Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read each statement given below carefully and determine the correct choice for the statements below. Please fill in the answers in the table given below

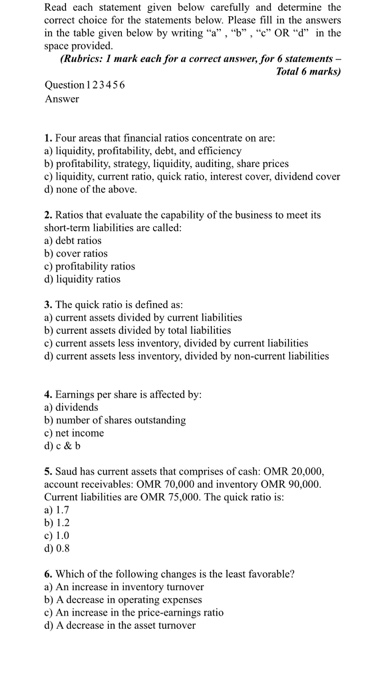

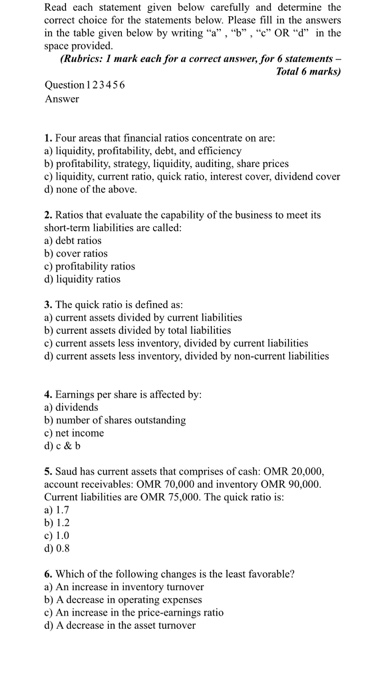

Read each statement given below carefully and determine the correct choice for the statements below. Please fill in the answers in the table given below by writing "a", "b", "c" OR "d" in the space provided (Rubrics: I mark each for a correct answer, for 6 statements - Total 6 marks) Question 123456 Answer 1. Four areas that financial ratios concentrate on are: a) liquidity, profitability, debt, and efficiency b) profitability, strategy, liquidity, auditing, share prices c) liquidity, current ratio, quick ratio, interest cover, dividend cover d) none of the above. 2. Ratios that evaluate the capability of the business to meet its short-term liabilities are called: a) debt ratios b) cover ratios c) profitability ratios d) liquidity ratios 3. The quick ratio is defined as: a) current assets divided by current liabilities b) current assets divided by total liabilities c) current assets less inventory, divided by current liabilities d) current assets less inventory, divided by non-current liabilities 4. Earnings per share is affected by: a) dividends b) number of shares outstanding c) net income d) c&b 5. Saud has current assets that comprises of cash: OMR 20.000, account receivables: OMR 70,000 and inventory OMR 90,000. Current liabilities are OMR 75,000. The quick ratio is: a) 1.7 b) 1.2 c) 1.0 d) 0.8 6. Which of the following changes is the least favorable? a) An increase in inventory turnover b) A decrease in operating expenses c) An increase in the price-earnings ratio d) A decrease in the asset tumover

Read each statement given below carefully and determine the correct choice for the statements below. Please fill in the answers in the table given below by writing "a", "b", "c" OR "d" in the space provided (Rubrics: I mark each for a correct answer, for 6 statements - Total 6 marks) Question 123456 Answer 1. Four areas that financial ratios concentrate on are: a) liquidity, profitability, debt, and efficiency b) profitability, strategy, liquidity, auditing, share prices c) liquidity, current ratio, quick ratio, interest cover, dividend cover d) none of the above. 2. Ratios that evaluate the capability of the business to meet its short-term liabilities are called: a) debt ratios b) cover ratios c) profitability ratios d) liquidity ratios 3. The quick ratio is defined as: a) current assets divided by current liabilities b) current assets divided by total liabilities c) current assets less inventory, divided by current liabilities d) current assets less inventory, divided by non-current liabilities 4. Earnings per share is affected by: a) dividends b) number of shares outstanding c) net income d) c&b 5. Saud has current assets that comprises of cash: OMR 20.000, account receivables: OMR 70,000 and inventory OMR 90,000. Current liabilities are OMR 75,000. The quick ratio is: a) 1.7 b) 1.2 c) 1.0 d) 0.8 6. Which of the following changes is the least favorable? a) An increase in inventory turnover b) A decrease in operating expenses c) An increase in the price-earnings ratio d) A decrease in the asset tumover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started