Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Reacher Corporation is evaluating a proposal to purchase a new machine that would cost $100,000 and would have a salvage value of $12,000 in

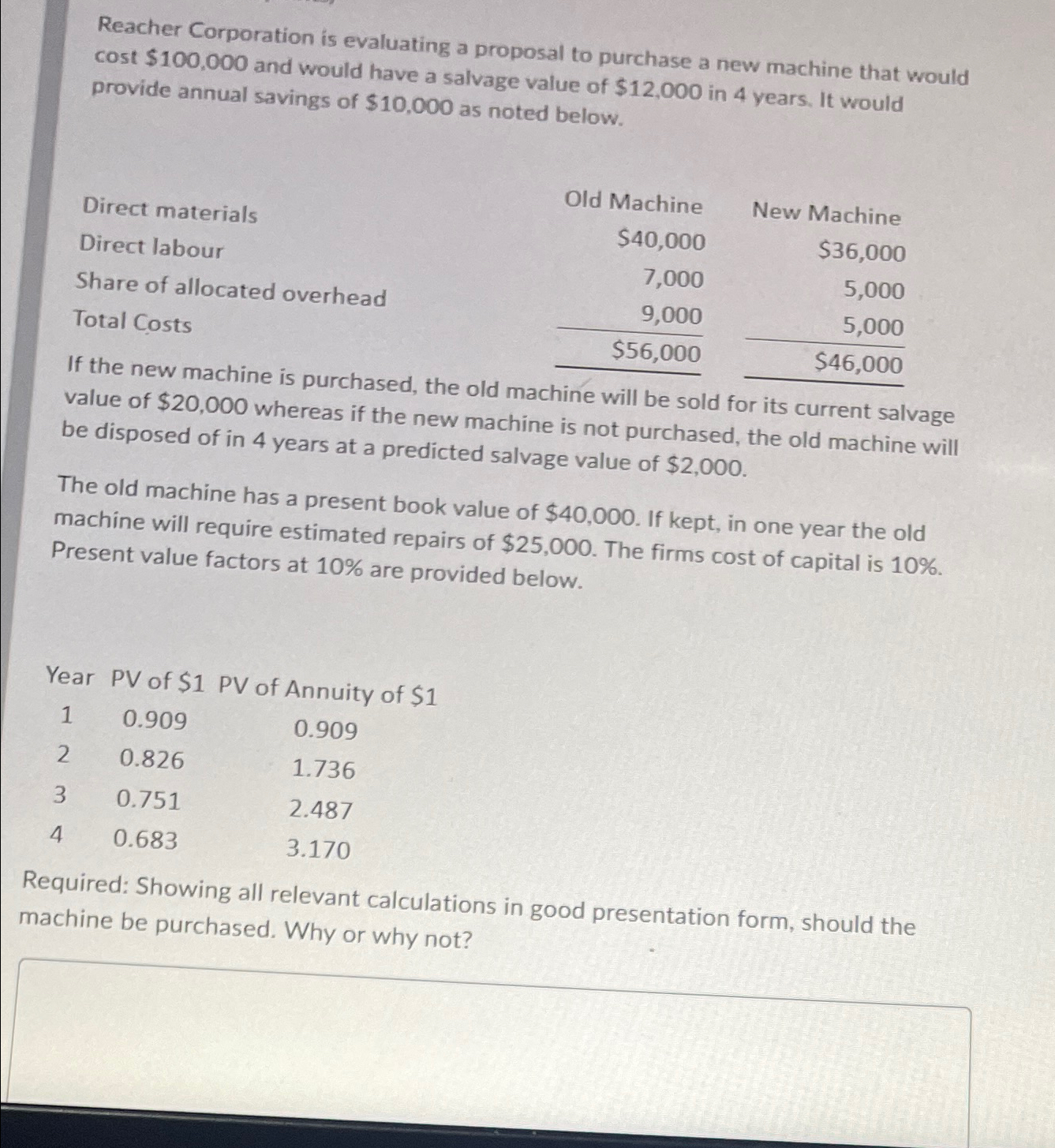

Reacher Corporation is evaluating a proposal to purchase a new machine that would cost $100,000 and would have a salvage value of $12,000 in 4 years. It would provide annual savings of $10,000 as noted below. Direct materials Direct labour Share of allocated overhead Old Machine New Machine $40,000 $36,000 7,000 5,000 9,000 5,000 $56,000 $46,000 Total Costs If the new machine is purchased, the old machine will be sold for its current salvage value of $20,000 whereas if the new machine is not purchased, the old machine will be disposed of in 4 years at a predicted salvage value of $2,000. The old machine has a present book value of $40,000. If kept, in one year the old machine will require estimated repairs of $25,000. The firms cost of capital is 10%. Present value factors at 10% are provided below. Year PV of $1 PV of Annuity of $1 1 0.909 0.909 2 0.826 1.736 3 0.751 2.487 0.683 3.170 Required: Showing all relevant calculations in good presentation form, should the machine be purchased. Why or why not?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started