Question

Raymond Supply, a national hardware chain, is considering purchasing a smaller chain, Strauss & Glazer Parts (SGP). Raymond's analysts project that the merger will result

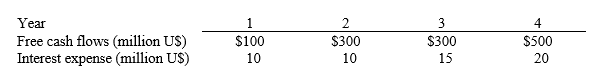

Raymond Supply, a national hardware chain, is considering purchasing a smaller chain, Strauss & Glazer Parts (SGP). Raymond's analysts project that the merger will result in the following free cash flows and interest expenses. After Year 4, both free cash flows and interest expenses will grow at constant rate of 4%.

Assume that all cash flows occur at the end of the year. SGP has 2 million shares outstanding and a target capital structure consisting of 40% debt and 60% common equity. Market value of SGPs debt is $200 million and cost of debt is 10%. The value of SGPs non-operating assets is $0. SGP's pre-merger beta is 2.0, and its post-merger tax rate would be 40%. The risk-free rate is 8% and the market risk premium (rM-rRF) is 4%. Using the APV method, answer the following questions.

1) Which discount rate should be used to value of the tax shields of SGP?

2) What is the per share value of SGP to Raymond Supply Corporation?

MUST USE APV METHOD TO SOLVE BOTH PROBLEMS. SHOW WORK.

Year Free cash flows (million US) Interest expense (million US) 1 $100 10 2 $300 10 3 $300 15 4 $500 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started