Answered step by step

Verified Expert Solution

Question

1 Approved Answer

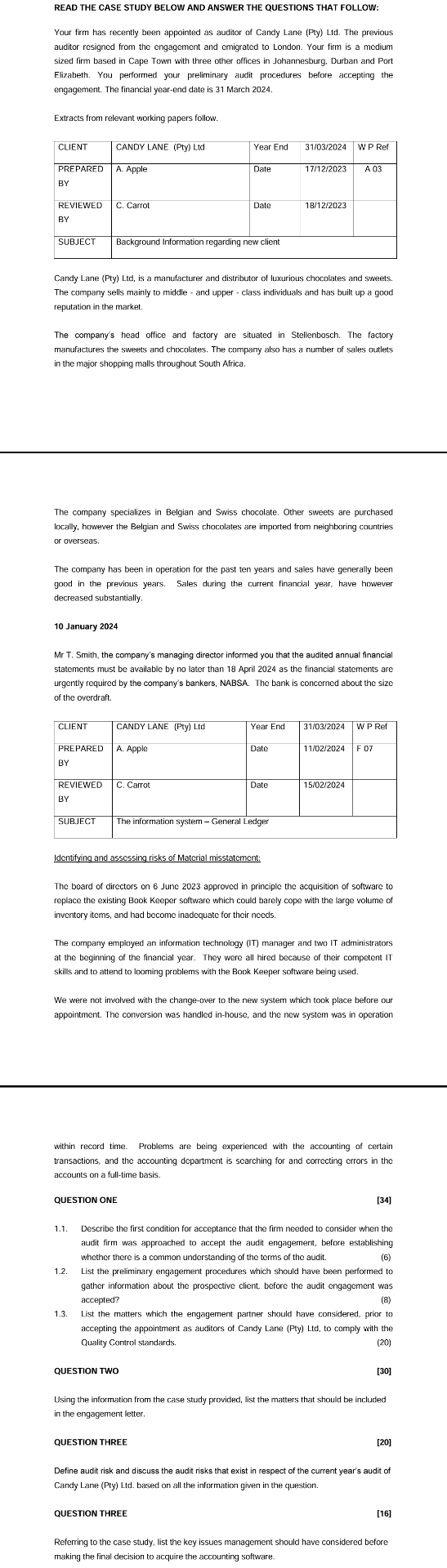

READ THE CASE STUDY BELOW AND ANSWER THE QUESTIONS THAT FOLLOW: Your firm has recently been appointed as auditor of Candy Lane ( Pty )

READ THE CASE STUDY BELOW AND ANSWER THE QUESTIONS THAT FOLLOW:

Your firm has recently been appointed as auditor of Candy Lane Pty Ltd The previous auditor resigned from the engagement and emigrated to London. Your firm is a medium sized firm based in Cape Town with three other offices in Johannesburg, Durban and Port Elizabeth. You performed your prelirrinary audit procedures before accepting the engagement. The financial yearend date is March

Extracts from relevant working papers follow.

tableCLIENTCANDY LANE Pty LtdYear End,W P ReftablePREPAREDBYA Apple,Date,A tableREVIEWEDBYC Carrot,Date,SUBJECTBackground Information regarding new client

Candy Lane Pty Ltd is a manufacturer and distributor of luxurious chocolates and sweets. The company sells mainly to middle and upper class individuals and has built up a good reputation in the market.

The company's head office and factory are situated in Stellenbosch. The factory manufactures the sweets and chocolates. The company also has a number of sales outlet: in the major shopping malls stroughout South Africa.

The company specializes in Belgian and Swiss chocolate. Other sweets are purchased Iocally, however the Belgian and Swiss chocolates are imported from neightoring countries or overseas

The company has been in operation for the past ten years and sales have generally been good in the previous years. Sales during the current financial year, have however decreased substantially.

January

Mr T Smith, the company's managing director informed you that the audited annual financial statements must be available by no later than April as the financial statements are urgently required by the company's bankers, NABSA. The bank is concerned about the sizo of the overdraft.

tableCLIENTCANDY LANE Pty LtdYear End,W P ReftablePREPAREDBYA Apple,Date,F tableREVIEWEDBYC Carrot,Date,SUBJECT,The information system General Ledger

Identifying and assessing risks of Material misstatement:

The board of directors on June approved in principle the acquisition of software to replace the existing Book Keeper software which could barely cope with the large volume of inventory items, and had become inadequate for their needs.

The company employed an information technology IT manager and two IT administrators at the beginning of the financial year. They were all hired because of their competent IT skills and to attend to looming problems with the Book Keeper software being used.

We were not involved with the changeover to the new system which took place before our appointment. The conversion was handled inhouse, and the new system was in operation

within record time. Problems are being experienced with the accounting of certain transactions, and the accounting department is searching for and correcting errors in the accounts on a fulltime basis.

QUESTION ONE

Describe the first condition for acceptance that the firm needed to consider when the audit firm was approached to accept the audit engagement, before establishing whether there is a common understanding of the terms of the audit.

List the preliminary engagement procedures which should have been performed to gather information about the prospective client, before the audit engagement was accepted?

List the matters which the engagement partner should have considered, prior to accepting the appointment as auditors of Candy Lane Pty Ltd to comply with the Quality Control standards.

QUESTION TWO

Using the information from the case study provided, list the matters that should be included in the engagement letter.

QUESTION THREE

Define audit risk and discuss the audit risks that exist in respect of the current year's audit of Candy Lane Pty Ltd based on all the information given in the question.

QUESTION THREE

Referring to the case study, list the key issues management should have considered before

making the final decision to acquire the accounting software.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started