Question

Every day, well-heeled citizens clatter in and out of the Rishengchang, China's first bank. The runaway success of the institution quickly established its hometown as

Every day, well-heeled citizens clatter in and out of the Rishengchang, China's first bank. The runaway success of the institution quickly established its hometown as the country's financial capital. "Rishengchang is the centre, and is happy and flourishing," declares a painted beam.

But the ledgers are dusty and unused; the visitors are not customers but tourists. The bank shut its doors 70 years ago after trade moved from the overland silk route to the seaboard - and Pingyao's unrivalled success crumbled to dust.

The most notable visitor to the museum, President Hu Jintao, may well recall the lesson in hubris as he stares at the biggest economic challenge that he and his premier, Wen Jiabao, have faced to date. Last month China's inflation rate hit an 11-year high at 7.1%, despite attempts to keep it in check. The central bank warned on Friday that China faced an increasing risk of inflation and implied that the authorities might allow faster appreciation of the Chinese currency, the yuan, to offset it.

Though snowstorms this winter have contributed, slashing agricultural production and increasing transport costs, last month's rise merely reinforces an underlying trend. The annual inflation rate more than tripled last year to 4.8% - well above the official target of 3% - despite six interest-rate rises and 10 increases in central banks' reserve requirements. Some analysts suggest the annual inflation rate could reach 6.8% this year and Wu Xiaoling, the former deputy governor of the central bank, warned recently that China was on the verge of "entrenched" inflation.

The surge presents a double challenge to officials: not only must they protect China's remarkable economic growth, but they must ensure ordinary citizens are not left behind. In the late 1980s, soaring inflation contributed to the social unrest that culminated in the Tiananmen Square protests in 1989.

The latest increases have hit the food sector hardest, according to the National Bureau of Statistics. The price of foodstuffs jumped 18.2% in the year to January, while other goods rose by only 1.5%.

In a country in which households spend a third of their income on food, the effect is immense. Winter blizzards sent tomato prices soaring by 138%, but even before the bad weather, fatty pork rose by 67%. Some analysts believe that this month's consumer price index rise could even approach double figures, as the effects of the cold snap spread from the raw food sector to processed goods.

"Its impact on low-income families will be beyond government's imagination," said Ding Jianchen, professor at Beijing's University of International Business and Economics. "When people's incomes don't rise at the same speed as the inflation and the employment pressures keep increasing, and at the same time the society lacks social security, then it will have influence on low-income families."

No one in Pingyao needs to read the financial pages to understand the problem; even middle-class families are feeling the crunch. Ask anyone in this city and they will lament the cost of cooking oil, clothing, or even a snack at KFC.

"We don't eat pork, lamb or beef so much any more. It's just too expensive," said Wu Qiaomei, an accountant. "Everything's rising; the cost of vegetables has doubled. Vegetables that would have cost around three kuai (21p) last year are more than six kuai now."

Her husband, Xu Jianguo, has also noticed the difference at work. Staff at his cooking pot factory are demanding higher pay to offset increased living costs. "He's felt the pressure. If it's a low wage they won't take the job," said Wu. "Of course, he's had to put his prices up. Everything's going up."

Xu is lucky as he exports mostly to Thailand, Malaysia and Japan. But other firms are at risk of a double whammy - the fall in demand from the US due to its downturn coupled with spiralling production costs in China. Wage inflation rose by 20% in the unskilled and low-skilled sector last year. "It does worry us, but we can't do anything," said Xu. "It will have to be the government which regulates inflation. I believe China will keep getting better and more prosperous. People should believe in the party and President Hu. It's impossible that things could go wrong as they did here in Pingyao. With a country as strong as China, it can't decline."

Certainly, no one expects it to face the kind of economic crunch affecting the US. The government has also been seeking for some time to rein back growth. But many economists believe rising prices in China are symptomatic of structural weaknesses. "Inflation is [the outcome of] China's political, social and economic contradictions in the performance of finance," said Ding. "Institutional weaknesses haven't been solved totally. Overstaffed government organisation hasn't been restructured and the government has neglected the development of agriculture."

Solving the problem will require reform of land ownership, business monopolies and state-owned enterprises, he added.

In the meantime, businesses must struggle with the higher cost of borrowing as well as the raised wage bill. Small firms are worst affected, but research by Standard Chartered's China team shows even a foreign blue chip firm is borrowing at 30% above the base rate.

The knock-on effects are not confined to China. Its cheap production has held down global inflation over the past 15 years; analysts believe that China's rising prices will soon be exported along with its clothing and electrical goods.

Domestically, there is a long way to go before the effects of inflation undermine the overall rise in the standard of living. Those who have lived through years of poverty appreciate the long-term change. "Thirty years ago, one family could probably eat a jin [500g] of meat a month. Now it's once a week," said 84-year-old Hua Benming, chatting outside his home on Pingyao's main street. But he complains that the rising cost of flour and cooking oil is affecting ordinary citizens who have not enjoyed the full fruits of China's economic miracle.

Compared with his predecessor Jiang Zemin, President Hu has gone out of his way to focus more on social welfare, rather than growth alone. But Hua, as with others, has yet to see that shift in rhetoric reflected in the lives of his friends and neighbours. "Development is so fast that it would be better to slow it down to help the really poor people," said Hua.

Inflation rates

The year to January 2008

· Services 2.6%

· Consumer goods 8.5%

· Foodstuffs 18.2% (of which)

Pork 59%

Cooking oil 37.1%

Chicken 16%

· Construction costs 5.7%

· Utilities 5.5%

· Residential rent 4.7%

Q. (A) Using aggregate demand and supply diagrams, evaluate the extent to which the inflation taking place in China is of a cost-push nature. (150 words)

Q. (B) Explain the main policies that the Chinese government has been adopting to try to reduce the level of inflation. (150 words)

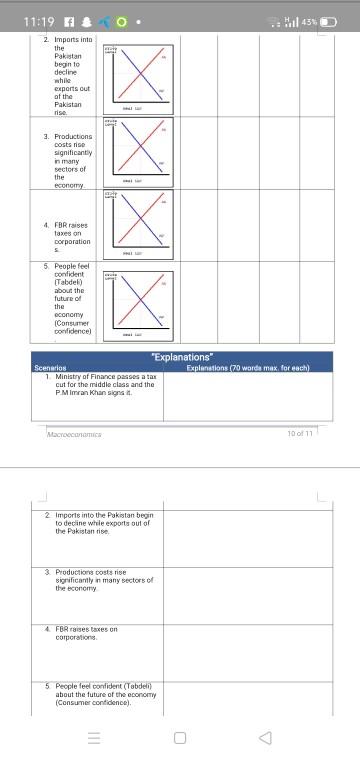

11:19 A al 43% 2. Imports inta the Pakistan begin to decline mhile exports out of the Pakistan rise. 3. Productions costs rise significantly in many sectors of the economy 4. FBR raises taxes on Dorporation 5. People feel confident (Tabdel) about the future of the economy (Consumer confidence) "Explanations" Explanations (70 worde max. for each) Scenarios 1. Ministry of Finance passes a tax cut for the middle class and the PMimran Khan signs it. Macroecanamica 10 of 11 2 Imports into the Pakistan begin to decine while exports out of the Pakistan rise 3. Productions costs rise significantly in many sectors of the economy 4. FBR raises taxes on corporations. 5 People feel confident (Tobdeli) about the future of the economy (Consumer contidence).

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Answer Costpush inflation This is a type of inflations occurs due to the increasing cost of production because of increasing input cost rising commo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started