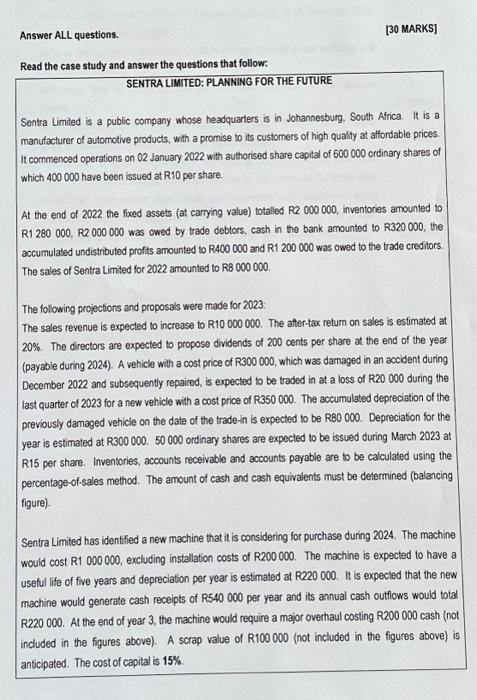

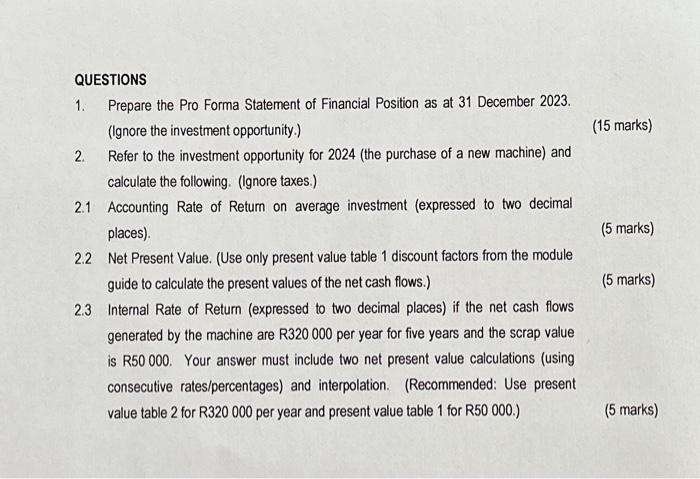

Read the case study and answer the questions that follow: SENTRA LIMITED: PLANNING FOR THE FUTURE Sentra Limited is a public company whose headquarters is in Johannesburg. South Africa. It is a manufacturer of automotive products, with a promise to its customers of high quality at affordable prices. It commenced operations on 02 January 2022 with authorised share capital of 600000 ordinary shares of which 400000 have been issued at R10 per share. At the end of 2022 the fixed assets (at carrying value) totalled R2000000, inventorias amounted to R1 280000 , R2 000000 was owed by trade debtors, cash in the bank amounted to R320 000, the accumulated undistributed profits amounted to R400 000 and R1 200000 was owed to the trade creditors. The sales of Sentra Limited for 2022 amounted to R8 000000 . The following projections and proposals were made for 2023 : The sales revenue is expected to increase to R10000000. The after-tax return on sales is estimated at 20%. The directors are expected to propose dividends of 200 cents per share at the end of the year (payable during 2024). A vehicle with a cost price of R300000, which was damaged in an accident during December 2022 and subsequently repaired, is expected to be traded in at a loss of R20 000 during the last quarter of 2023 for a new vehicle with a cost price of R350 000. The accumulated depreciation of the previously damaged vehicle on the date of the trade-in is expected to be RBO 000. Depreciation for the year is estimated at R300 000. 50000 ordinary shares are expected to be issued during March 2023 at R15 per share. Inventories, accounts receivable and accounts payable are to be calculated using the percentage-of-sales method. The amount of cash and cash equivalents must be determined (balancing figure). Sentra Limited has identfied a new machine that it is considering for purchase during 2024. The machine would cost R1 000000 , excluding installation costs of R200000. The machine is expected to have useful life of five years and depreciation per year is estimated at R220 000. It is expected that the ne machine would generate cash receipts of R540 000 per year and its annual cash outflows would tote R220 000. At the end of year 3, the machine would require a major overhaul costing R200 000 cash (n) induded in the figures above). A scrap value of R100000 (not included in the figures above) anticipated. The cost of capital is 15%. QUESTIONS 1. Prepare the Pro Forma Statement of Financial Position as at 31 December 2023. (Ignore the investment opportunity.) (15 marks) 2. Refer to the investment opportunity for 2024 (the purchase of a new machine) and calculate the following. (Ignore taxes.) 2.1 Accounting Rate of Return on average investment (expressed to two decimal places). (5 marks) 2.2 Net Present Value. (Use only present value table 1 discount factors from the module guide to calculate the present values of the net cash flows.) (5 marks) 2.3 Internal Rate of Return (expressed to two decimal places) if the net cash flows generated by the machine are R320 000 per year for five years and the scrap value is R50 000. Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. (Recommended: Use present value table 2 for R320000 per year and present value table 1 for R50 000.)