Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and

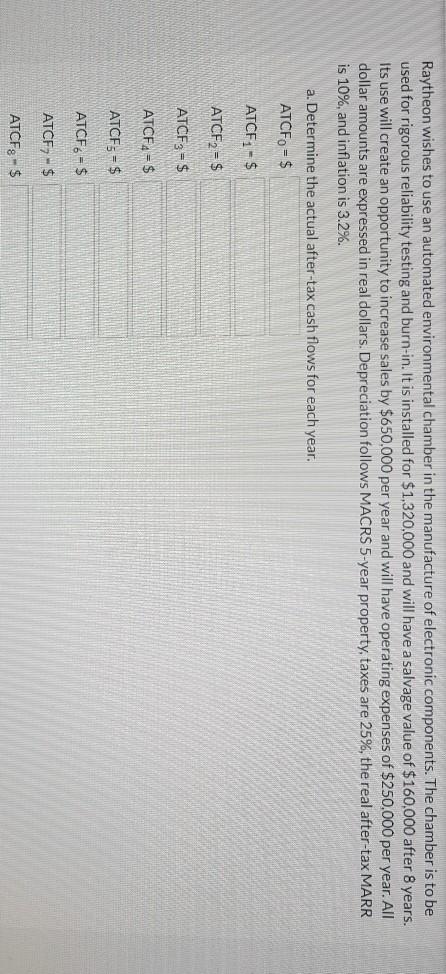

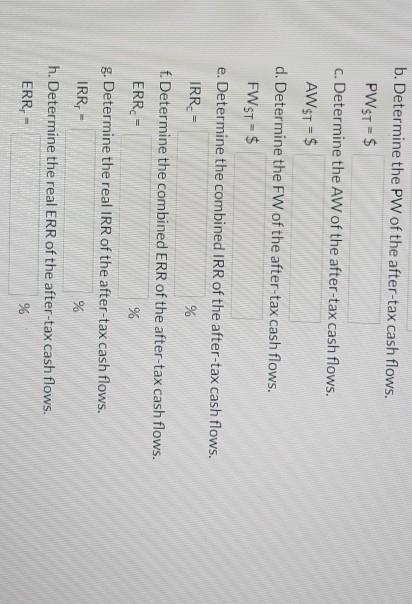

Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1,320,000 and will have a salvage value of $160,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. All dollar amounts are expressed in real dollars. Depreciation follows MACRS 5-year property, taxes are 25%, the real after-tax MARR is 10%, and inflation is 3.2%. a. Determine the actual after-tax cash flows for each year. ATCF - $ ATCF1-$ ATCF2 = $ ATCF3 = $ ATCFA = $ ATCF3 = $ ATCF6 - $ ATCF - $ ATCF $ b. Determine the PW of the after-tax cash flows. PWST - $ c. Determine the AW of the after-tax cash flows. AWST = $ d. Determine the FW of the after-tax cash flows. FWST = $ e. Determine the combined IRR of the after-tax cash flows. IRR = % f. Determine the combined ERR of the after-tax cash flows. ERR - % g. Determine the real IRR of the after-tax cash flows. IRR, % h. Determine the real ERR of the after-tax cash flows. ERR- % Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1,320,000 and will have a salvage value of $160,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. All dollar amounts are expressed in real dollars. Depreciation follows MACRS 5-year property, taxes are 25%, the real after-tax MARR is 10%, and inflation is 3.2%. a. Determine the actual after-tax cash flows for each year. ATCF - $ ATCF1-$ ATCF2 = $ ATCF3 = $ ATCFA = $ ATCF3 = $ ATCF6 - $ ATCF - $ ATCF $ b. Determine the PW of the after-tax cash flows. PWST - $ c. Determine the AW of the after-tax cash flows. AWST = $ d. Determine the FW of the after-tax cash flows. FWST = $ e. Determine the combined IRR of the after-tax cash flows. IRR = % f. Determine the combined ERR of the after-tax cash flows. ERR - % g. Determine the real IRR of the after-tax cash flows. IRR, % h. Determine the real ERR of the after-tax cash flows. ERR- %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started