Answered step by step

Verified Expert Solution

Question

1 Approved Answer

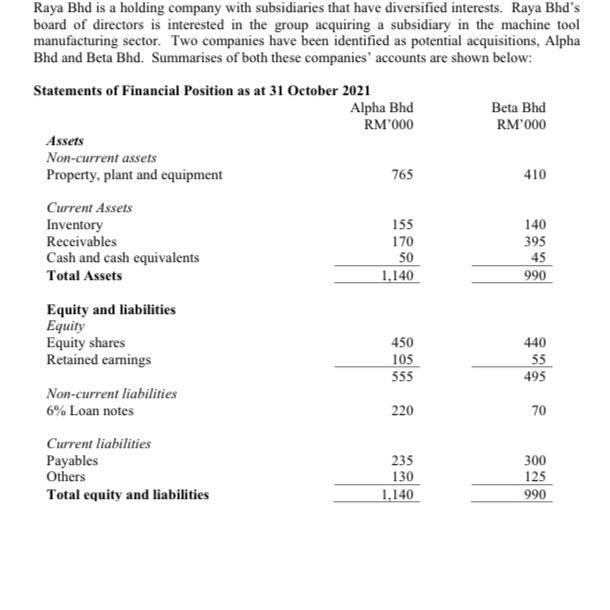

Raya Bhd is a holding company with subsidiaries that have diversified interests. Raya Bhd's board of directors is interested in the group acquiring a

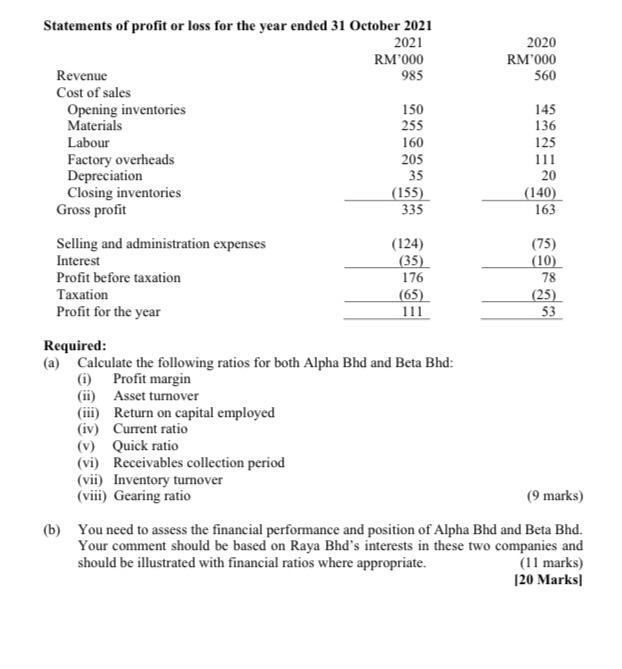

Raya Bhd is a holding company with subsidiaries that have diversified interests. Raya Bhd's board of directors is interested in the group acquiring a subsidiary in the machine tool manufacturing sector. Two companies have been identified as potential acquisitions, Alpha Bhd and Beta Bhd. Summarises of both these companies' accounts are shown below: Statements of Financial Position as at 31 October 2021 Alpha Bhd Beta Bhd RM'000 RM'000 Assets Non-current assets Property, plant and equipment 765 410 Current Assets Inventory Receivables 155 170 140 395 45 Cash and cash equivalents Total Assets 50 1,140 990 Equity and liabilities Equity Equity shares Retained earnings 450 440 105 555 55 495 Non-current liabilities 6% Loan notes 220 70 Current liabilities Payables Others 235 130 300 125 990 Total equity and liabilities 1,140 Statements of profit or loss for the year ended 31 October 2021 2021 2020 RM'000 RM'000 Revenue 985 560 Cost of sales Opening inventories Materials 150 255 145 136 Labour 160 125 111 Factory overheads Depreciation Closing inventories Gross profit 205 35 20 (155) 335 (140) 163 Selling and administration expenses Interest (124) (35) 176 (75) (10) 78 Profit before taxation (65) 111 Taxation (25) 53 Profit for the year Required: (a) Calculate the following ratios for both Alpha Bhd and Beta Bhd: (i) Profit margin (ii) Asset turnover (ii) Return on capital employed (iv) Current ratio (v) Quick ratio (vi) Receivables collection period (vii) Inventory tumover (viii) Gearing ratio (9 marks) (b) You need to assess the financial performance and position of Alpha Bhd and Beta Bhd. Your comment should be based on Raya Bhd's interests in these two companies and (11 marks) 120 Marks] should be illustrated with financial ratios where appropriate.

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a RATIOS FORMULA APLHA BETA i PROFIT MARGIN Profit for the yearRevenue100 11269035532994923 9464285714285714 ii ASSET TURNOVER RevenueTotal Assets 086...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started