Question

Raw material available for use * $12,000 $40,000 $52,000 None of the options ..... Direct labor * $17,000 $25,500 $32,000 None of the options .....

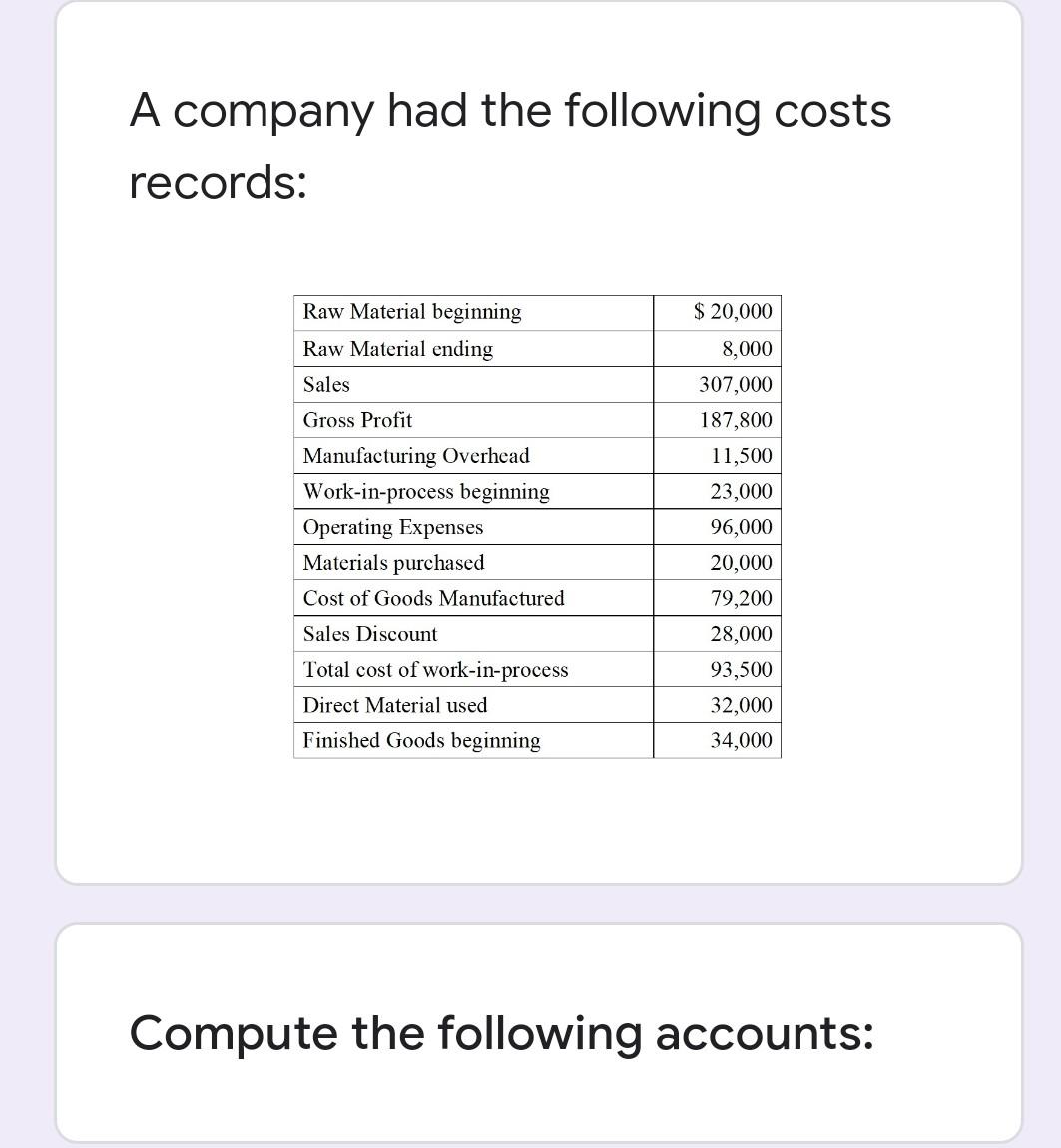

Raw material available for use * $12,000 $40,000 $52,000 None of the options ..... Direct labor * $17,000 $25,500 $32,000 None of the options ..... Total manufacturing costs * $70,500 $65,000 $72,500 None of the options ..... Cost of goods sold * $91,200 $71,200 $22,000 None of the options ...... Work-in-process ending * $14,300 $22,500 $28,300 None of the options ...... Finished goods ending * $14,000 $22,000 $28,000 None of the options ..... Net sales * $335,000 $307,000 $279,000 None of the options ...... Total inventory balance in the Balance Sheet * $44,300 $77,000 $32,700 None of the options

A company had the following costs records: $ 20,000 Raw Material beginning Raw Material ending Sales 8,000 Gross Profit Manufacturing Overhead Work-in-process beginning Operating Expenses Materials purchased Cost of Goods Manufactured Sales Discount Total cost of work-in-process Direct Material used Finished Goods beginning 307,000 187,800 11,500 23,000 96,000 20,000 79,200 28,000 93,500 32,000 34,000 Compute the following accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started