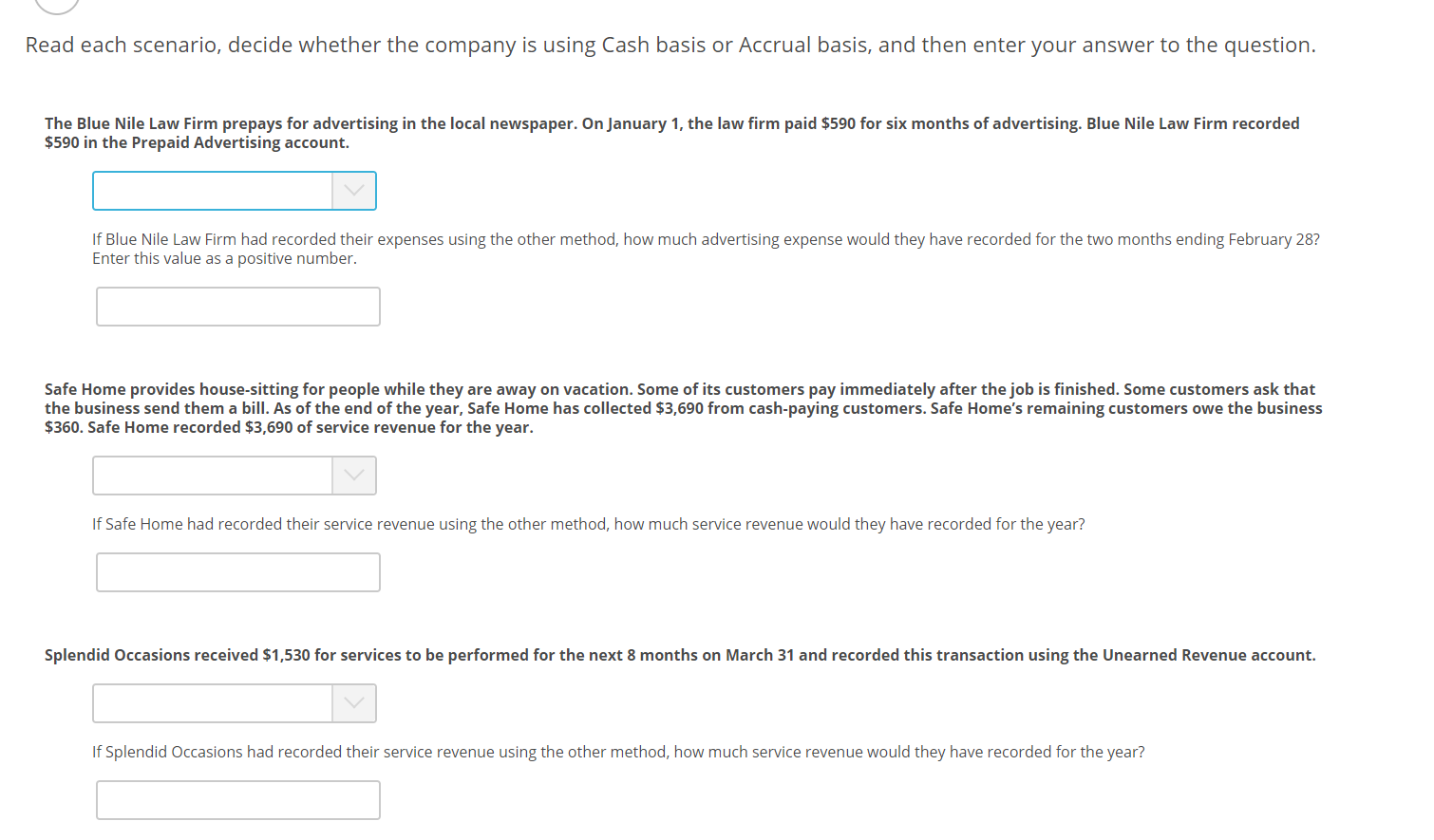

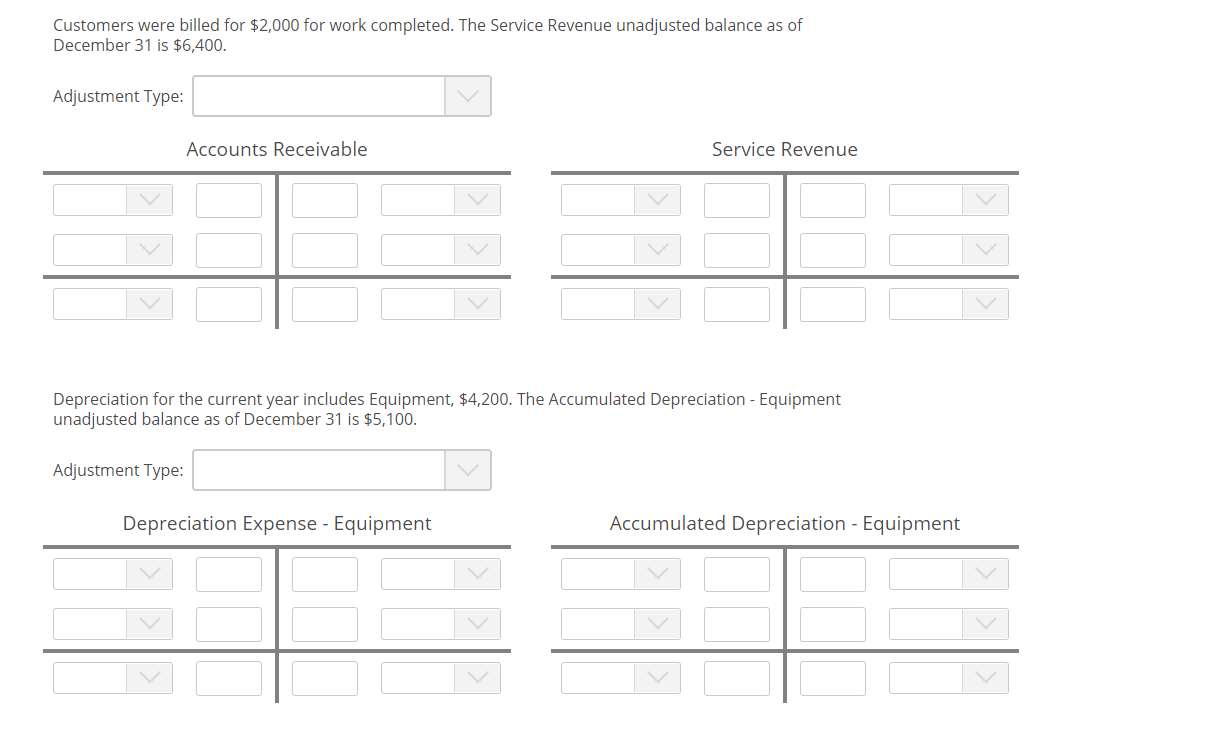

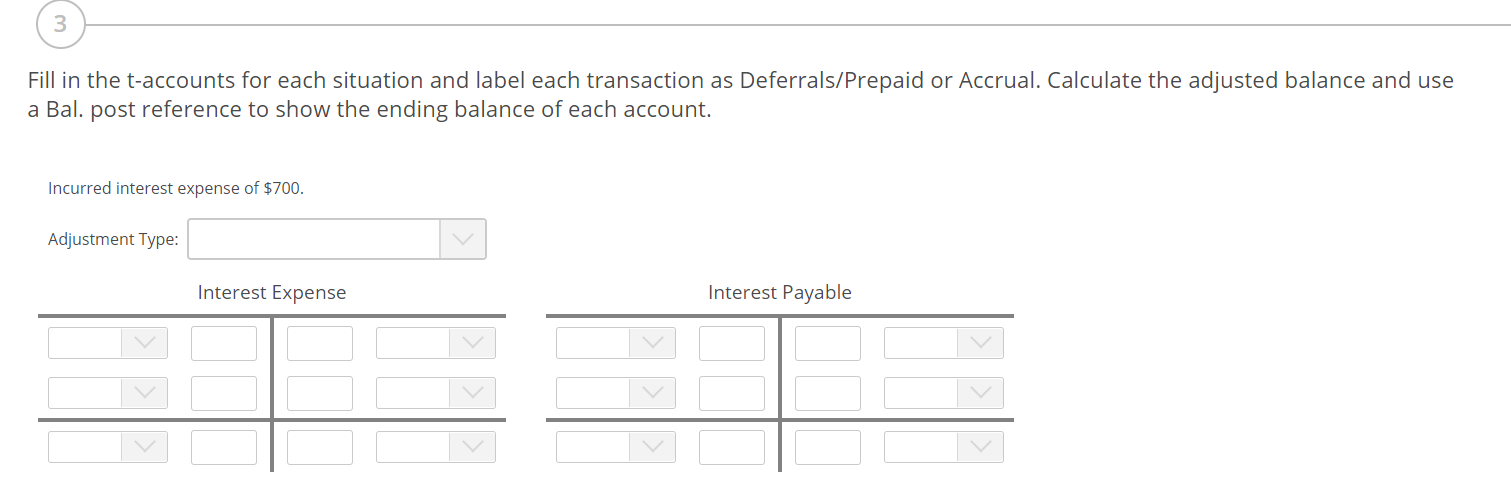

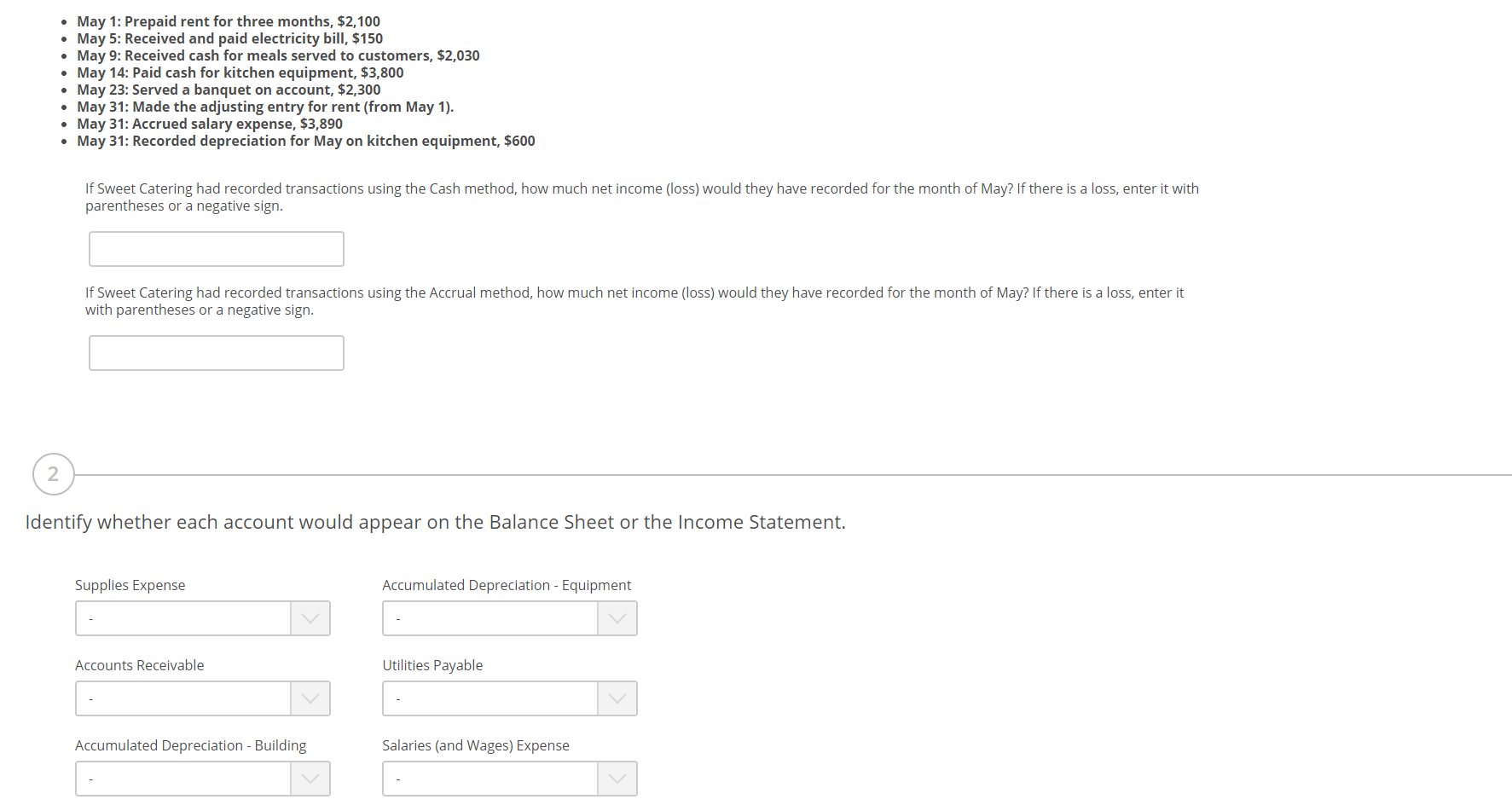

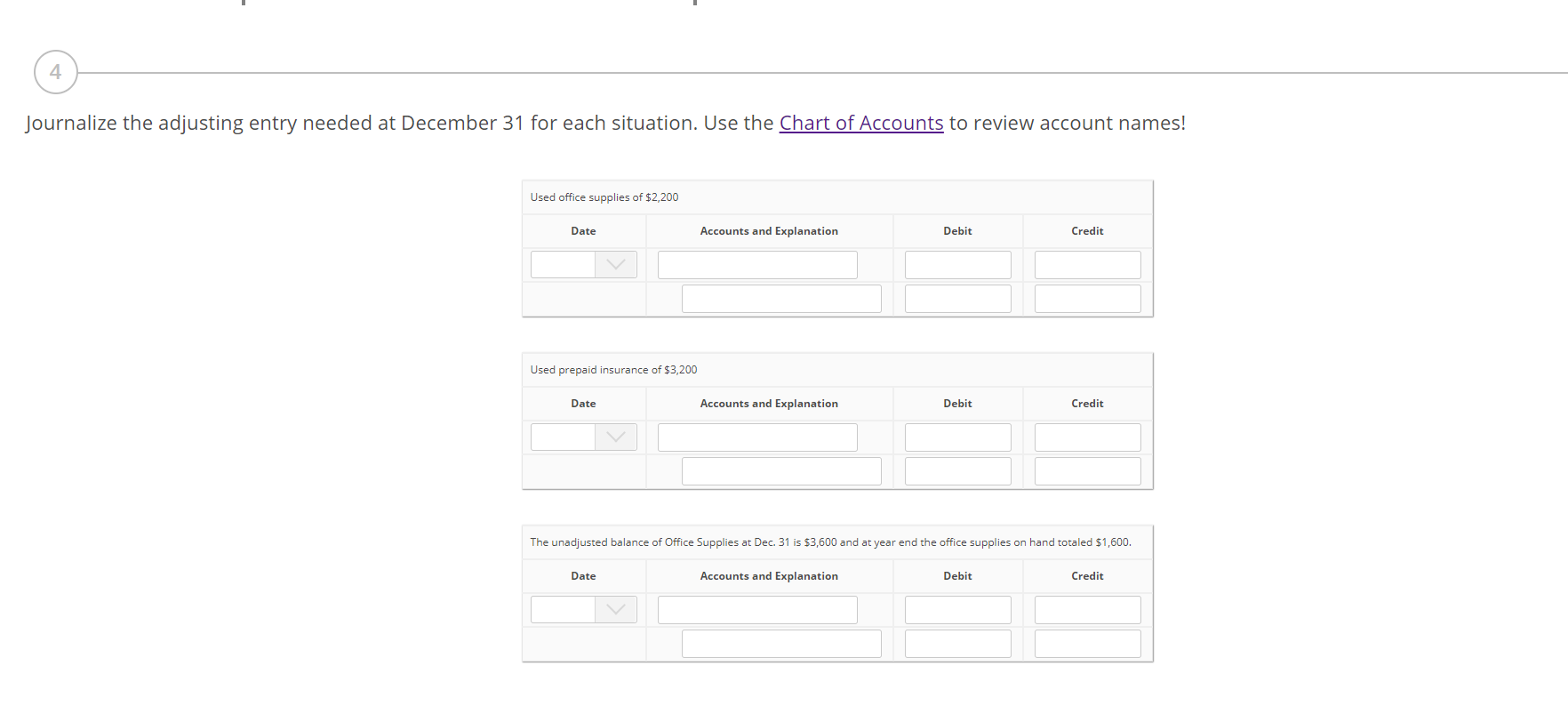

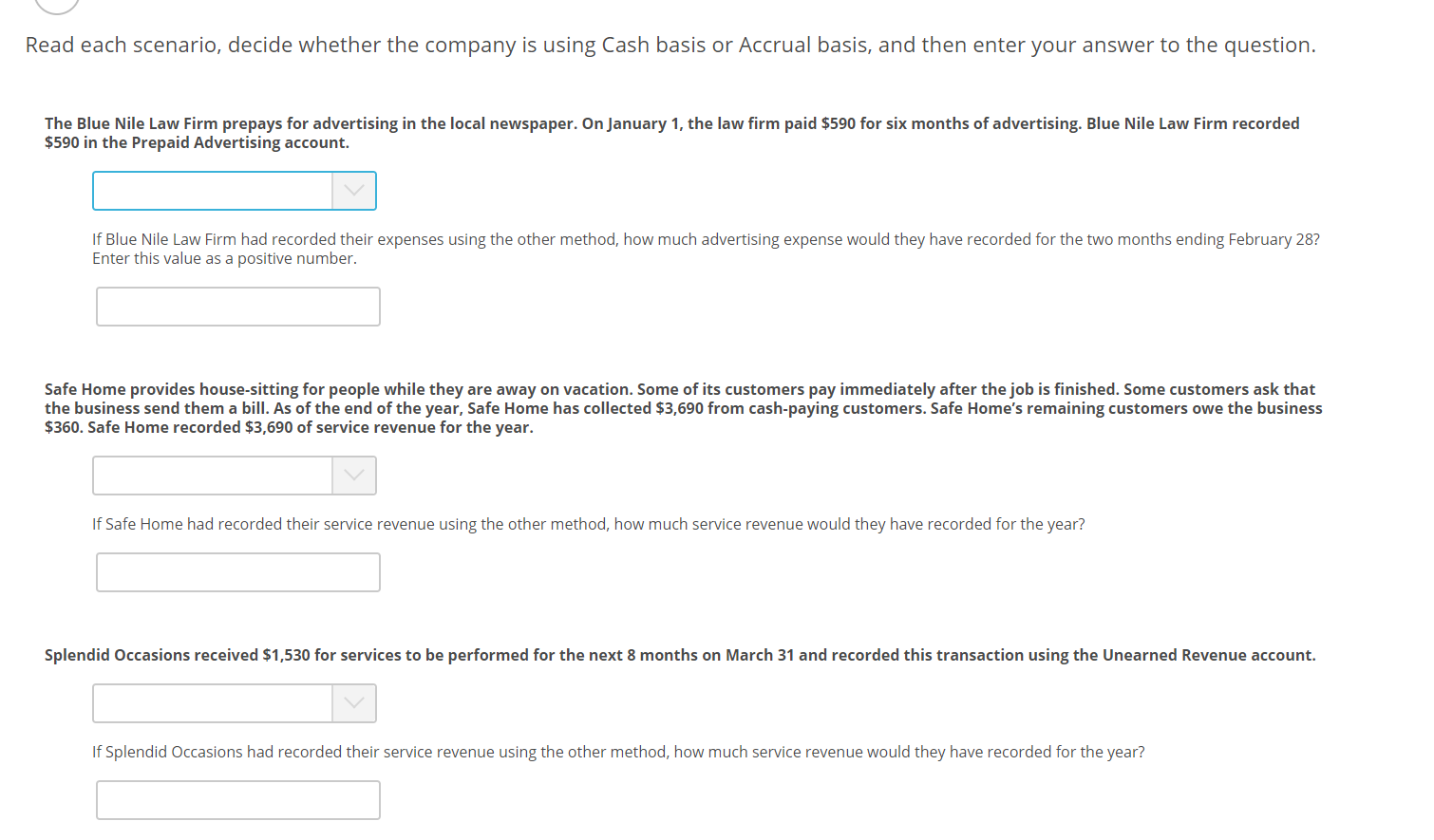

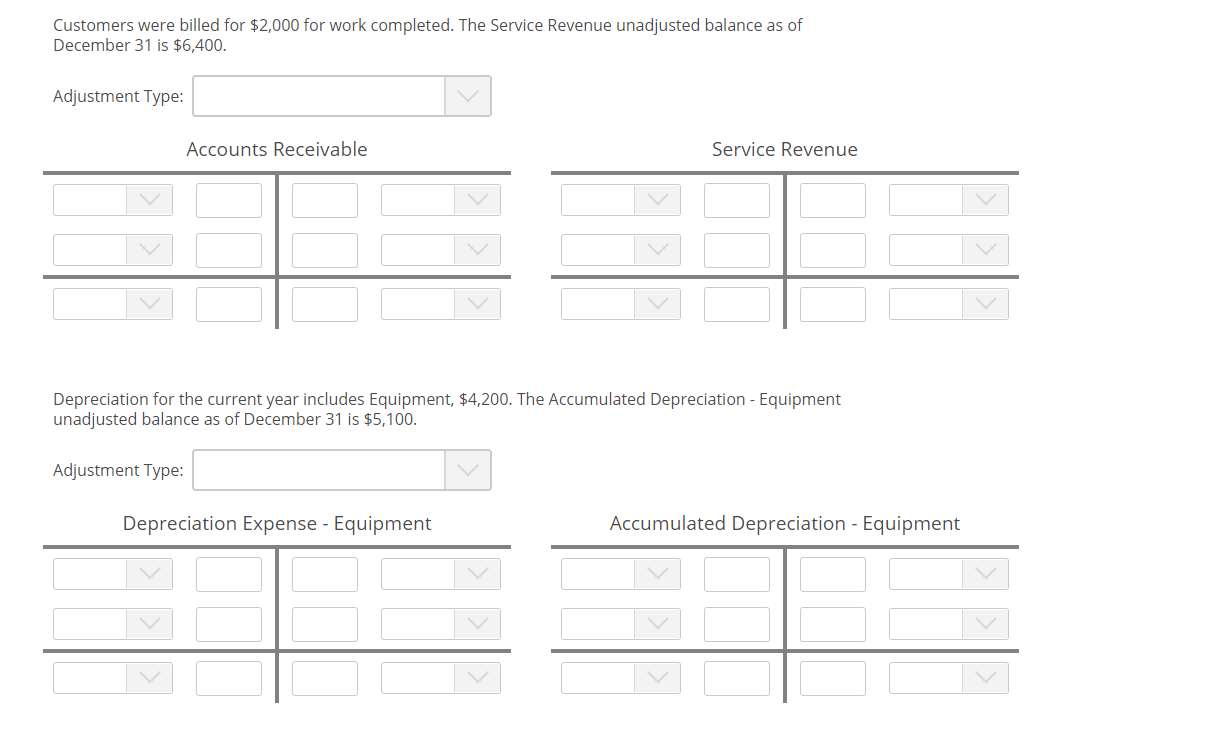

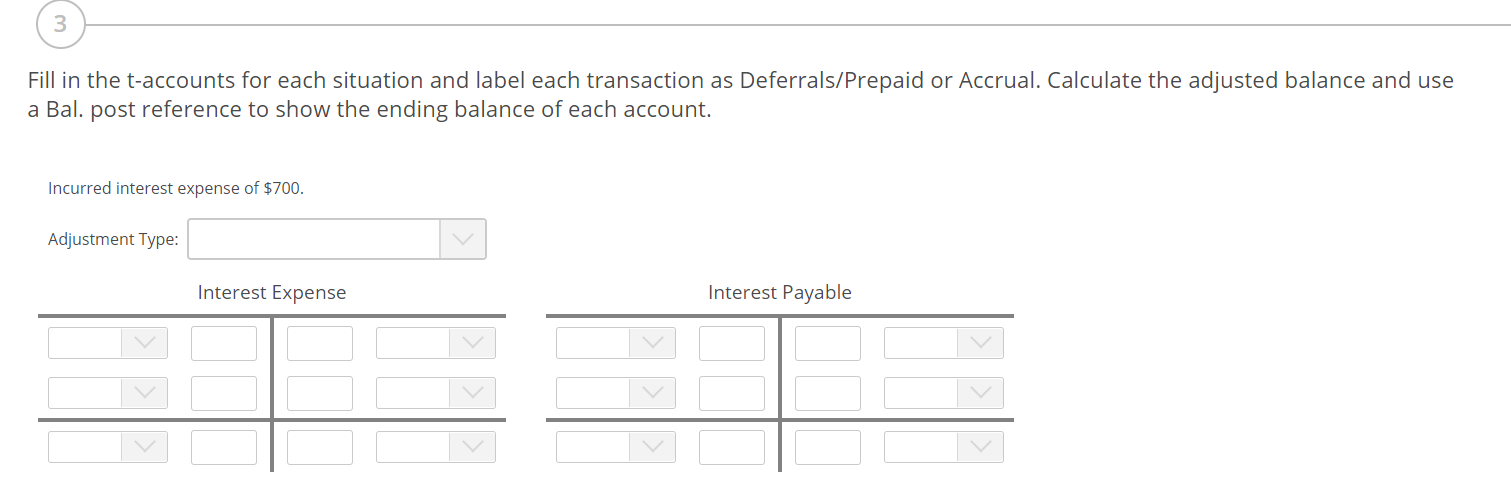

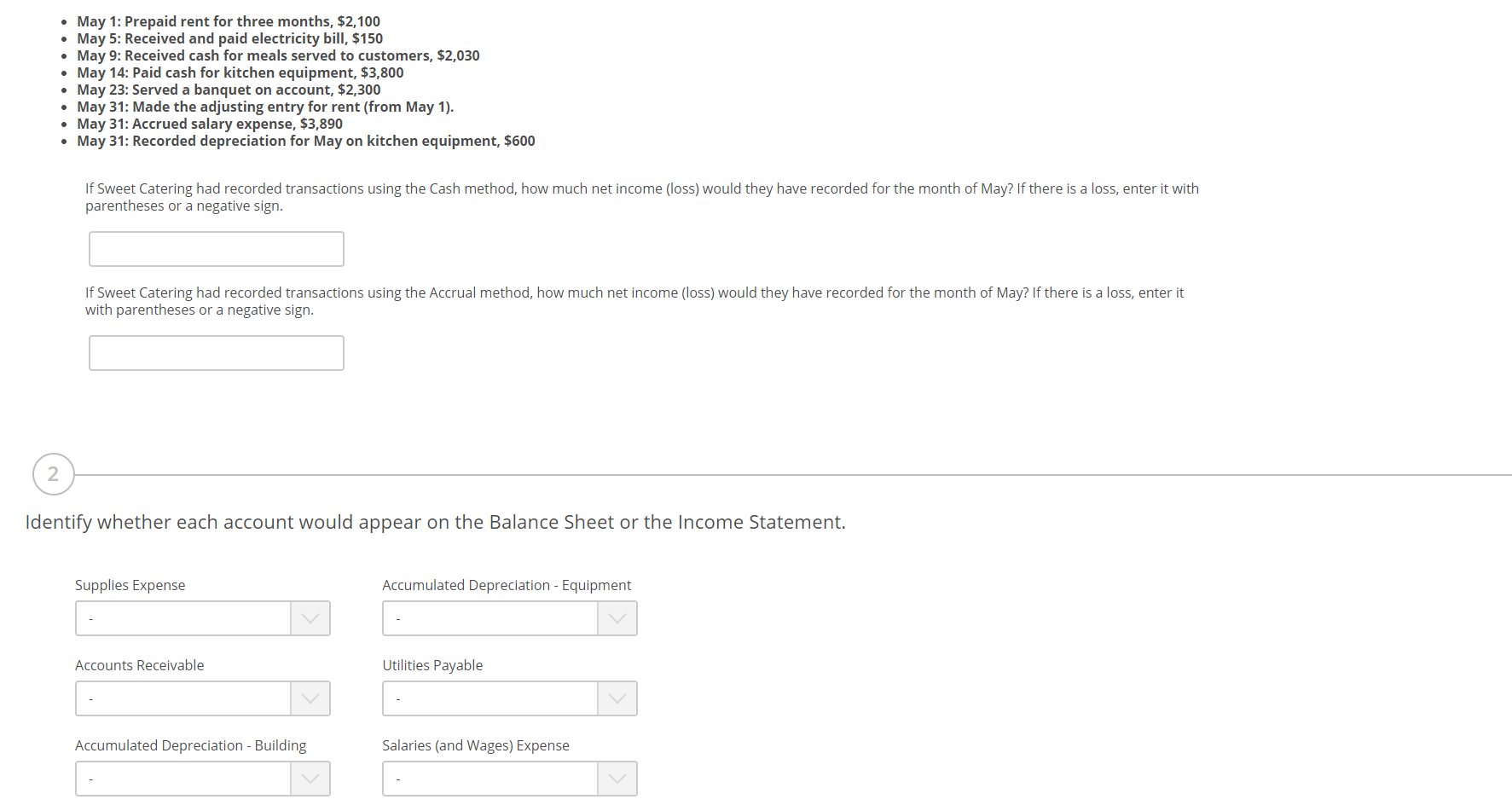

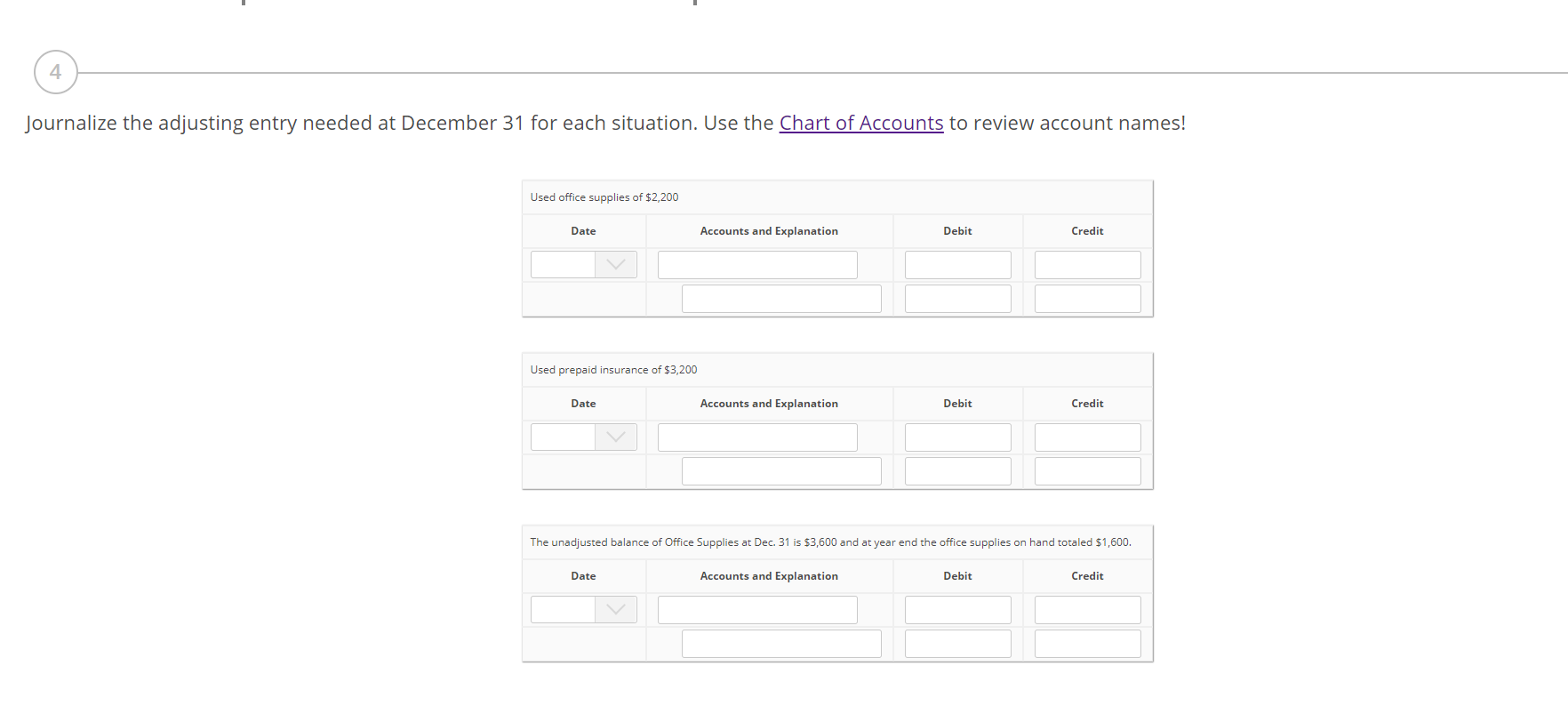

Read each scenario, decide whether the company is using Cash basis or Accrual basis, and then enter your answer to the question. The Blue Nile Law Firm prepays for advertising in the local newspaper. On January 1, the law firm paid $590 for six months of advertising. Blue Nile Law Firm recorded $590 in the Prepaid Advertising account. If Blue Nile Law Firm had recorded their expenses using the other method, how much advertising expense would they have recorded for the two months ending February 28? Enter this value as a positive number. Safe Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. As of the end of the year, Safe Home has collected $3,690 from cash-paying customers. Safe Home's remaining customers owe the business $360. Safe Home recorded $3,690 of service revenue for the year. If Safe Home had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Splendid Occasions received $1,530 for services to be performed for the next 8 months on March 31 and recorded this transaction using the Unearned Revenue account. If Splendid Occasions had recorded their service revenue using the other method, how much service revenue would they have recorded for the year? Customers were billed for $2,000 for work completed. The Service Revenue unadjusted balance as of December 31 is $6,400. Adjustment Type: Accounts Receivable Service Revenue Depreciation for the current year includes Equipment, $4,200. The Accumulated Depreciation - Equipment unadjusted balance as of December 31 is $5,100. Adjustment Type: Depreciation Expense - Equipment Accumulated Depreciation - Equipment 3 Fill in the t-accounts for each situation and label each transaction as Deferrals/Prepaid or Accrual. Calculate the adjusted balance and use a Bal. post reference to show the ending balance of each account. Incurred interest expense of $700. Adjustment Type: Interest Expense Interest Payable . May 1: Prepaid rent for three months, $2,100 May 5: Received and paid electricity bill, $150 May 9: Received cash for meals served to customers, $2,030 May 14: Paid cash for kitchen equipment, $3,800 May 23: Served a banquet on account, $2,300 May 31: Made the adjusting entry for rent (from May 1). May 31: Accrued salary expense, $3,890 May 31: Recorded depreciation for May on kitchen equipment, $600 If Sweet Catering had recorded transactions using the Cash method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. If Sweet Catering had recorded transactions using the Accrual method, how much net income (loss) would they have recorded for the month of May? If there is a loss, enter it with parentheses or a negative sign. 2 Identify whether each account would appear on the Balance Sheet or the Income Statement. Supplies Expense Accumulated Depreciation - Equipment Accounts Receivable Utilities Payable Accumulated Depreciation - Building Salaries (and Wages) Expense 4 Journalize the adjusting entry needed at December 31 for each situation. Use the Chart of Accounts to review account names! Used office supplies of $2,200 Date Accounts and Explanation Debit Credit Used prepaid insurance of $3,200 Date Accounts and Explanation Debit Credit The unadjusted balance of Office Supplies at Dec 31 is $3,600 and at year end the office supplies on hand totaled $1,600. Date Accounts and Explanation Debit Credit