Question

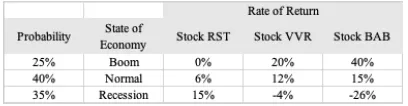

Ravi, a fund manager working for a private equity firm, isconsidering including the following stocks in the firm?sportfolio: He plans to invest 40% of the

Ravi, a fund manager working for a private equity firm, isconsidering including the following stocks in the firm?sportfolio:

He plans to invest 40% of the portfolio funds in stock RST andthe balance equally between VVR and BAB. Beta of stock VVR is 0.15higher than RST.

The firm?s in-house economist anticipates the probability ofboom, normal and recession to be 25%, 40% and 35% respectively. Theyield on long term government securities is 3% per year.

(a) Calculate the expected return and standard deviation foreach stock. (6 marks)

(b) Calculate the expected return, expected risk premium andstandard deviation for the portfolio. (4 marks)

(c) Interpret your answer for part (a) and (b) and advise Ravion his asset allocation plan for the portfolio. (6 marks)

(d) Compute the expected market risk premium assuming capitalasset pricing model holds. (4 marks) (e) Explain whether stock RSTor stock VVR is riskier. (5 marks)

Probability 25% 40% 35% State of Economy Boom Normal Recession Stock RST 0% 6% 15% Rate of Return Stock VVR 20% 12% -4% Stock BAB 40% 15% -26%

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Okay here are the key steps to solve this problem a Expected return of Company G using ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started