Answered step by step

Verified Expert Solution

Question

1 Approved Answer

- Ratios that help determine whether a comnanv ran access its cash and pay its short-term obligations are called ratios. - nauos that help determine

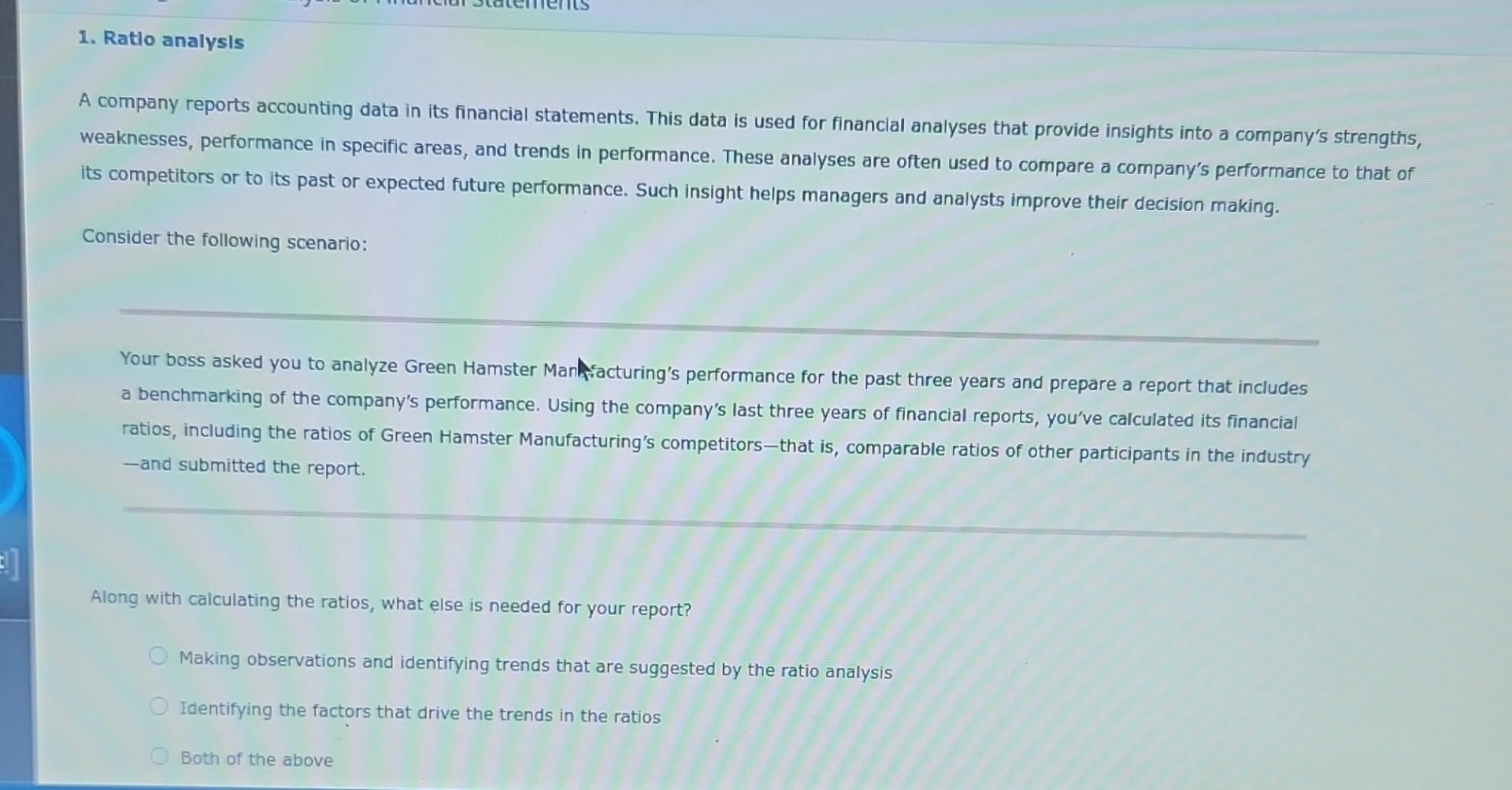

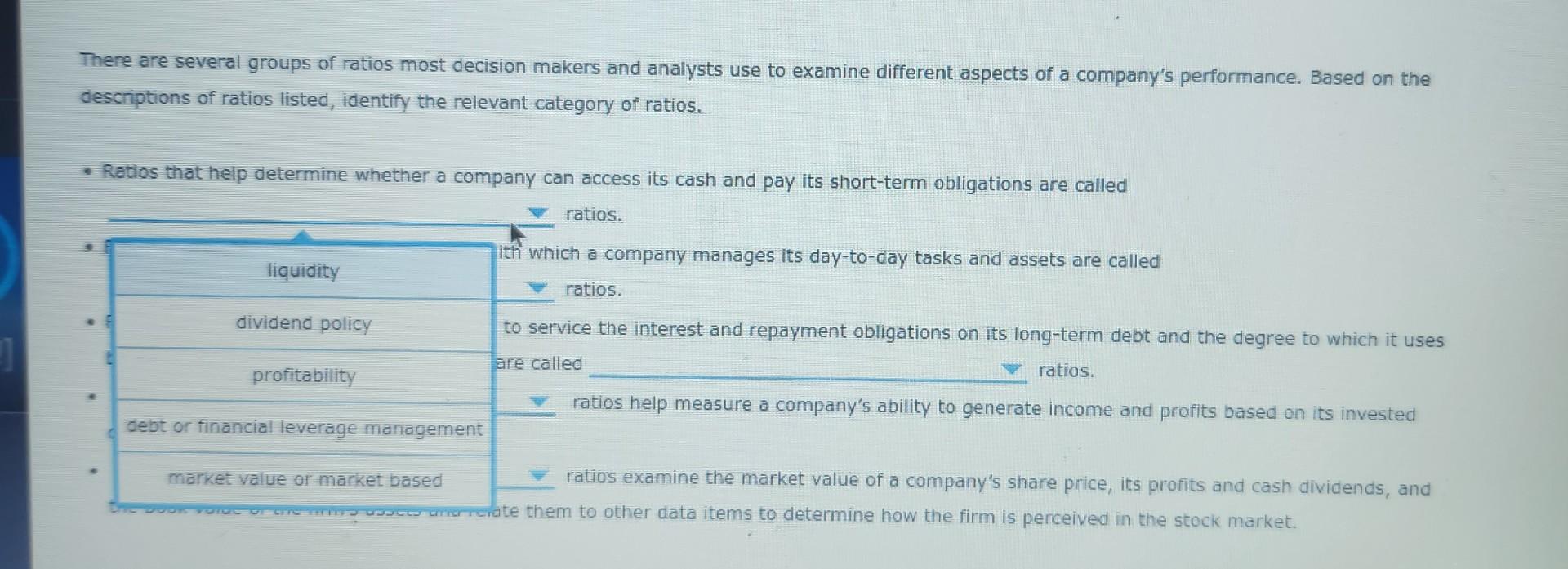

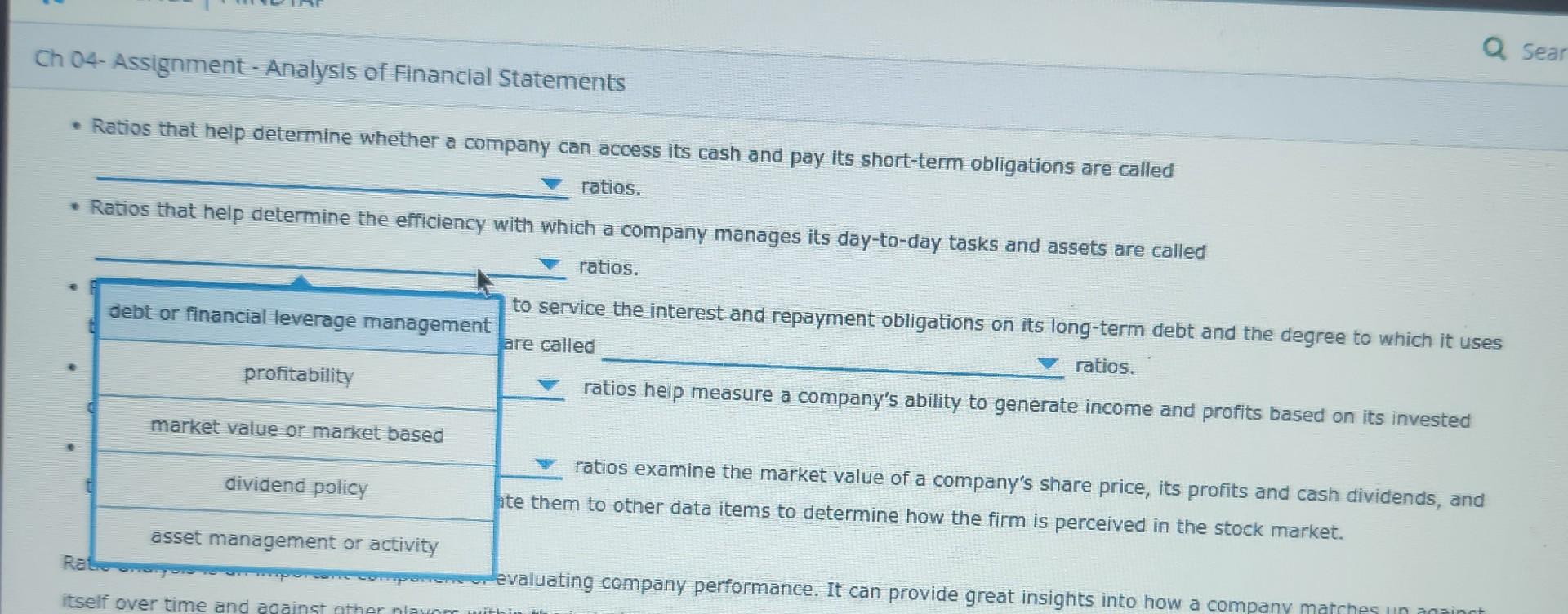

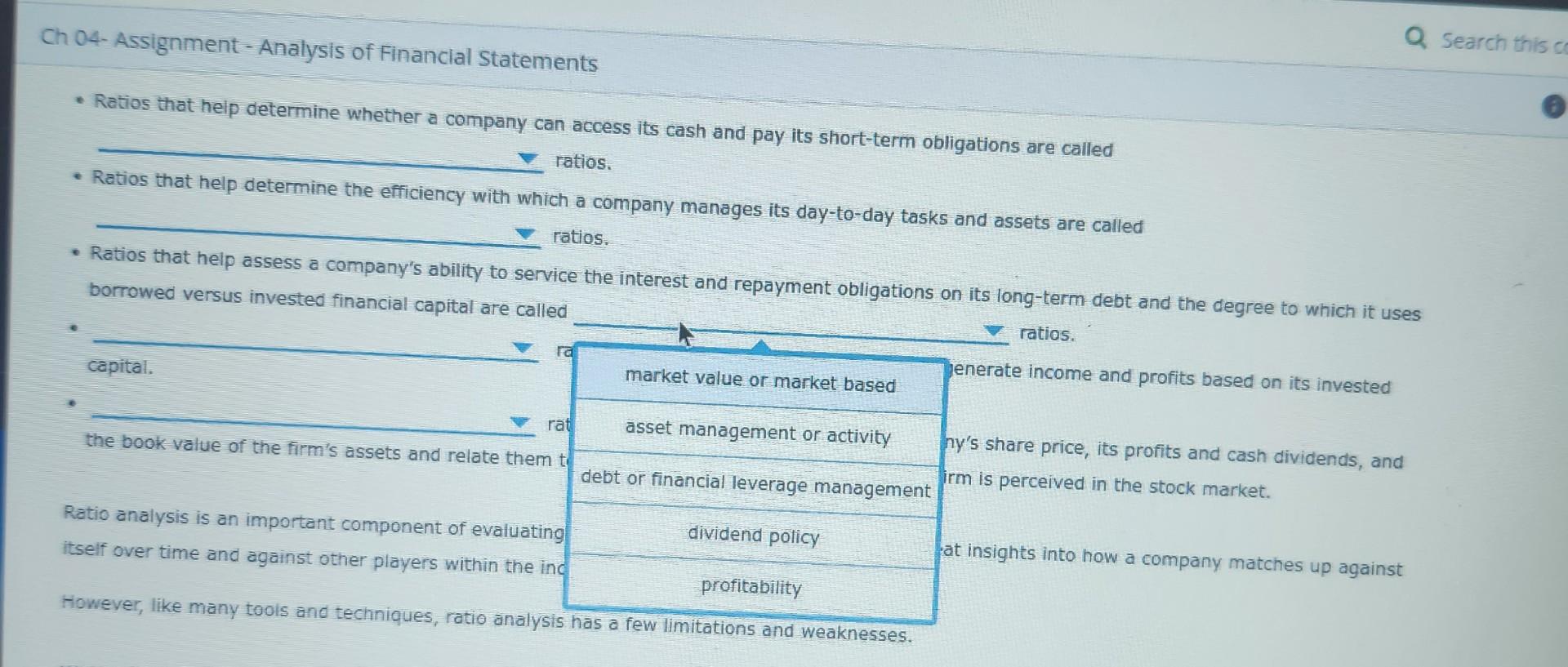

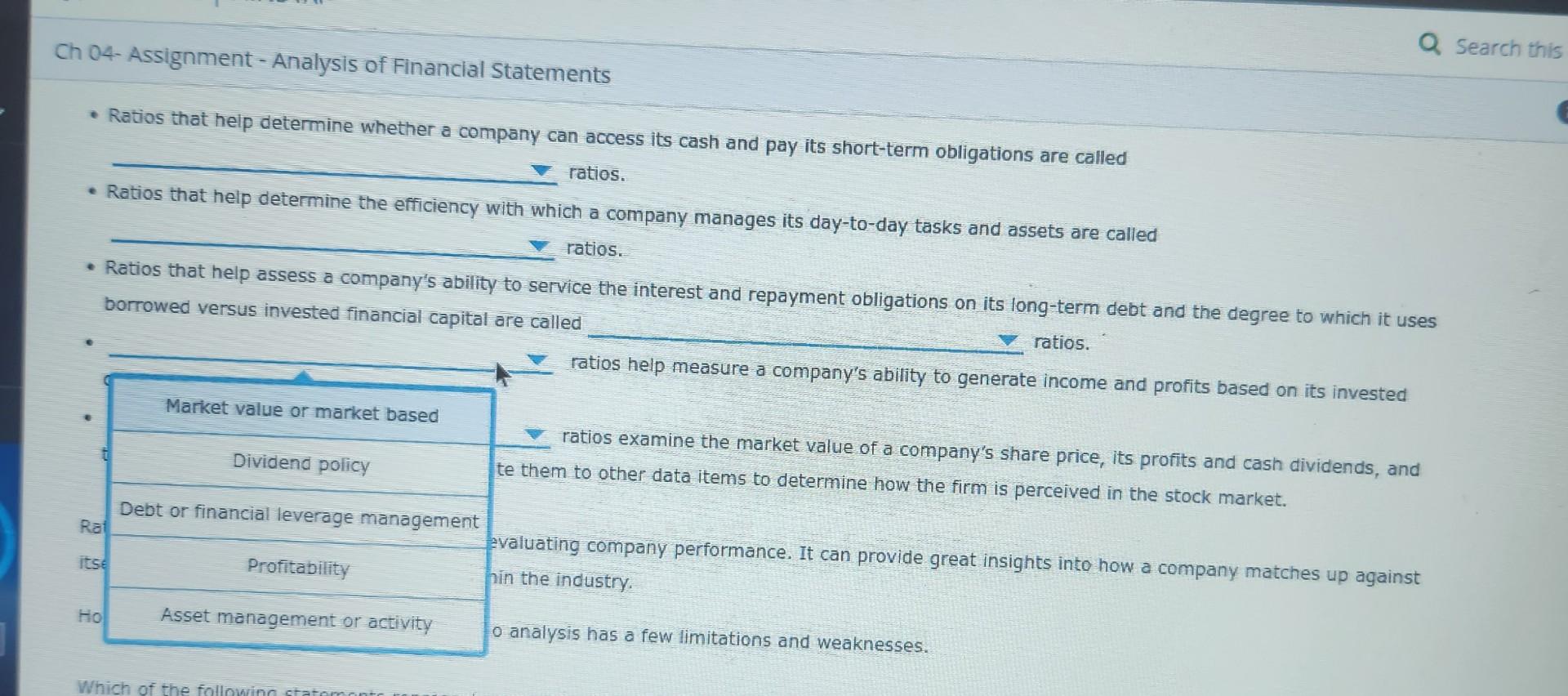

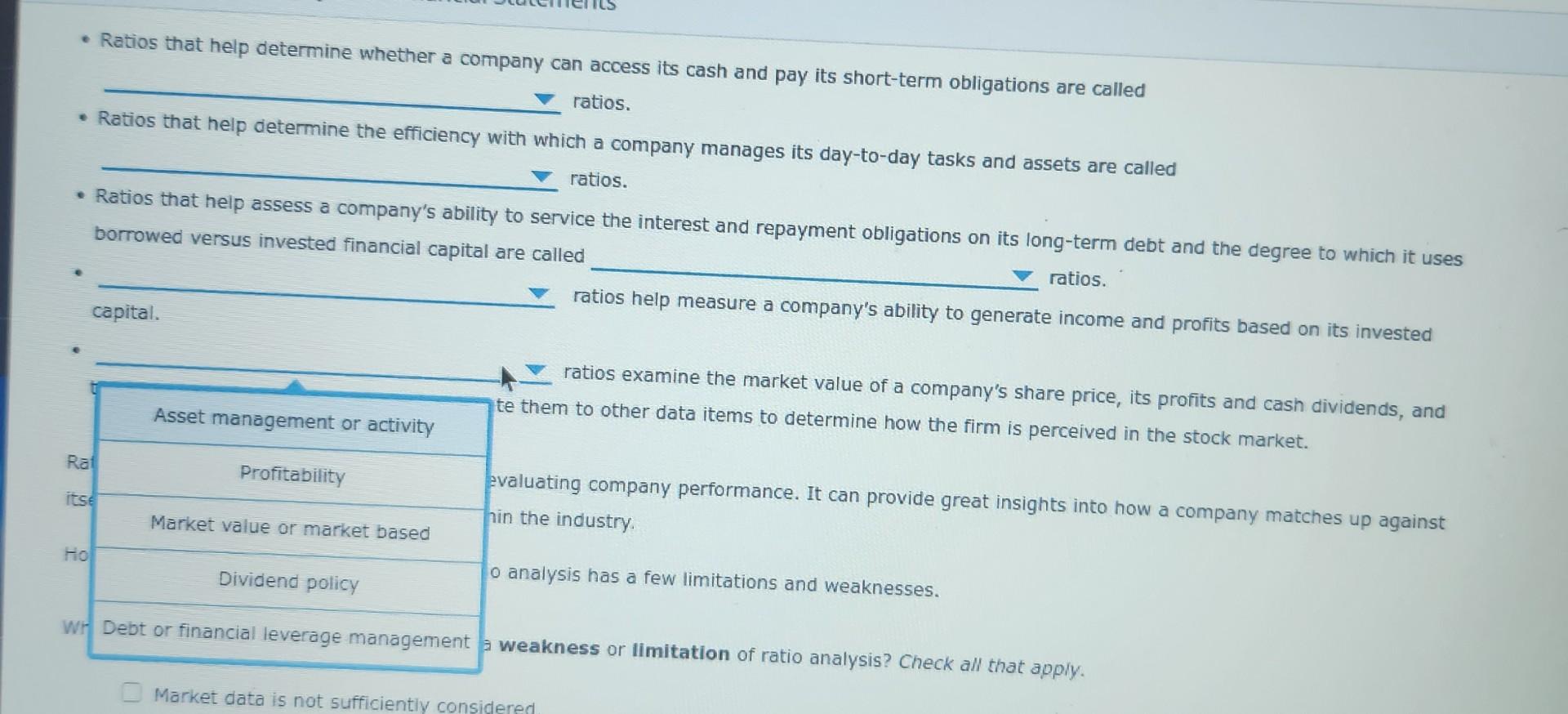

- Ratios that help determine whether a comnanv ran access its cash and pay its short-term obligations are called ratios. - nauos that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. - katios that help assess a company's ability to service the interest and repayment obligations on its long-term debt and the degree to which it uses borrowed versus invested financial capital are called ratios. enerate income and profits based on its invested che book value of the firm's assets and relate them 1 Ratio analysis is an important component of evaluating itself over time and against other players within the inc However, like many tools and techniques, ratio analysis y's share price, its profits and cash dividends, and m is perceived in the stock market. t insights into how a company matches up against t insights into how a company matches up against A company reports accounting data in its financial statements. This data is used for financial analyses that provide insights into a company's strengths, weaknesses, performance in specific areas, and trends in performance. These analyses are often used to compare a company's performance to that of its competitors or to its past or expected future performance. Such insight helps managers and analysts improve their decision making. Consider the following scenario: Your boss asked you to analyze Green Hamster Manfacturing's performance for the past three years and prepare a report that includes a benchmarking of the company's performance. Using the company's last three years of financial reports, you've calculated its financial ratios, including the ratios of Green Hamster Manufacturing's competitors-that is, comparable ratios of other participants in the industry -and submitted the report. Along with calculating the ratios, what else is needed for your report? Making observations and identifying trends that are suggested by the ratio analysis Identifying the factors that drive the trends in the ratios Both of the above Ratio analysis is an important component of evaluating company performance. It can provide great insights into how a company matches up against itself over time and against other players within the industry. However, like many tools and techniques, ratio analysis has a few limitations and weaknesses. Which of the following statements represent a weakness or IImitation of ratio analysis? Check all that apply. Market data is not sufficiently considered. Window dressing might be in effect. Seasonal factors can distort data. - Ratios that help determine whether a comnanu ran access its cash and pay its short-term obligations are called ratios. - Katios that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. - Ratios that help assess a company's ability to service the interest and repayment obliaations on itc long-term debt and the degree to which it uses borrowed versus invested financial capital are called - ratios. ratios help measure a company's ability to generate income and profits based on its invested ratios examine the market value of a company's share price, its profits and cash dividends, and te them to other data items to determine how the firm is perceived in the stock market. valuating company performance. It can provide great insights into how a company matches up against in the industry. , analysis has a few limitations and weaknesses. weakness or limitation of ratio analysis? Check all that apply. Market data is not sufficientily considered There are several groups of ratios most decision makers and analysts use to examine different aspects of a company's performance. Based on the descriptions of ratios listed, identify the relevant category of ratios. - Ratios that help determine whether a company can access its cash and pay its short-term obligations are called ratios. ith which a company manages its day-to-day tasks and assets are called ratios. to service the interest and repayment obligations on its long-term debt and the degree to which it uses are called ratios. ratios help measure a company's ability to generate income and profits based on its invested ratios examine the market value of a company's share price, its profits and cash dividends, and te them to other data items to determine how the firm is perceived in the stock market. - Ratios that help determine whether a comnanv ran access its cash and pay its short-term obligations are called atios. - Ratios that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. to service the interest and repayment obliatione nn ite Ing-term debt and the degree to which it uses ire called. ratios. ratios help measure a company's ability to generate income and profits based on its invested ratios examine the market value of a company's share price, its profits and cash dividends, and e them to other data items to determine how the firm is perceived in the stock market. valuating company performance. It can provide great insights into how a companv 04-Assignment - Analysis of Financial Statements Ratios that help determine whether a combanv can access its cash and pay its short-term obligations are called ratios. - Ratios that help determine the efficiency with which a company manages its day-to-day tasks and assets are called ratios. Ratios that help assess a company's ability to service the interest and repayment obliaations nn ite inng-term debt and the degree to which it uses borrowed versus invested financial capital are called ratios. ratios help measure a company's ability to generate income and profits based on its invested ratios examine the market value of a company's share price, its profits and cash dividends, and them to other data items to determine how the firm is perceived in the stock market. luating company performance. It can provide great insights into how a company matches up against the industry. analysis has a few limitations and weaknesses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started