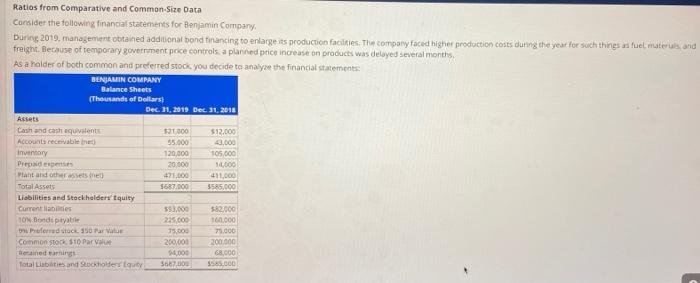

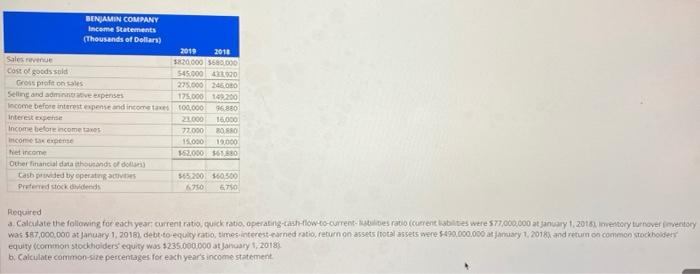

Ratios from Comparative and Common Size Data Consider the following financial statements for Benjamin Company During 2019, management obtained additional bond financing to enlarge its production facilities. The company faced higher production costs during the year for such things as fuel mater and freight. Because of temporary government price controls a planned price increase on products was delayed several months As a holder of both common and preferred stock, you decide to analyze the financial statements BENJAMIN COMPANY Balance Sheets (Thousands of Dollars) Dec 31, 2019 Dec 31, 2018 Assets Cash and cash equivalent 1000 $12.000 Accounts receivable) 55.000 3.000 Inventory 120.000 105.000 Prod 20 000 1.000 Pant and other assets the 421,000 411,000 Total Assets $687.000 3585.000 Liabilities and Stockholders' quity Currenties 590.000 $82.000 SON Dondi piatti 225.000 160.000 Preferred stock. 350r Value 75.000 71.000 Common stock 510 Parva 200,000 200.000 trecand canning 000 68.000 Total Liabetes and stockholder 56700 3585.000 BENJAMIN COMPANY Income Statements (Thousands of Dollars) 2019 2011 Sales revenue 5820.000 5680.00 Cost of goods sold 545.000 100 Gross profit osales 275.000 246.00 Selling and admite expenses 175.000 10200 Income before interestepense and income 00.000 96.800 interest 2100 100 Income before income taxe 72.000 200 income tax expen 15.000 10000 Net income 192.000 951.580 Other financial data thousands of dollar) tasbided by operate 563.20060500 750 6750 Required a. Calculate the following for each year current ratio, quick ratio operating cashHow to-current les ratio (current abilities were 577.000.000 at January 1, 2016. mestory turnover inventory was 587,000,000 at January 1, 2018) debt to equity ratio, times interest-earned to return on assets total assets were $490.000.000 atjanary1.2018 od return on.common stockholders equity (common stockholders equity was $235.000.000 at January 1, 2018 6. Calculate common size percentages for each year's income statement Round answers to two decimal places 2019 2.32 0 x 2018 0 x 0 x OX Current ratio: Quick ratio Operating-cash-flow-to-current liabilities ratio: Inventory turnover: Debt-to-equity ratio: Times-interest-earned ratio: Return on assets: Return on common stockholders' equity: 0 X OX OX 0 % x OX OX 096 x 096 x 0% X Round answers to one decimal place. Income Statements Year Ended 2019 Sales revenue $820,000 Cost of goods sold 545,000 Gross profit on sales 275,000 Selling and administrative expenses 175,000 Income before interest expense and income taxes 100,000 Interest expense 23,000 Income before income taxes 77,000 Income tax expense 15,000 Net income $62,000 Common Size 100 % 66.5% 33.5% 21.3% 12.296 2.8 % 9.4% 1.8 % 7.6% Year Ended 2018 $680,000 433,920 246,080 149,200 96,880 16,000 80,880 19,000 $61,880 Common Size 100 % 63.8 % 36.296 12.996 X 14.2% 2.4% 11.996 2.8% 9.1%