read second photo first tthen use other pictures for support

read second photo first tthen use other pictures for support

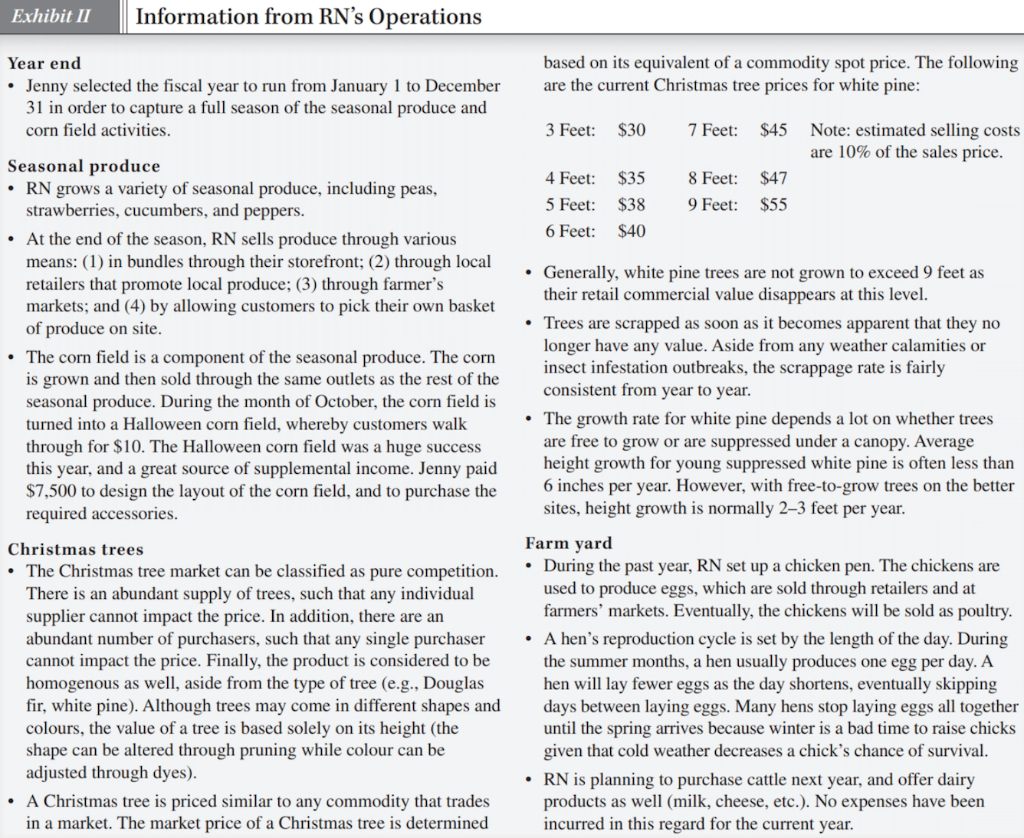

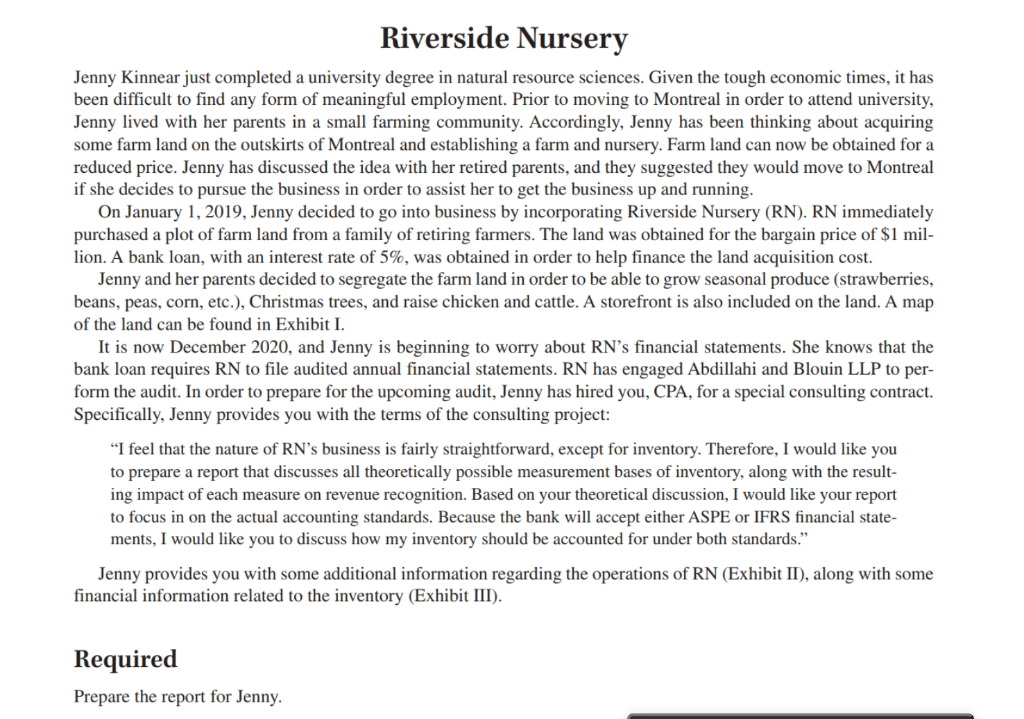

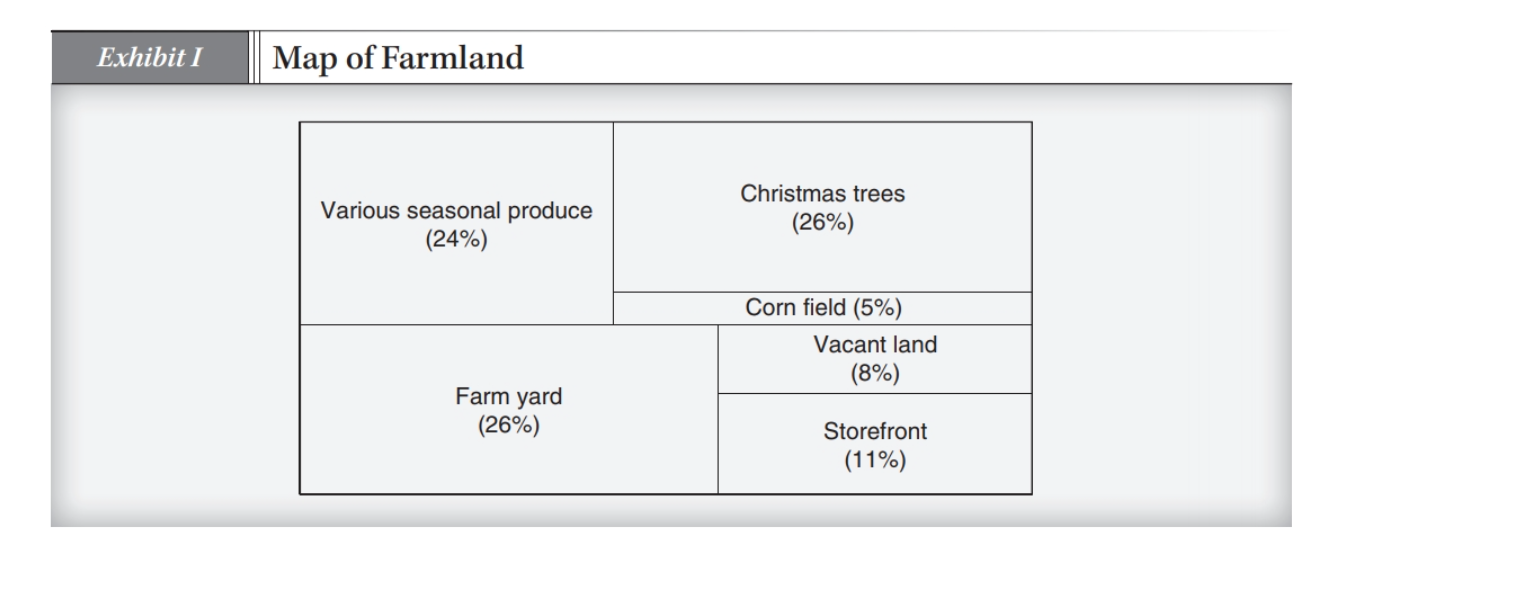

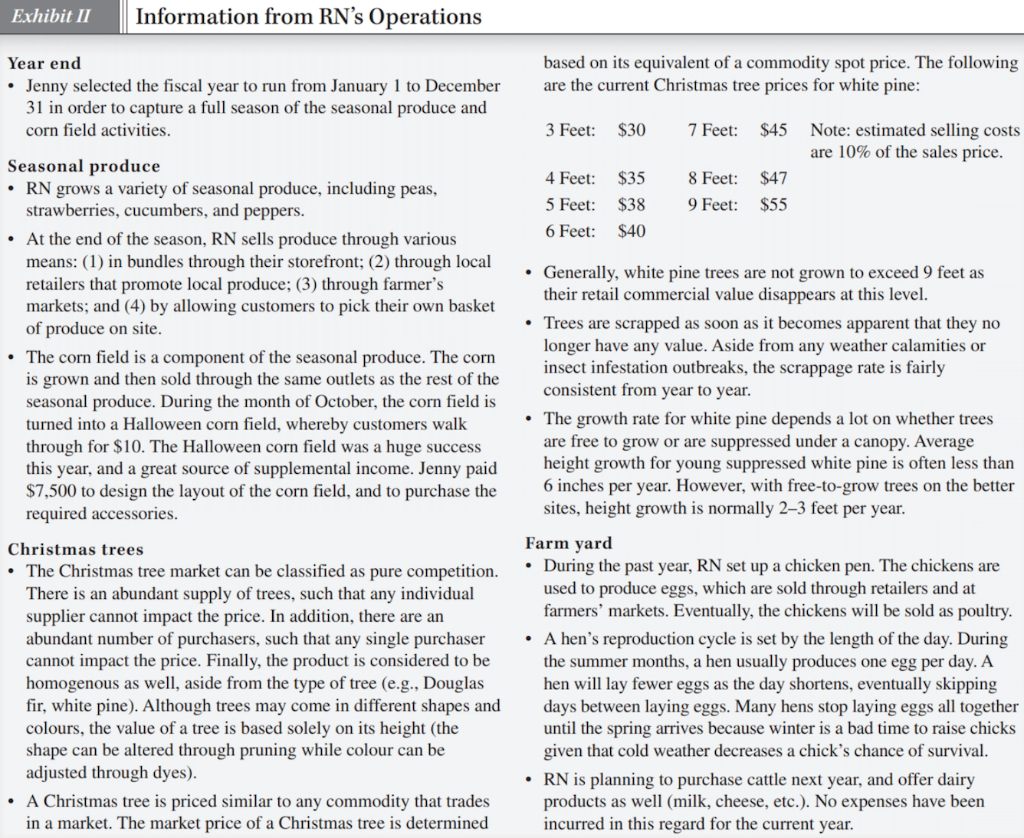

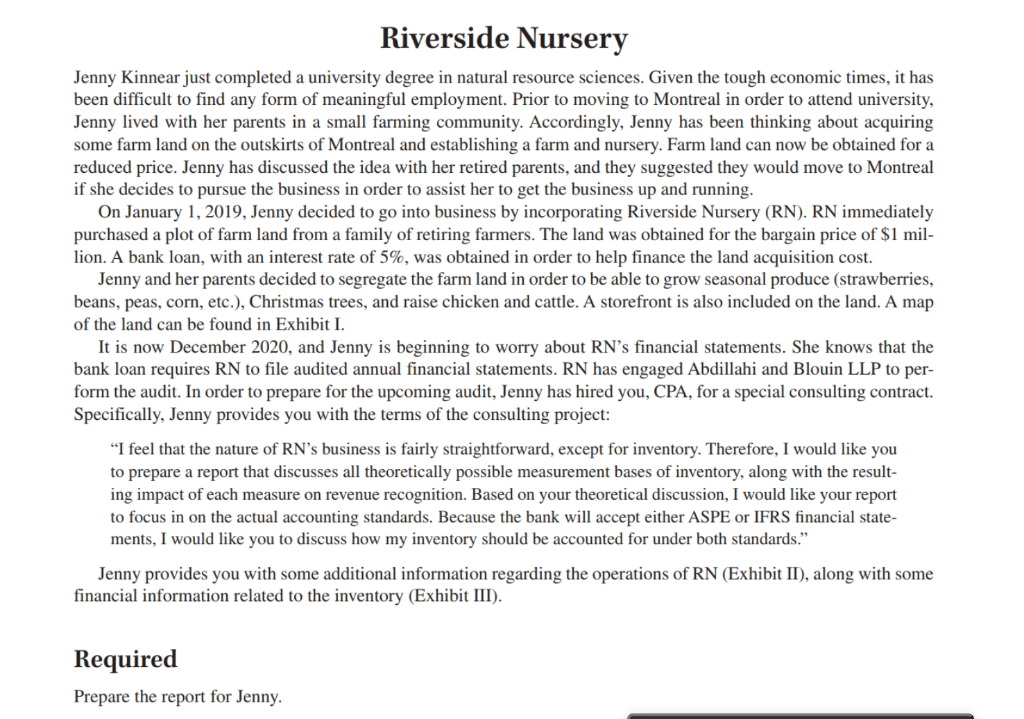

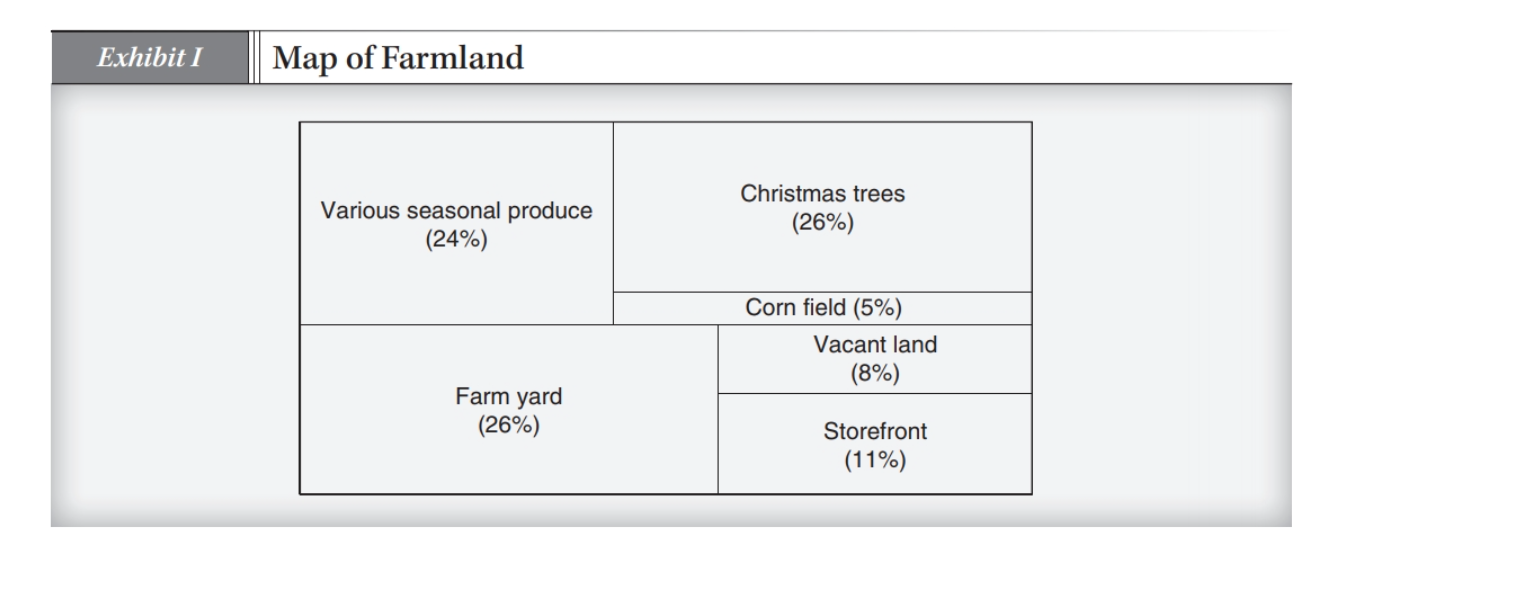

Exhibit II Information from RN's Operations based on its equivalent of a commodity spot price. The following are the current Christmas tree prices for white pine: Year end Jenny selected the fiscal year to run from January 1 to December 31 in order to capture a full season of the seasonal produce and corn field activities. 3 Feet: $30 7 Feet: $45 Note: estimated selling costs are 10% of the sales price. 4 Feet: 5 Feet: 6 Feet: $35 $38 $40 8 Feet: 9 Feet: $47 $55 Seasonal produce RN grows a variety of seasonal produce, including peas, strawberries, cucumbers, and peppers. At the end of the season, RN sells produce through various means: (1) in bundles through their storefront; (2) through local retailers that promote local produce; (3) through farmer's markets; and (4) by allowing customers to pick their own basket of produce on site. The corn field is a component of the seasonal produce. The corn is grown and then sold through the same outlets as the rest of the seasonal produce. During the month of October, the corn field is turned into a Halloween corn field, whereby customers walk through for $10. The Halloween corn field was a huge success this year, and a great source of supplemental income. Jenny paid $7,500 to design the layout of the corn field, and to purchase the required accessories. Christmas trees The Christmas tree market can be classified as pure competition. There is an abundant supply of trees, such that any individual supplier cannot impact the price. In addition, there are an abundant number of purchasers, such that any single purchaser cannot impact the price. Finally, the product is considered to be homogenous as well, aside from the type of tree (e.g., Douglas fir, white pine). Although trees may come in different shapes and colours, the value of a tree is based solely on its height (the shape can be altered through pruning while colour can be adjusted through dyes). A Christmas tree is priced similar to any commodity that trades in a market. The market price of a Christmas tree is determined Generally, white pine trees are not grown to exceed 9 feet as their retail commercial value disappears at this level. Trees are scrapped as soon as it becomes apparent that they no longer have any value. Aside from any weather calamities or insect infestation outbreaks, the scrappage rate is fairly consistent from year to year. The growth rate for white pine depends a lot on whether trees are free to grow or are suppressed under a canopy. Average height growth for young suppressed white pine is often less than 6 inches per year. However, with free-to-grow trees on the better sites, height growth is normally 2-3 feet per year. Farm yard During the past year, RN set up a chicken pen. The chickens are used to produce eggs, which are sold through retailers and at farmers' markets. Eventually, the chickens will be sold as poultry. A hen's reproduction cycle is set by the length of the day. During the summer months, a hen usually produces one egg per day. A hen will lay fewer eggs as the day shortens, eventually skipping days between laying eggs. Many hens stop laying eggs all together until the spring arrives because winter is a bad time to raise chicks given that cold weather decreases a chick's chance of survival. RN is planning to purchase cattle next year, and offer dairy products as well (milk, cheese, etc.). No expenses have been incurred in this regard for the current year. Riverside Nursery Jenny Kinnear just completed a university degree in natural resource sciences. Given the tough economic times, it has been difficult to find any form of meaningful employment. Prior to moving to Montreal in order to attend university, Jenny lived with her parents in a small farming community. Accordingly, Jenny has been thinking about acquiring some farm land on the outskirts of Montreal and establishing a farm and nursery. Farm land can now be obtained for a reduced price. Jenny has discussed the idea with her retired parents, and they suggested they would move to Montreal if she decides to pursue the business in order to assist her to get the business up and running. On January 1, 2019, Jenny decided to go into business by incorporating Riverside Nursery (RN). RN immediately purchased a plot of farm land from a family of retiring farmers. The land was obtained for the bargain price of $1 mil- lion. A bank loan, with an interest rate of 5%, was obtained in order to help finance the land acquisition cost. Jenny and her parents decided to segregate the farm land in order to be able to grow seasonal produce (strawberries, beans, peas, corn, etc.), Christmas trees, and raise chicken and cattle. A storefront is also included on the land. A map of the land can be found in Exhibit I. It is now December 2020, and Jenny is beginning to worry about RN's financial statements. She knows that the bank loan requires RN to file audited annual financial statements. RN has engaged Abdillahi and Blouin LLP to per- form the audit. In order to prepare for the upcoming audit, Jenny has hired you, CPA, for a special consulting contract. Specifically, Jenny provides you with the terms of the consulting project: "I feel that the nature of RN's business is fairly straightforward, except for inventory. Therefore, I would like you to prepare a report that discusses all theoretically possible measurement bases of inventory, along with the result- ing impact of each measure on revenue recognition. Based on your theoretical discussion, I would like your report to focus in on the actual accounting standards. Because the bank will accept either ASPE or IFRS financial state- ments, I would like you to discuss how my inventory should be accounted for under both standards. Jenny provides you with some additional information regarding the operations of RN (Exhibit II), along with some financial information related to the inventory (Exhibit III). Required Prepare the report for Jenny. Exhibit I Map of Farmland Various seasonal produce (24%) Christmas trees (26%) Corn field (5%) Vacant land (8%) Farm yard (26%) Storefront (11%) Exhibit III Financial Information Related to inventory During the year, RN started its Christmas tree farm by purchas- ing 8,000 white pine seedlings for $8 each. The seedlings are just below one foot tall when planted this year. Approximately 3% of all seedlings do not survive their first year. RN purchased and instaled a sprinkler system that covers farm land area (seasonal and Christmas trees) for a total of $175,000. The system has an expected useful life of 8 years. RN consumed $55,000 in water directly related to the use of the sprinkler system. RN hired two student employees to work directly to maintain (prune, weed, water, etc.) the seasonal produce and Christmas trees. The two employees earned $35,000 in total over the course of the summer months. RN incurred costs of $13,000 for seeds related to the seasonal produce items. RN utilized fertilizers during the past year in order to aid with the growth process. Super Grow fertilizer was used for both the seasonal produce and trees, and cost $29,000. In addition, a total of $17,500 worth of Tree Booster was purchased during the year. A total of $2,500 worth of the product remained at year end. An organic pesticide was used during the year as well. A total of $27,000 and $34,000 was spent on Tree Bug Zapper and Pest Be Gone, respectively. The ending balance of Tree Bug Zapper and Pest Be Gone was $3,500 and $2,500, respectively. In order to help aerate the soil, RN purchased a land cultivator for $55,000. The equipment is expected to have a useful life of six years, and was used for the land around both the seasonal produce and trees. RN purchased 100 chickens (87 hens able to lay eggs, 10 chicks, and 3 roosters) for a total cost of $950 from a local farm. The hens are expected to be able to lay eggs for the next five years, at which point the hens will be sold for $8 each to a local gro- cery store. RN purchased $6,500 of chicken feed during the year. The year-end inventory of chicken feed is $2,250. In addition, RN purchased a cage for $2,500, which is expected to last . 12 years. A dozen eggs are sold for $4, which reflects a premium as they are sold as organic eggs. Hens can be sold in the open market for $8 per hen. Exhibit II Information from RN's Operations based on its equivalent of a commodity spot price. The following are the current Christmas tree prices for white pine: Year end Jenny selected the fiscal year to run from January 1 to December 31 in order to capture a full season of the seasonal produce and corn field activities. 3 Feet: $30 7 Feet: $45 Note: estimated selling costs are 10% of the sales price. 4 Feet: 5 Feet: 6 Feet: $35 $38 $40 8 Feet: 9 Feet: $47 $55 Seasonal produce RN grows a variety of seasonal produce, including peas, strawberries, cucumbers, and peppers. At the end of the season, RN sells produce through various means: (1) in bundles through their storefront; (2) through local retailers that promote local produce; (3) through farmer's markets; and (4) by allowing customers to pick their own basket of produce on site. The corn field is a component of the seasonal produce. The corn is grown and then sold through the same outlets as the rest of the seasonal produce. During the month of October, the corn field is turned into a Halloween corn field, whereby customers walk through for $10. The Halloween corn field was a huge success this year, and a great source of supplemental income. Jenny paid $7,500 to design the layout of the corn field, and to purchase the required accessories. Christmas trees The Christmas tree market can be classified as pure competition. There is an abundant supply of trees, such that any individual supplier cannot impact the price. In addition, there are an abundant number of purchasers, such that any single purchaser cannot impact the price. Finally, the product is considered to be homogenous as well, aside from the type of tree (e.g., Douglas fir, white pine). Although trees may come in different shapes and colours, the value of a tree is based solely on its height (the shape can be altered through pruning while colour can be adjusted through dyes). A Christmas tree is priced similar to any commodity that trades in a market. The market price of a Christmas tree is determined Generally, white pine trees are not grown to exceed 9 feet as their retail commercial value disappears at this level. Trees are scrapped as soon as it becomes apparent that they no longer have any value. Aside from any weather calamities or insect infestation outbreaks, the scrappage rate is fairly consistent from year to year. The growth rate for white pine depends a lot on whether trees are free to grow or are suppressed under a canopy. Average height growth for young suppressed white pine is often less than 6 inches per year. However, with free-to-grow trees on the better sites, height growth is normally 2-3 feet per year. Farm yard During the past year, RN set up a chicken pen. The chickens are used to produce eggs, which are sold through retailers and at farmers' markets. Eventually, the chickens will be sold as poultry. A hen's reproduction cycle is set by the length of the day. During the summer months, a hen usually produces one egg per day. A hen will lay fewer eggs as the day shortens, eventually skipping days between laying eggs. Many hens stop laying eggs all together until the spring arrives because winter is a bad time to raise chicks given that cold weather decreases a chick's chance of survival. RN is planning to purchase cattle next year, and offer dairy products as well (milk, cheese, etc.). No expenses have been incurred in this regard for the current year. Riverside Nursery Jenny Kinnear just completed a university degree in natural resource sciences. Given the tough economic times, it has been difficult to find any form of meaningful employment. Prior to moving to Montreal in order to attend university, Jenny lived with her parents in a small farming community. Accordingly, Jenny has been thinking about acquiring some farm land on the outskirts of Montreal and establishing a farm and nursery. Farm land can now be obtained for a reduced price. Jenny has discussed the idea with her retired parents, and they suggested they would move to Montreal if she decides to pursue the business in order to assist her to get the business up and running. On January 1, 2019, Jenny decided to go into business by incorporating Riverside Nursery (RN). RN immediately purchased a plot of farm land from a family of retiring farmers. The land was obtained for the bargain price of $1 mil- lion. A bank loan, with an interest rate of 5%, was obtained in order to help finance the land acquisition cost. Jenny and her parents decided to segregate the farm land in order to be able to grow seasonal produce (strawberries, beans, peas, corn, etc.), Christmas trees, and raise chicken and cattle. A storefront is also included on the land. A map of the land can be found in Exhibit I. It is now December 2020, and Jenny is beginning to worry about RN's financial statements. She knows that the bank loan requires RN to file audited annual financial statements. RN has engaged Abdillahi and Blouin LLP to per- form the audit. In order to prepare for the upcoming audit, Jenny has hired you, CPA, for a special consulting contract. Specifically, Jenny provides you with the terms of the consulting project: "I feel that the nature of RN's business is fairly straightforward, except for inventory. Therefore, I would like you to prepare a report that discusses all theoretically possible measurement bases of inventory, along with the result- ing impact of each measure on revenue recognition. Based on your theoretical discussion, I would like your report to focus in on the actual accounting standards. Because the bank will accept either ASPE or IFRS financial state- ments, I would like you to discuss how my inventory should be accounted for under both standards. Jenny provides you with some additional information regarding the operations of RN (Exhibit II), along with some financial information related to the inventory (Exhibit III). Required Prepare the report for Jenny. Exhibit I Map of Farmland Various seasonal produce (24%) Christmas trees (26%) Corn field (5%) Vacant land (8%) Farm yard (26%) Storefront (11%) Exhibit III Financial Information Related to inventory During the year, RN started its Christmas tree farm by purchas- ing 8,000 white pine seedlings for $8 each. The seedlings are just below one foot tall when planted this year. Approximately 3% of all seedlings do not survive their first year. RN purchased and instaled a sprinkler system that covers farm land area (seasonal and Christmas trees) for a total of $175,000. The system has an expected useful life of 8 years. RN consumed $55,000 in water directly related to the use of the sprinkler system. RN hired two student employees to work directly to maintain (prune, weed, water, etc.) the seasonal produce and Christmas trees. The two employees earned $35,000 in total over the course of the summer months. RN incurred costs of $13,000 for seeds related to the seasonal produce items. RN utilized fertilizers during the past year in order to aid with the growth process. Super Grow fertilizer was used for both the seasonal produce and trees, and cost $29,000. In addition, a total of $17,500 worth of Tree Booster was purchased during the year. A total of $2,500 worth of the product remained at year end. An organic pesticide was used during the year as well. A total of $27,000 and $34,000 was spent on Tree Bug Zapper and Pest Be Gone, respectively. The ending balance of Tree Bug Zapper and Pest Be Gone was $3,500 and $2,500, respectively. In order to help aerate the soil, RN purchased a land cultivator for $55,000. The equipment is expected to have a useful life of six years, and was used for the land around both the seasonal produce and trees. RN purchased 100 chickens (87 hens able to lay eggs, 10 chicks, and 3 roosters) for a total cost of $950 from a local farm. The hens are expected to be able to lay eggs for the next five years, at which point the hens will be sold for $8 each to a local gro- cery store. RN purchased $6,500 of chicken feed during the year. The year-end inventory of chicken feed is $2,250. In addition, RN purchased a cage for $2,500, which is expected to last . 12 years. A dozen eggs are sold for $4, which reflects a premium as they are sold as organic eggs. Hens can be sold in the open market for $8 per hen

read second photo first tthen use other pictures for support

read second photo first tthen use other pictures for support