Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the case below and answer the questions given: Assume that you are an independent auditor who runs your own auditing firm. Majan Company

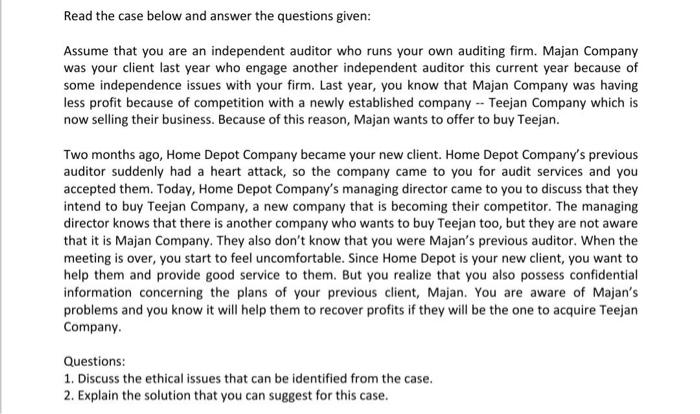

Read the case below and answer the questions given: Assume that you are an independent auditor who runs your own auditing firm. Majan Company was your client last year who engage another independent auditor this current year because of some independence issues with your firm. Last year, you know that Majan Company was having less profit because of competition with a newly established company-Teejan Company which is now selling their business. Because of this reason, Majan wants to offer to buy Teejan. Two months ago, Home Depot Company became your new client. Home Depot Company's previous auditor suddenly had a heart attack, so the company came to you for audit services and you accepted them. Today, Home Depot Company's managing director came to you to discuss that they intend to buy Teejan Company, a new company that is becoming their competitor. The managing director knows that there is another company who wants to buy Teejan too, but they are not aware that it is Majan Company. They also don't know that you were Majan's previous auditor. When the meeting is over, you start to feel uncomfortable. Since Home Depot is your new client, you want to help them and provide good service to them. But you realize that you also possess confidential information concerning the plans of your previous client, Majan. You are aware of Majan's problems and you know it will help them to recover profits if they will be the one to acquire Teejan Company. Questions: 1. Discuss the ethical issues that can be identified from the case. 2. Explain the solution that you can suggest for this case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started