Answered step by step

Verified Expert Solution

Question

1 Approved Answer

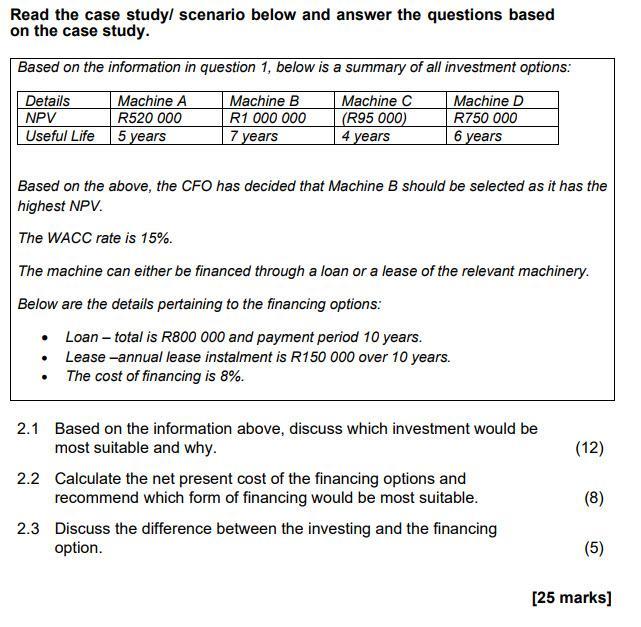

Read the case study/ scenario below and answer the questions based on the case study. Based on the information in question 1, below is

Read the case study/ scenario below and answer the questions based on the case study. Based on the information in question 1, below is a summary of all investment options: Machine A Machine C Details NPV Machine B R1 000 000 Machine D R750 000 R520 000 (R95 000) Useful Life 5 years 7 years 4 years 6 years Based on the above, the CFO has decided that Machine B should be selected as it has the highest NPV. The WACC rate is 15%. The machine can either be financed through a loan or a lease of the relevant machinery. Below are the details pertaining to the financing options: Loan total is R800 000 and payment period 10 years. Lease-annual lease instalment is R150 000 over 10 years. The cost of financing is 8%. 2.1 Based on the information above, discuss which investment would be most suitable and why. 2.2 Calculate the net present cost of the financing options and recommend which form of financing would be most suitable. 2.3 Discuss the difference between the investing and the financing option. (12) (8) (5) [25 marks]

Step by Step Solution

★★★★★

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

21 Suitability of Investment Option To determine the most suitable investment option we need to calculate the Net Present Value NPV for both Machine B and the financing options loan and lease and then ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started