Question

Read the attached case, Financial Statement Analysis for Small Business, A Resource Guide. Focus on how the author uses the ratios to interpret the business

Read the attached case, Financial Statement Analysis for Small Business, A Resource Guide. Focus on how the author uses the ratios to interpret the business performance.

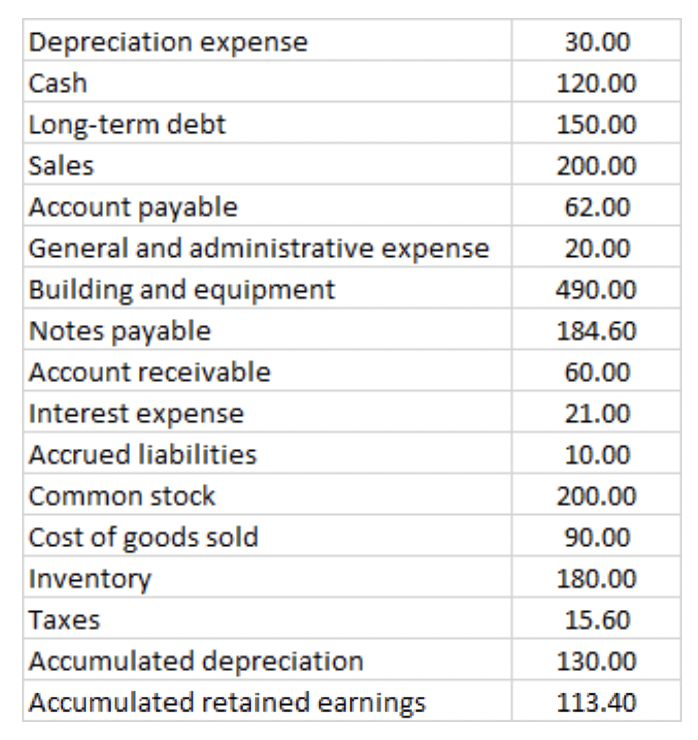

Q2-1: Reviewing financial statement (SNT)

Prepare a balance sheet and income statement for SNT, Inc, from the following scrambled list of items:

2-1-1 Show the balance sheet here

2-1-2 Show the income statement here.

2-1-3 Calculate the following profit indicators

- What is the gross profit?

- What is the net operating profit (EBIT)?

- What is the net income?

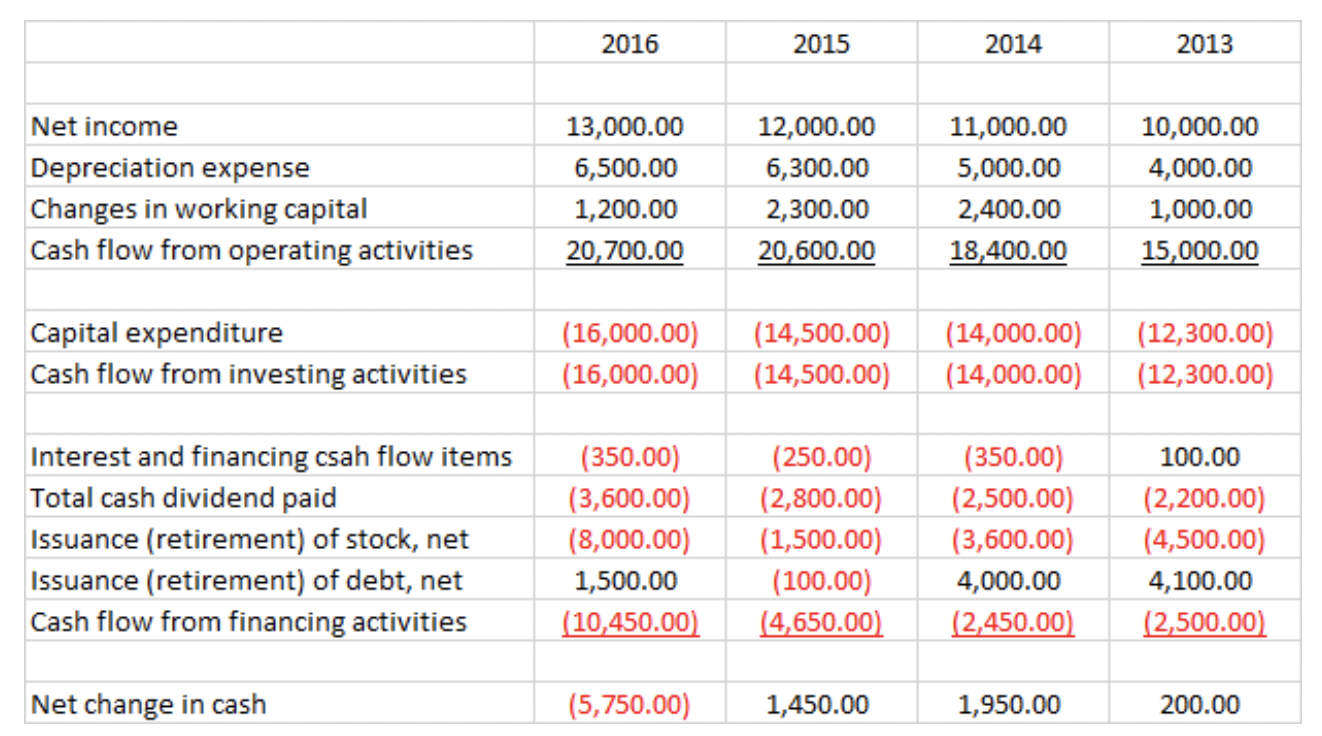

Q2-2 Reviewing cash flow statement (BOX)

Answer the following questions using the information found in these statements.

2-2-1: Did the company generate positive cash flow from its operations?

2-2-2: How much did the company invest in new capital expenditure over these four years?

2-2-3: Describe the sources of financing in the financial markets over these four years.

2-2-4: Based solely on the cash flow statement for 2013 to 2016, writing a brief narrative that describe the major activities of the companys management team over the four years.

Q2-3. Concept

2-3-1. Explain difference between net cash flow, operation cash flow and free cash flow.

2-3-2. Why free cash flow is the most important measure to value a company.

Q2-4. Financial ratio analysis (LYZ)

Data for LYZ Chip Company and its industry average follow.

- Calculate the indicated ratios for LYZ.

- Construct the extended Dupont equation for both LYZ and industry.

- Outline Lozanos strengths and weakness as revealed by your analysis.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started