Answered step by step

Verified Expert Solution

Question

1 Approved Answer

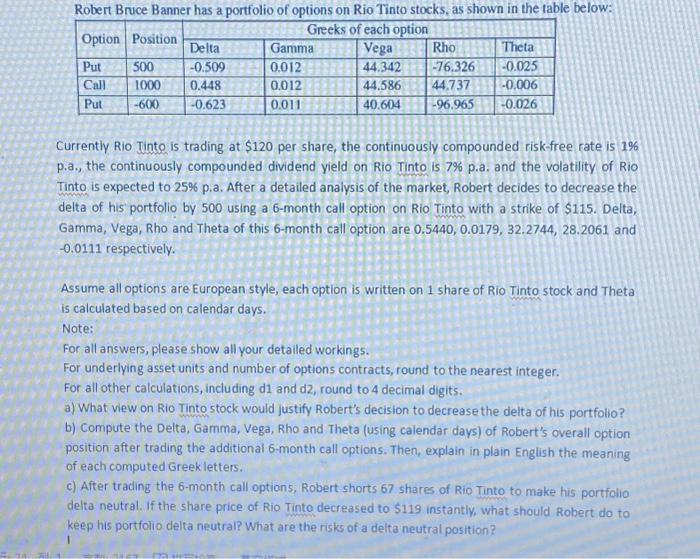

Robert Bruce Banner has a portfolio of options on Rio Tinto stocks, as shown in the table below: Greeks of each option Option Position

Robert Bruce Banner has a portfolio of options on Rio Tinto stocks, as shown in the table below: Greeks of each option Option Position Vega Put 44.342 Call 44.586 Put 40.604 500 1000 -600 Delta -0.509 0.448 -0.623 Gamma 0.012 0.012 0.011 Rho -76.326 44.737 -96.965 Theta -0.025 -0.006 -0.026 Currently Rio Tinto is trading at $120 per share, the continuously compounded risk-free rate is 1% p.a., the continuously compounded dividend yield on Rio Tinto is 7% p.a. and the volatility of Rio Tinto is expected to 25% p.a. After a detailed analysis of the market, Robert decides to decrease the delta of his portfolio by 500 using a 6-month call option on Rio Tinto with a strike of $115. Delta, Gamma, Vega, Rho and Theta of this 6-month call option are 0.5440, 0.0179, 32.2744, 28.2061 and -0.0111 respectively. Assume all options are European style, each option is written on 1 share of Rio Tinto stock and Theta is calculated based on calendar days. DATEN Note: For all answers, please show all your detailed workings. For underlying asset units and number of options contracts, round to the nearest integer. For all other calculations, including d1 and d2, round to 4 decimal digits. a) What view on Rio Tinto stock would justify Robert's decision to decrease the delta of his portfolio? b) Compute the Delta, Gamma, Vega, Rho and Theta (using calendar days) of Robert's overall option position after trading the additional 6-month call options. Then, explain in plain English the meaning of each computed Greek letters... c) After trading the 6-month call options, Robert shorts 67 shares of Rio Tinto to make his portfolio delta neutral. If the share price of Rio Tinto decreased to $119 instantly, what should Robert do to keep his portfolio delta neutral? What are the risks of a delta neutral position?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started