Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read Burkenroad report regarding POOL in 2022. Briefly summarize the investment thesis. What valuation methods are used in the report? What issues do you see

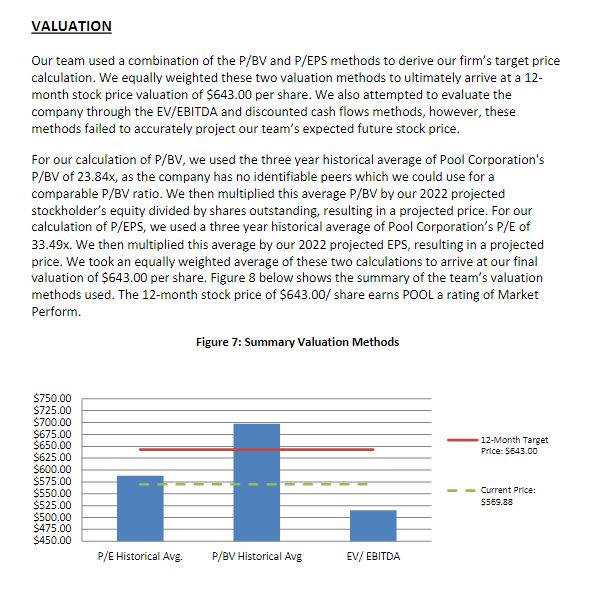

Read Burkenroad report regarding POOL in 2022. Briefly summarize the investment thesis. What valuation methods are used in the report? What issues do you see in the valuation? Read Burkenroad's report regarding POOL in 2021. What issues do you see in the valuation? The investment thesis for POOL differs between 2021 and 2022. Do you see any potential issues with the analyses overall?

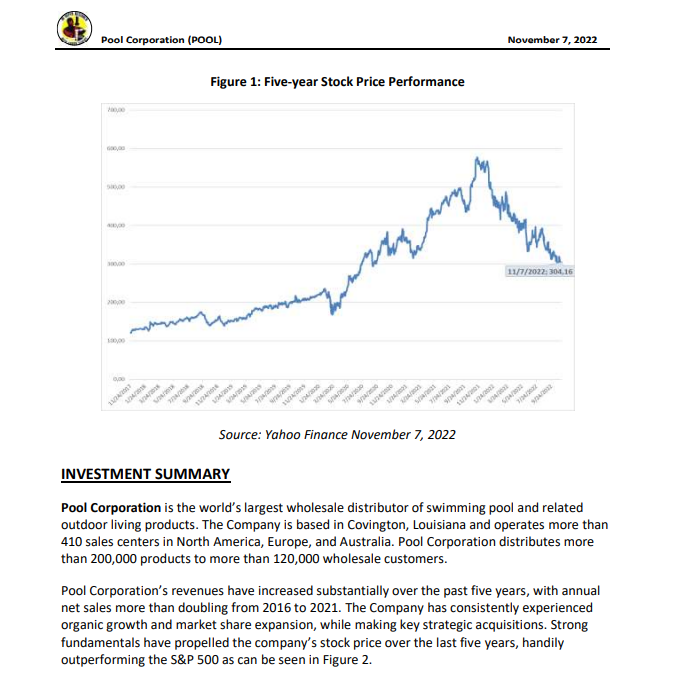

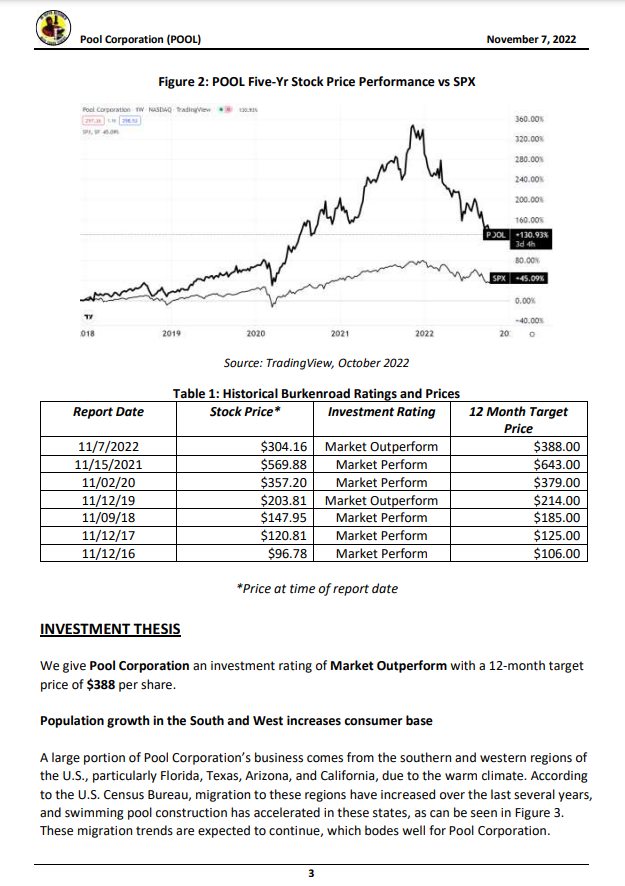

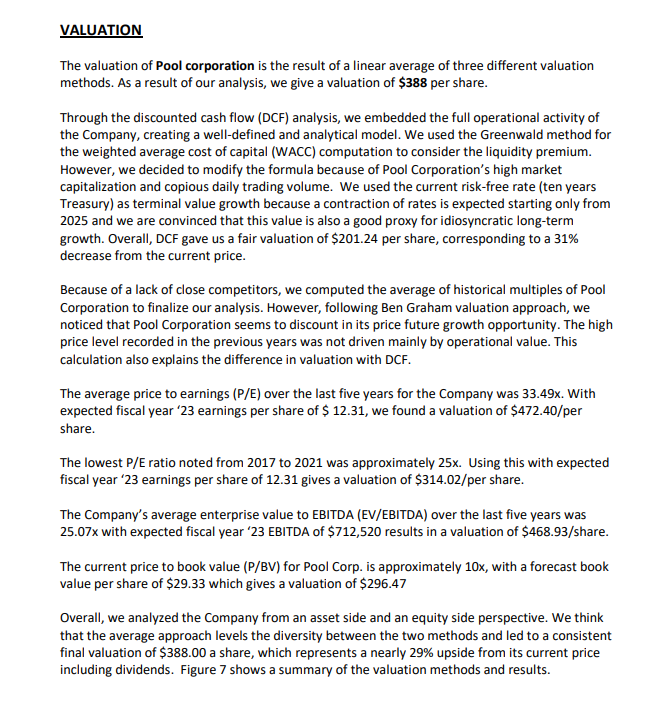

PONTCHARTRAIN LAKE MAUREPAS Ruddock FALAY ST. MARTIN Catahoula ORLEANS NEW ORLEANS LAFAYETTE ETTE BI University Tulane FREEMAN SCHOOL OF BUSINESS KENNER BURKENROAD REPORTS Martinvillen 10 Batohen E6613 Ves Loreaulie New Iberia 2035 Paincourtville Sp ASSUMPTION podes( ST./ MARTIN Map courtesy of Louisians Department of Transportation and Development Avery Island November 7, 2022 Pool Corporation POOL/NASDAQ Continuing Coverage: Jump In! The Water is Fine at Pool Corp. Investment Rating: Market Outperform PRICE: $ 304.16 S&P 500: 3,806.80 DJIA: 32,827.00 EPS P/E CFPS P/CFPS Market Capitalization Equity Market Cap (MM): Enterprise Value (MM): Shares Outstanding (MM) Estimated Float (MM): 6-Mo. Avg. Daily Volume: Short Ratio RUSSELL 2000: 1,809.81 Population growth in the South and West increases consumer base Rising interest rates and slow housing demand could impact revenue End of COVID may slow related sales surge Relationships, acquisitions, and execution propelled Pool Corporation to its market leadership position Our 12-month target price is $388.00. Valuation 2021 A $ 15.97 32.3x $17.68 29.2x Analysts: Robert Fontova Kyle Messer Thompson Murray Matteo Turri ET AL 2022 E $ 18.69 16.3x $ 20.33 15.0x $ 11,877 $ 13,328 un 10.5 EV/EBITDA BURKENROAD REPORTS Stock Data 52-Week Range: $278.10 - $582.27 12-Month Stock Performance: -39.76% 39.05 Dividend Yield: 37.85 Book Value Per Share: 1.32% $ 30.50 454,600 Beta: 0.94 11.6x DEEP-SOUTH S 2023 E $ 12.20 24.9x $ 14.08 21.6x Company Quick View: Pool Corporation rides the wave of COVID-19 and a hot housing market to propel it to record profits in 2022. The world's largest wholesaler of swimming pool equipment and related outdoor living products offers more than 200,000 products to outdoor-living enthusiasts worldwide. Based out of Covington, Louisiana, Pool Corporation boasts 410 sales centers across the globe and employs more than 5,500 people. Company Website: https://www.poolcorp.com/ Investment Research Manager: Henry Mann STOCKS . The Burkenroad Reports are produced solely as a part of an educational program of Tulane University's Freeman School of Business. The reports are not investment advice and you should not and may not rely on them in making any investment decision. You should consult an investment professional and/or conduct your own primary research regarding any potential investment.

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Here are the deep and stepbystep calculations for the key metrics in the Pool Corporation report 1 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started