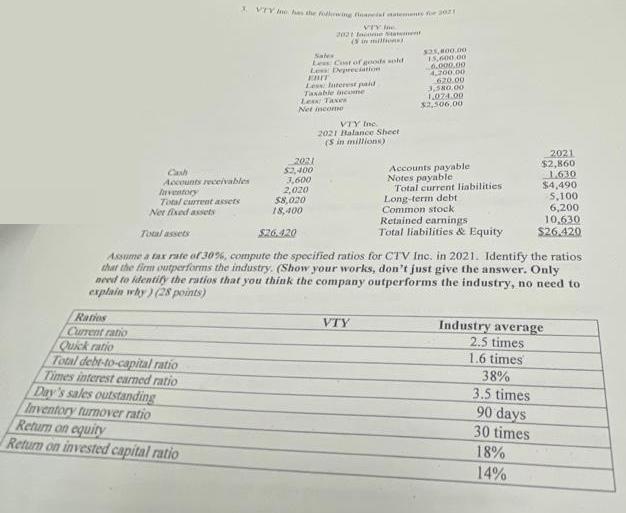

3 VTV In has the following financial statements for 3021 Sales VTY 2021 fame Statement Les Cost of goods sold Less Depreciation Less Interest

3 VTV In has the following financial statements for 3021 Sales VTY 2021 fame Statement Les Cost of goods sold Less Depreciation Less Interest paid Taxable income $25,800.00 15,600 00 6.000.00 4,200.00 620.00 3,580.00 1.024.00 $2,506,00 Les Taxes Net income VTY Inc. 2021 Balance Sheet (S in millions) 2021 Cash $2,400 Accounts receivables 3,600 Inventory 2,020 Total current assets $8,020 Net fixed assets 18,400 $26.420 2021 Accounts payable $2,860 Notes payable 1,630 Total current liabilities: $4,490 Long-term debt 5,100 Common stock 6,200 Retained earnings 10,630 $26.420 Total assets Total liabilities & Equity Assume a tax rate of 30%, compute the specified ratios for CTV Inc. in 2021. Identify the ratios that the firm outperforms the industry. (Show your works, don't just give the answer. Only need to identify the ratios that you think the company outperforms the industry, no need to explain why) (28 points) Ratios Current ratio Quick ratio Total debt-to-capital ratio Times interest earned ratio Day's sales outstanding Inventory turnover ratio Return on equity Return on invested capital ratio VTY Industry average 2.5 times 1.6 times 38% 3.5 times 90 days 30 times 18% 14%

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To compute the specified ratios for CTV Inc in 2021 well use the given financial data Lets calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started