Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the case study on Gap Incorporated from Page 25 of Chapter one in the textbook and answer the following questions in your own

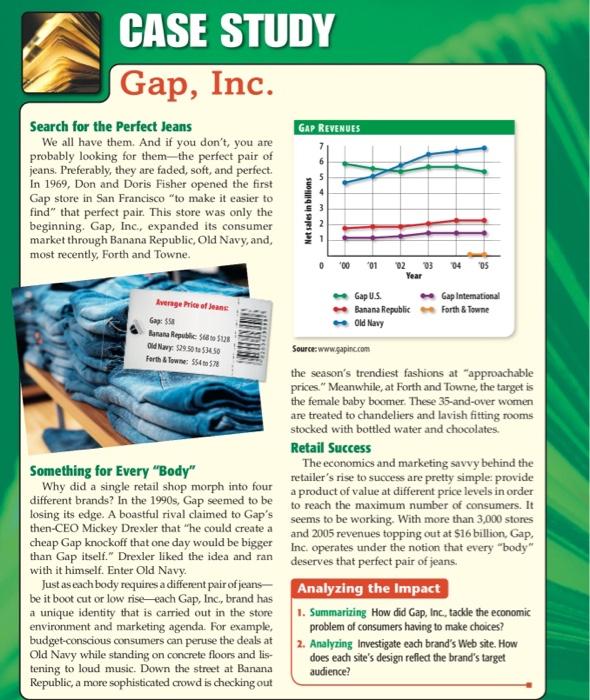

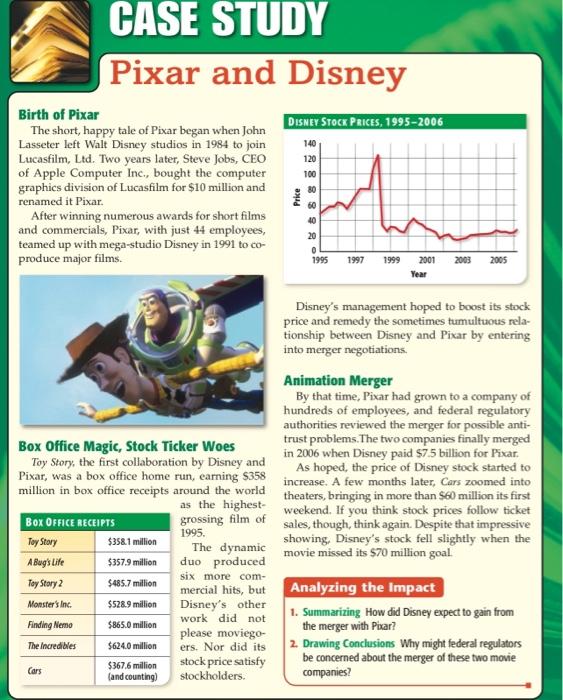

Read the case study on Gap Incorporated from Page 25 of Chapter one in the textbook and answer the following questions in your own words. Questions: 1. How did Gap Inc. tackle the economic problem of consumers having different preferences for their clothing stores? (5 marks) 2. Investigate each brand's Web site. How does each site's design reflect the brand's target audience? Note that one of these store's websites don't exist, look at the ones which do. (5 marks) 3. How does Gap Incorporated's marketing strategy reflect the concept of differentiation? (5 marks) 4. Find and explain 2 other examples of companies using THIS METHOD of marketing to take advantage of differentiation. (5 marks each) Instructions: Read the Disney Pixar Case study found in the textbook in Chapter 7 page 23 (or page 190) and answer the following questions in your own words. 1. How did Disney expect to gain from the merger with Pixar? (5 marks) 2. Why might Federal regulators be concerned about the merger of these two movie companies. (5 marks) 3. If I love animated movies, why might I not want the two companies to merge? (5 marks) 4. If I love animated movies, why might 1 be excited that the two companies to merge? (5 marks) 5. If Disney has a monopoly in the animated movies industry, will they be more or less likely to innovate? Explain. (5 marks) CASE STUDY Gap, Inc. Search for the Perfect Jeans GAP REVENUES We all have them. And if you don't, you are probably looking for them-the perfect pair of jeans. Preferably, they are faded, soft, and perfect. In 1969, Don and Doris Fisher opened the first Gap store in San Francisco "to make it easier to find" that perfect pair. This store was only the beginning. Gap, Inc., expanded its consumer market through Banana Republic, Old Navy, and, most recently, Forth and Towne. 5 O 00 01 02 03 04 Year e Gap Intemational e Gap U.S. e Banana Republic e Old Navy Avernge Prie of Jeane Forth & Towne Gap: 55a Ranana Republic Sto St28 O Navy S2950 ta $350 Source: www.gapinc.com Ferth lowne S5emsn the season's trendiest fashions at "approachable prices." Meanwhile, at Forth and Towne, the target is the female baby boomer. These 35-and-over women are treated to chandeliers and lavish fitting rooms stocked with bottled water and chocolates. Retail Success The economics and marketing savvy behind the Something for Every "Body" Why did a single retail shop morph into four retailer's rise to success are pretty simple: provide different brands? In the 1990s, Gap seemed to be to reach the maximum number of consumers. It losing its edge. A boastful rival claimed to Gap's seems to be working. With more than 3,000 stores then-CEO Mickey Drexler that "he could create a and 2005 revenues topping out at $16 billion, Gap, cheap Gap knockoff that one day would be bigger Inc. operates under the notion that every "body" than Gap itself." Drexler liked the idea and ran with it himself. Enter Old Navy. Just as each body requires a different pair of jeans- be it boot cut or low rise-each Gap, Inc., brand has a unique identity that is carried out in the store environment and marketing agenda. For example, budget-conscious consumers can peruse the deals at Old Navy while standing on concrete floors and lis- tening to loud music. Down the street at Banana Republic, a more sophisticated crowd is checking out a product of value at different price levels in order deserves that perfect pair of jeans. Analyzing the Impact 1. Summarizing How did Gap, Inc., tackle the economic problem of consumers having to make choices? 2. Analyzing Investigate each brand's Web site. How does each site's design refled the brand's target audience? Net sales in billions CASE STUDY Pixar and Disney Birth of Pixar The short, happy tale of Pixar began when John Lasseter left Walt Disney studios in 1984 to join Lucasfilm, Ltd. Two years later, Steve Jobs, CEO of Apple Computer Inc., bought the computer graphics division of Lucasfilm for $10 million and renamed it Pixar. After winning numerous awards for short films and commercials, Pixar, with just 44 employees, teamed up with mega-studio Disney in 1991 to co- produce major films. DISNEY STOCK PRICES, 1995-2006 140 120 100 g 80 60 40 20 1997 1999 2001 2003 2005 1995 Year Disney's management hoped to boost its stock price and remedy the sometimes tumultuous rela- tionship between Disney and Pixar by entering into merger negotiations. Animation Merger By that time, Pixar had grown to a company of hundreds of employees, and federal regulatory authorities reviewed the merger for possible anti- trust problems. The two companies finally merged Box Office Magic, Stock Ticker Woes Toy Story, the first collaboration by Disney and in 2006 when Disney paid $7.5 billion for Pixar. As hoped, the price of Disney stock started to Pixar, was a box office home run, earning $358 increase. A few months later, Cars zoomed into million in box office receipts around the world theaters, bringing in more than $60 million its first as the highest- weekend. If you think stock prices follow ticket grossing film of sales, though, think again. Despite that impressive showing. Disney's stock fell slightly when the Box OFFICE RECEIPTS 1995. The dynamic movie missed its $70 million goal. duo produced Toy Story $358.1 million A Bug's Life $357.9 million six more com- Analyzing the Impact Toy Story 2 $485.7 million mercial hits, but Disney's other work did not Monster's Inc. $528.9 million 1. Summarizing How did Disney expect to gain from the merger with Pisar? 2. Drawing Conclusions Why might federal regulators be concerned about the merger of these two movie companies? Finding Nemo $865.0 million please moviego- ers. Nor did its The Incredibles $624.0 million $367.6 million (and counting) stock price satisfy stockholders. Cars Price

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 GAP to tackle the problem of individual having preferences for different brands introduced its own ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started