Answered step by step

Verified Expert Solution

Question

1 Approved Answer

****!!!!!!!!!READ & HELP ANSWER BOTH QUESTIONS FULLY! PLEASE SHOW ALL WORK!!!!!!!!**** Please Read and Answer both questions!! 1. Stan and Dottie Vigarus are each 38

****!!!!!!!!!READ & HELP ANSWER BOTH QUESTIONS FULLY! PLEASE SHOW ALL WORK!!!!!!!!****

Please Read and Answer both questions!!

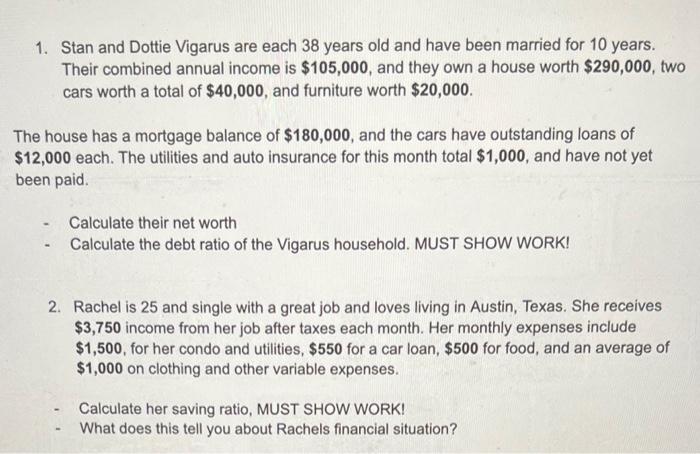

1. Stan and Dottie Vigarus are each 38 years old and have been married for 10 years. Their combined annual income is $105,000, and they own a house worth $290,000, two cars worth a total of $40,000, and furniture worth $20,000. The house has a mortgage balance of $180,000, and the cars have outstanding loans of $12,000 each. The utilities and auto insurance for this month total $1,000, and have not yet been paid. - Calculate their net worth - Calculate the debt ratio of the Vigarus household. MUST SHOW WORK! 2. Rachel is 25 and single with a great job and loves living in Austin, Texas. She receives $3,750 income from her job after taxes each month. Her monthly expenses include $1,500, for her condo and utilities, $550 for a car loan, $500 for food, and an average of $1,000 on clothing and other variable expenses. - Calculate her saving ratio, MUST SHOW WORK! - What does this tell you about Rachels financial situation 1. Stan and Dottie Vigarus are each 38 years old and have been married for 10 years. Their combined annual income is $105,000, and they own a house worth $290,000, two cars worth a total of $40,000, and furniture worth $20,000.

The house has a mortgage balance of $180,000, and the cars have outstanding loans of $12,000 each. The utilities and auto insurance for this month total $1,000, and have not yet been paid.

-Calculate their net worth

-Calculate the debt ratio of the Vigarus household. MUST SHOW WORK!

2. Rachel is 25 and single with a great job and loves living in Austin, Texas. She receives $3,750 income from her job after taxes each month. Her monthly expenses include $1,500, for her condo and utilities, $550 for a car loan, $500 for food, and an average of $1,000 on clothing and other variable expenses.

-Calculate her saving ratio, MUST SHOW WORK!

-What does this tell you about Rachels financial situation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started