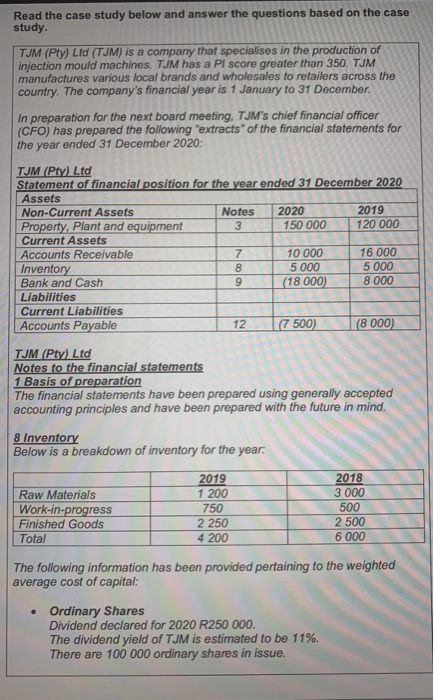

Read the case study below and answer the questions based on the case study. TJM (Pty) Ltd (TJM) is a company that specialises in the production of injection mould machines. TJM has a Pl score greater than 350. TJM manufactures various local brands and wholesales fo retailers across the country. The company's financial year is 1 January to 31 December In preparation for the next board meeting. TJM's chief financial officer (CFO) has prepared the following extracts of the financial statements for the year ended 31 December 2020: M (Pty Ltd Statement of financial position for the year ended 31 December 2020 Assets Non-Current Assets Notes 2020 2019 Property. Plant and equipment 3 150 000 120 000 Current Assets Accounts Receivable 7 10 000 16 000 Inventory 8 5000 5000 Bank and Cash 9 (18 000) 8 000 Liabilities Current Liabilities Accounts Payable 12 (7 500) (8 000) TJM (Pty) Ltd Notes to the financial statements 1 Basis of preparation The financial statements have been prepared using generally accepted accounting principles and have been prepared with the future in mind. 8 Inventory Below is a breakdown of inventory for the year: 2019 Raw Materials Work-in-progress Finished Goods Total 750 2 250 4 200 2018 3 000 500 2 500 6 000 The following information has been provided pertaining to the weighted average cost of capital: Ordinary Shares Dividend declared for 2020 R250 000. The dividend yield of TJM is estimated to be 11%. There are 100 000 ordinary shares in issue. Debentures These debentures are non-convertible and non-redeemable. The debentures current yield to maturity is 20% The market value of the debentures is R14 million. Extract from the statement of comprehensive income: 2019 2018 2017 R R Profit after tax 650 000 601 800 557 200 The tax rate is 28%. 1.1 Construct the questions that should be asked of the CFO by the board members regarding any concerns or shortfalls pertaining to the extracts of the financial statements presented above. Your questions should be based on the presentation and disclosure of the financial statements and the questions should be accompanied by the reasons why such question should be asked. (10) 1.2 Based on the information provided, complete the calculation of WACC, showing all workings. Round all calculations to two decimal points. (15) 1.3 Will it be possible for TJM to achieve an optimum WACC by changing the mix of its capital source components? Explain. [30 mark