Question

Razor's 60th birthday is on 1 January 2020. His salary for the year ended 31 December 2020 is P400,000. At the 31st of December

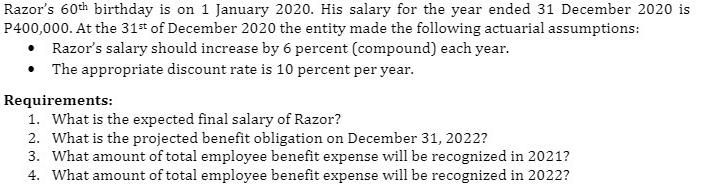

Razor's 60th birthday is on 1 January 2020. His salary for the year ended 31 December 2020 is P400,000. At the 31st of December 2020 the entity made the following actuarial assumptions: Razor's salary should increase by 6 percent (compound) each year. The appropriate discount rate is 10 percent per year. Requirements: 1. What is the expected final salary of Razor? 2. What is the projected benefit obligation on December 31, 2022? 3. What amount of total employee benefit expense will be recognized in 2021? 4. What amount of total employee benefit expense will be recognized in 2022?

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The expected final salary of Razor can be calculated as follows Salary in 2020 P400000 Annual increa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting Business Reporting For Decision Making

Authors: Jacqueline Birt, Keryn Chalmers, Albie Brooks, Suzanne Byrne, Judy Oliver

4th Edition

978-0730302414, 0730302415

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App