Answered step by step

Verified Expert Solution

Question

1 Approved Answer

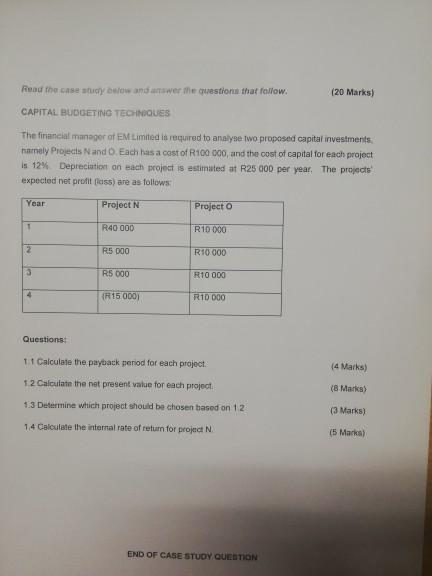

Read the case study below and answer the questions that follow. (20 Marks) CAPITAL BUDGETING TECHNIQUES The financial manager of EM Limited is required to

Read the case study below and answer the questions that follow. (20 Marks) CAPITAL BUDGETING TECHNIQUES The financial manager of EM Limited is required to analyse two proposed capital investments, namely Projects Nando. Each has a cost of R100 000, and the cost of capital for each project is 12% Depreciation on each project is estimated at R25 000 per year. The projects expected not profit fiss) are as follows: Year Project N Project 1 R40 000 R10 000 2 RS 000 R10 000 3 R5 000 R10 000 (R15 0007 RID 000 Questions 1. Calculate the payback period for each project (4 Marks) 1 2 Calculate the net present value for each project (8 Marks) 13 Determine which project should be chosen based on 12 (3 Marks) 14 Calculate the internal rate of return for project N. (5 Marka) END OF CASE STUDY

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started